Equity market concentration and the value of spreading across styles

The lesson from history is that passive investing in markets leads to concentrations in expensive areas just before those areas suffer. That is alarming if we consider how passive portfolios have evolved since the global financial crisis.

Over the past decade a static investment strategy has been anything but static. In fact, as markets have become more heavily concentrated in the US, in giant companies and in technology shares, investment strategy weightings have shifted too. Today, these weightings overwhelmingly favour the winners of the last decade. Getting here has been rewarding, as rising rates in persistent winners have let those shares contribute more to passive fund returns.

*Read Orbis Investments’ whitepaper ‘Sunrise on Venus: Investing for the Next Decade’ here.

But when trends change, those concentrations carry risks: US stocks, giant companies and technology shares are all more richly valued than the rest of the market, so passive exposure to global stock markets has led to heavy concentrations in the most richly valued parts of the market.

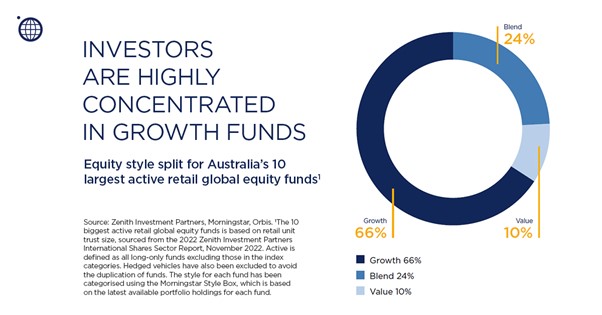

That would be alarming enough, as close to 70 per cent of the assets in Australia’s 10 biggest retail global equity funds are in passive strategies*. But investors have also actively allocated to styles best suited to the day that is now approaching dusk. If we look just at the 10 biggest active retail global equity funds in Australia, the figure below shows that 66 per cent of active assets are in growth strategies, ie., those that generally pay higher prices for companies expected to grow more quickly. Only 10 per cent of assets are in value strategies.

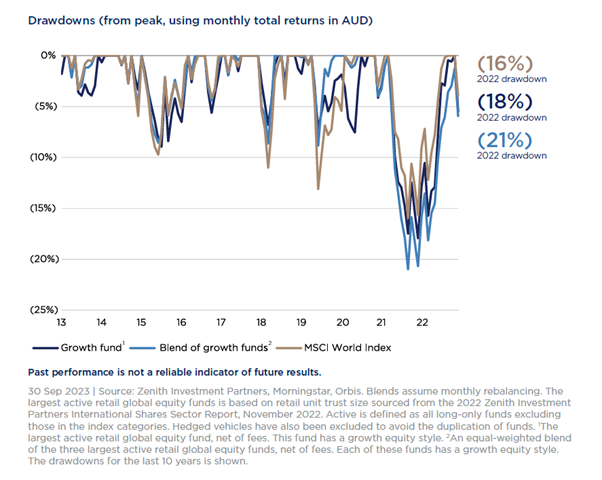

Concentration in growth has worked fantastically well over the past 15 years. The largest active fund which has a growth style, trounced the broader market and a blend of the three biggest active global equity funds, which all have a growth style, beat the broader market over the same period. That is not just down to luck. While we prefer to focus on valuations, managers with a sound growth philosophy and the structure to stick with it over the long term can deliver very healthy returns.

The trouble is what happens when that falls out of favour. If investors hold multiple active funds to get diversification, but those active funds invest in very similar things, investors can end up being diversified in name only.

As illustrated in the figure above, in 2022 the broader global equity market fell around 16 per cent, and after a bit of a recovery this year, it is still down around 4 per cent. The largest active retail global equity fund, which has a growth style, fell slightly more with a decline of 18 per cent. Attempting to diversify by holding the two other largest active retail global equity funds did not help at all because they also have a growth style. Investors in that mix of funds saw declines of 21 per cent, and are still underwater today. Yet investors remain concentrated, with the bulk of their active assets in growth-style funds, and their passive assets concentrated in giant US technology shares. With valuations where they are today, that worries us.

We believe the key is to diversify across styles within equities. Markets in aggregate are expensive, but not uniformly expensive. We have seen this before. When money is cheap, asset prices rise, and the prices of speculative assets rise the most. That channels money to wasteful places, which drives inflation, and ultimately prompts higher interest rates. The resulting downcycle is unpleasant for passive investors, and painful for those holding the most expensive assets. But there are undervalued assets, too, the companies that were neglected during the euphoric easy money times. Simply holding these assets can make a remarkable difference to investors’ returns in downcycles.

Investors can take simple steps to prepare for a downcycle: get properly diversified, and own undervalued assets. Value stocks can limit the downside in equity market declines, and blending a value style fund into a passive and growth-heavy portfolio can both reduce risk and enhance long-term returns.

*The 10 biggest retail global equity funds is based on retail unit trust size sourced from the 2022 Zenith Investment Partners International Shares Sector Report, November 2022. Passive is defined as those funds in index categories.