Cheaper, more diversified and delivering

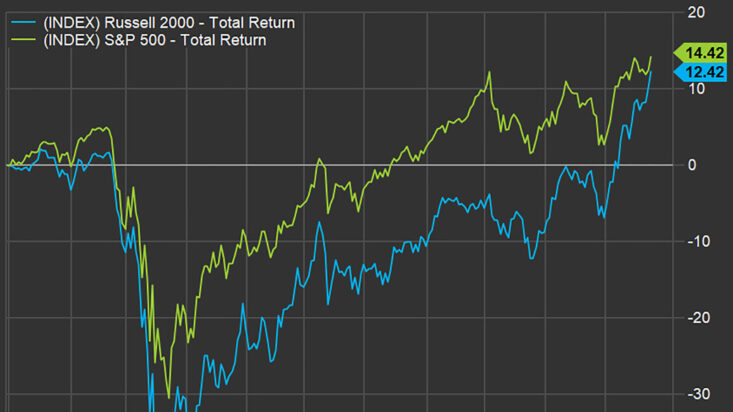

With attention focused on the record-breaking run of the Dow Jones Industrial Average (DJIA), which now sits above 30,000 points for the first time, smaller companies continue to be neglected. Yet with the Russell 2000 currently over 20% higher in November alone, perhaps the tide is beginning to turn.

One of the core premises of Eugene Fama and Kenneth French’s seminal work on asset pricing and portfolio management was the outperformance of smaller companies over larger ones over the longer term. Originally, they suggested the outperformance came from the ‘higher risk’ nature of these companies, yet in more recent times it has become clear that the tailwind may be much more powerful than that.

Defined as a company with a market capitalisation of between AUD$300 million and AUD$2 – 3 billion, these companies may be small on a global scale, but would include some of Australia’s best-known names. For instance, wealth managers Pendal Group (ASX: PDL) and IOOF Ltd (ASX: IFL) along with building products supplier CSR Ltd (ASX: CSR) would all fall under this definition. It is clear from this comparison along that the perception that smaller companies are ‘higher risk’ may be overstated.

The Russell 2000 index is widely seen as the most important smaller company index in the world, tracking the performance of 2,000 US listed companies. Traditional investment managers and advisers have historically avoided the sector on concerns that it is more indebted than its larger-cap peers, is over reliant on the domestic US economy and as a result, is a highly cyclical exposure. However, as the incredible performance of the S&P 500 and Nasdaq continues, experts are now questioning whether they reflect the actual health of the economy.

On a headline level, the Russell 2000 stands out as being great value and a unique diversification opportunity. The current price earnings ratio of the index is ‘just’ 18x historical earnings, some 25% cheaper than the 25x valuation of the large cap dominated S&P 500. But most importantly, in a time of great uncertainty and a growing number of potential economic scenarios in 2021, the index is far more diversified.

The largest holding in the index is just 0.5% of the portfolio, the top ten less than 5%. Compare this to the S&P 500 in which Apple (NASDAQ: NYSE) 6% of the index and the top ten now account for 27% of the total and the opportunity becomes more obvious. Similarly, the underlying portfolio exposures offer more exposure to the ‘real economy’, with healthcare the largest allocation at 19.7% and financials 15.7% of the portfolio.

These aren’t the big-name investment banks, paying CEO’s millions of dollars in wages, but rather the regional banks, smaller hospital and care providers and the like, working with and serving the masses in what could be the strongest period of growth in the US economy in several decades. But it isn’t all domestic, despite the common perception, the pandemic and the decades of globalisation that came before it, mean that smaller companies are actually more exposed to the global economy than before. As the saying goes, ‘from little things, big things grow’.

Every business needs to start somewhere and before the days of the ‘unicorn’ listing they began as smaller companies. Similarly, to start up technology names, growth rates can be exceptional for those willing to look. The sheer size of the universe of 2,000 names means few analysts pay significant attention to the sector, offering a rare ‘information advantage’ for those willing to specialise.

More diversification, better valuation and strong growth rates, what more does one need? Despite the clear benefits of an exposure to global smaller companies Australian investors remain heavily underweight to the sector. Something the likes of Ausbil Investment Management’s Global Small Cap team lead by Simon Wood and Tobias Bucks and Ned Bell of Bell Asset Management are seeking to rectify, among others. Both strategies seek to outperform the broader MSCI Small Cap index, rather than the US focused Russell 2000 but the stories remain the same. Find the winners of tomorrow, by looking harder than the rest.

The end of 2020 has seen an incredible flurry of initial public offering (IPO) activity on the ASX, however, as the years comes to a close it is clear investors are becoming wary of their quality. Several high-profile IPO’s were pulled in the final weeks and a market tiring of e-commerce linked listings resulted in steep losses for a number of companies. On the other side of the world, companies as much as 10 times larger are delivering solid returns with more established business models and likely significantly less risk.