Despite continued growth, tech remains underweight in portfolios

Technology has been the best performing sector for 10 years. And it has outperformed for the correct reason: it makes more money.

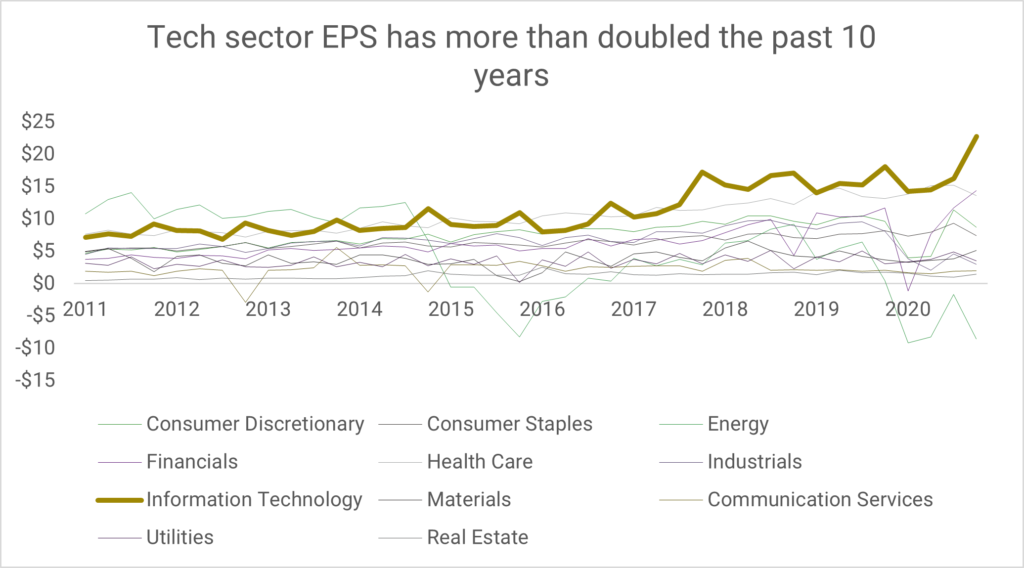

The past decade, the tech sector saw its profits – as measured by earnings per share (EPS) – swell more than any other sector. Making matters better for tech, the rate of profit growth was also the highest of any sector, according to data from S&P Global.

These results are more remarkable when one considers that several sectors – particularly energy, materials, real estate – saw no EPS growth at all over that period.

