‘Easy wins’ not enough for QOAR: Joint advice association group

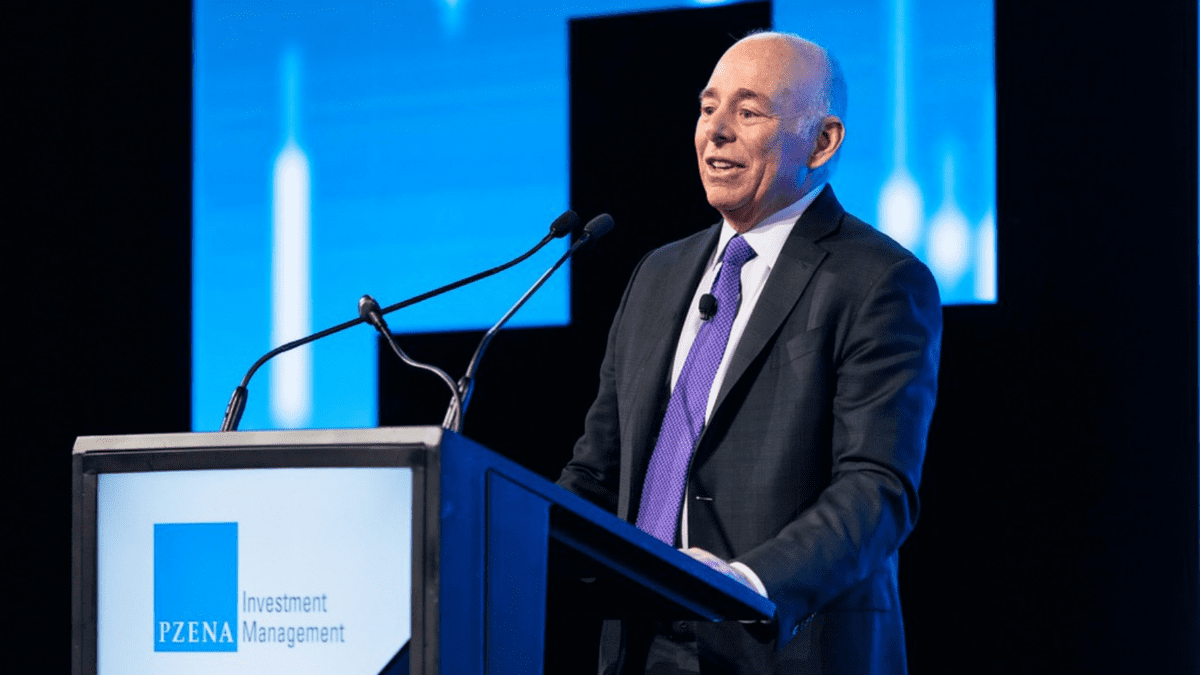

The Joint Association Working Group (JAWG) has pleaded with financial services minister Stephen Jones (pictured) to make significant change as part of the Quality of Advice Review, calling for a “holistic package” of reforms and a consultation with industry for a committed implementation timeframe.

The final Quality of Advice Review set of proposals was submitted to treasury by review leader Michelle Levy on December 16. The government is expected to publish the review, and it’s response, in the coming days.

The final suite of recommendations are tipped to stick relatively close to Levy’s draft recommendations, which included a new ‘good advice’ mandate to supplant Best Interest Duty and a host of disclosure rules, that will open the way for super funds to provide advice to members. It also included deep cuts to the existing compliance regime, new ‘relevant provider’ designation and an end to the term ‘general advice’.

In a letter released by the group Thursday it said “urgent action is needed”, and called the government’s impending response a “rare opportunity to deliver affordable and accessible advice to consumers as an outcome”.

JAWG said that the recommendations alone are not enough; the government must put together a comprehensive plan to tackle the pressing issues facing advice if it wants more people to be able to access it.

The government’s package must accommodate scaled advice, help increase the number of advisers in the profession, remove excess administration, aid in reducing cost and put an end to “shifting goalposts”, the group explained.

“We believe that many of the final recommendations of the Quality of Advice Review are aimed at achieving these objectives. But Australian consumers will be left behind without the adoption of a holistic package of reforms. The reforms must extend beyond easy wins such as streamlining fee disclosure requirements and iron-out obligations like the design and distribution obligations.

“The government should commit to implementation timeframes that would see consultation with industry on a holistic package of reforms that are introduced into the Parliament this year.”

The release was signed by executives from the Association of Financial Advisers, the Boutique Financial Planning Association, Chartered Accountants Australia and New Zealand, CPA Australia, the FPA, the FSC, the Financial Services Institute of Australia, the Institute of Public Accountants, the Licensee Leadership Forum, the Self-managed Super Fund Association, the Stockbrokers and Investment Advisers Association and the Advisers Association.