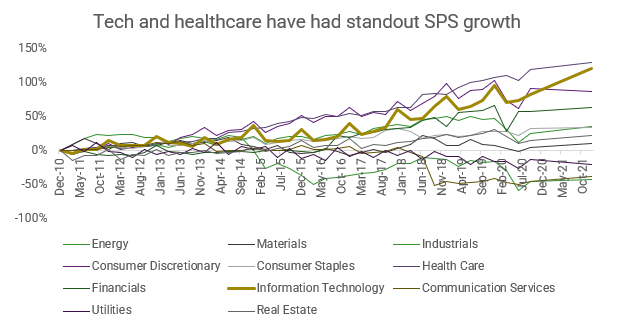

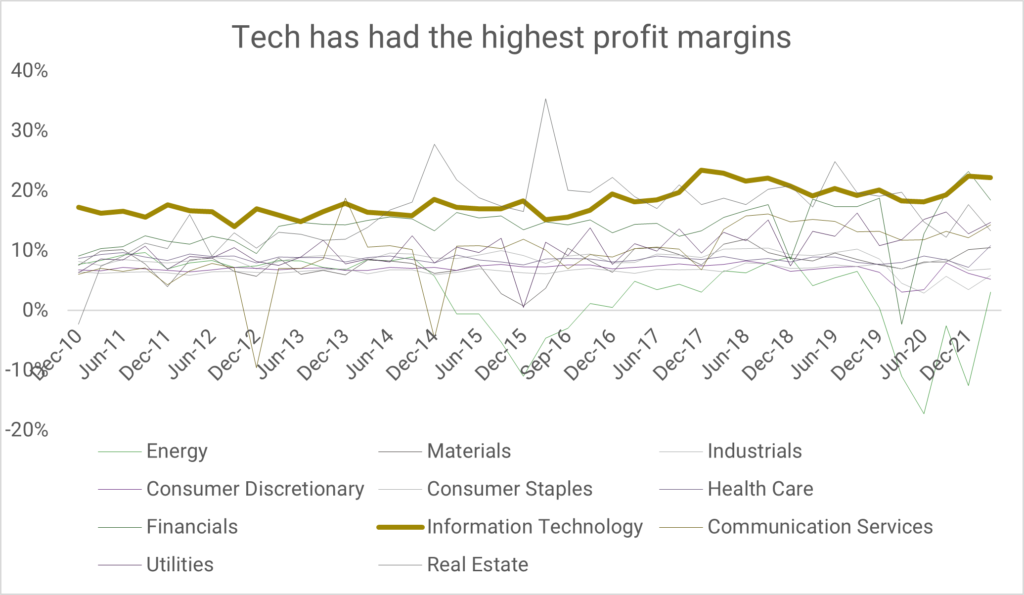

Technology companies also saw some of the strongest revenue growth, which can be measured by sales per share (SPS). The tech sector came a narrow second place to the health care sector the past 10 years in terms of overall revenue (SPS) growth. However, tech more effectively spun revenue into profit, due to its superior margins. Which sector had the best profit margins? Some years it was financials, other years it was tech. But the tech sector’s margins were the most consistently high.

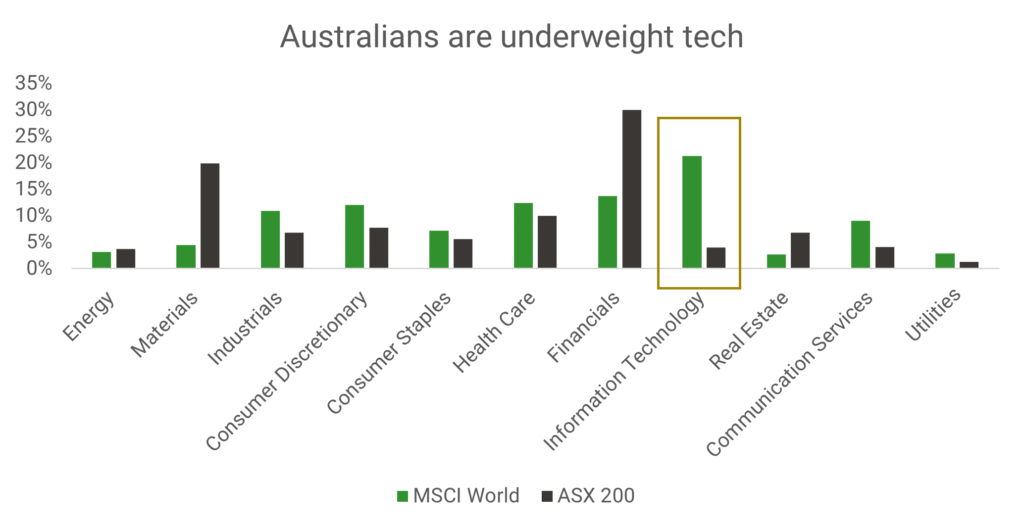

Yet Australians are underweight tech

For all the success of the tech sector, Australians have mostly sat the rally out. The Australian share market has only a very small tech sector: technology companies make up just 4% of the ASX 200. The Australian share market is instead dominated by the banks and miners – with the financials and materials sector taking 50% of the ASX 200. Putting this is in perspective, the MSCI World – which measures the total global share market – is made up 21% of technology companies. Financials and materials together get just 19%.

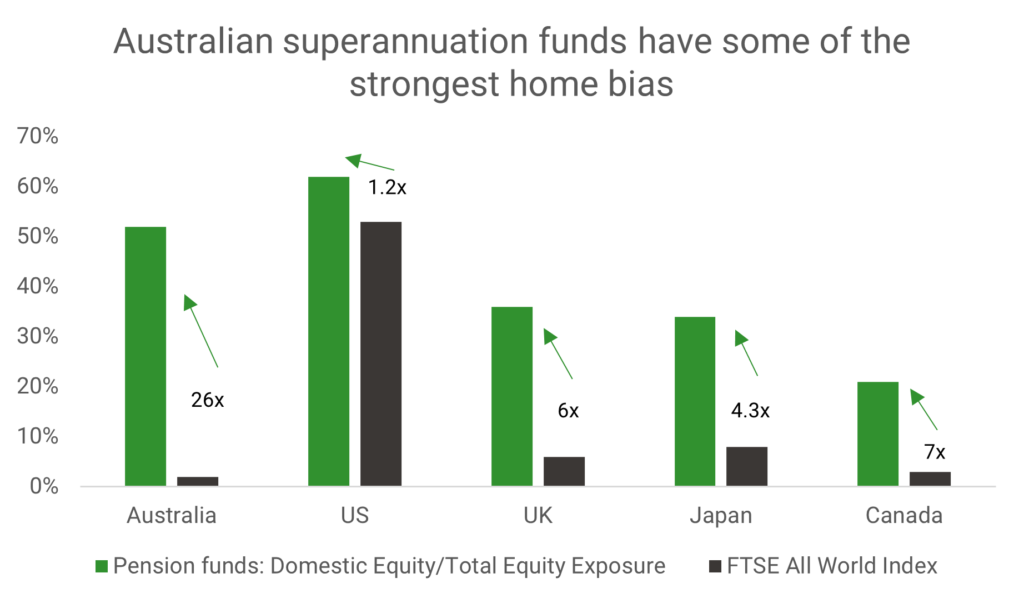

Australians often stay under-exposed to technology companies due to their reluctance to invest overseas. According to a review from FTSE Russell, Australians’ have a strong preference to invest at home. On average, Australians put just 47% of their portfolios into foreign assets. This comes despite the Australian share market making up just 2% of the global share market. This implies a preference for staying home – or “home bias” – of 26 times[1]. Home bias exists in other countries, too. But usually to a smaller extent. For instance, home bias is roughly 1.2 times in the US and roughly 6 times in the UK.

[1] 2: calculated as % domestic equity market over total equity exposure divided by the country weight in MSCI World

Australia, of course, has produced successful tech companies in recent years. Afterpay, Atlassian, Canva – all come to mind. Yet when homegrown technology companies hit global scale, they can prefer to list their shares on American exchanges, where the capital market is deeper, exchange fees are lower and tech companies are highly valued.

What this all means is that Australian investors wanting to invest in tech companies are forced to shop overseas.

Our solution: Technology ETFs

Technology ETFs have become a popular way for investors to get a slice of this sector. And in so doing, fix the underrepresentation of technology companies in many Australian portfolios.

At ETF Securities, our solution to this has been the ETFS Morningstar Global Technology ETF (TECH). The fund invests in tech companies picked by Morningstar’s team of researchers. It is designed to give investors access to the full variety of what the sector has to offer: from household names like Microsoft to smaller companies in higher growth areas like Uber. It also aims to avoid some of the common pitfalls that dog technology investors—such as buying into overhyped companies or bottom fishing on dying businesses.

Disclaimer

ETFS Management (AUS) Limited (AFSL 466778) (“ETFS”), is the responsible entity and issuer of units in the ETFS Morningstar Global Technology ETF (TECH) ARSN: 616 755 654 ‘The Fund’. The Product Disclosure Statement contains all of the details of the offer of units in the Fund. Any investment decision should only be considered after reading the relevant offer document in full.

This document is communicated by ETFS. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments and any investments should only be made on the basis of the relevant product disclosure statement which should be considered by any potential investor including any risks identified therein.

This document does not take into account your personal needs and financial circumstances. You should seek independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Although we use reasonable efforts to obtain reliable, comprehensive information, we make no representation and give no warranty that it is accurate or complete.

Investments in any product issued by ETFS are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Neither ETFS, ETFS Capital Limited nor any other member of the ETFS Capital Group guarantees the performance of any products issued by ETFS or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and investor may lose some or all of their investment. Past performance is not an indication of future performance.

Information current as at 5 May 2021.

ETFS MORNINGSTAR GLOBAL TECHNOLOGY ETF (TECH)

The Morningstar® Developed Markets Technology Moat Focus IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the ETFS Morningstar Global Technology ETF and bears no liability with respect to that ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar® Developed Markets Technology Moat Focus IndexSM is a service mark of Morningstar, Inc.