Buffett pushes back on ESG proxy pressure

The US$500 billion ($649 billion) investment conglomerate Berkshire Hathaway (NYSE: BRK.A) is the latest group to come under pressure for its climate change and diversity disclosures. Its response and the growing pressure offers a unique insight into the increasingly complex web that is ESG investing, and how these issues are best applied by both companies and investors.

Ahead of its annual shareholder meeting (scheduled for May 1) Berkshire received a number of proxy directions from shareholders seeking greater disclosure of climate change and diversity issues from the group. The first is from a group lead by the California Public Employees Retirement System, known as CalPERs, which asked for an annual assessment on how the company is addressing climate risks.

Specifically, the pension fund is asking for three things: “1. Summaries of risks and opportunities for each of the company’s subsidiaries and investee organisations that the board believes could be materially impacted by, or significantly contribute to, climate change; 2. An explanation of how the board oversees and manages climate-related risks and opportunities; and, 3. An examination of the feasibility of the company establishing science-based, greenhouse gas (GHG) reduction targets, consistent with limiting climate change to well-below 2C”.

The second proposal, from Handlery Hotels, has asked for Berkshire’s holding companies to publish reports regarding their diversity and inclusion efforts. Specifically, they should include “the process that the board follows for assessing the effectiveness of diversity, equity and inclusion programs; and the board’s assessment of program effectiveness, as reflected in any goals, metrics, and trends related to its promotion, recruitment and retention of protected classes of employees.”

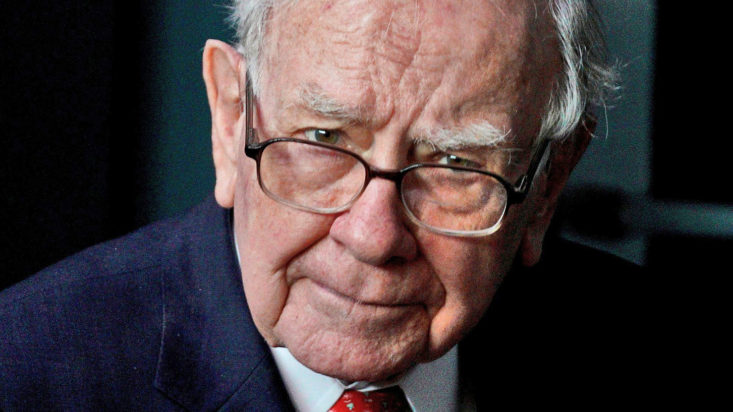

As has been the case for many years, Berkshire urged shareholders to vote against the proposals. The key reason being that as a conglomerate, Berkshire has over 60 businesses; it says this type of reporting is the responsibility of those companies, not Berkshire’s. But is this enough? By providing capital to these many businesses, is it not Berkshire’s responsibility to consider the impact of that capital on the environment and community? If not, what is the responsibility of index managers like BlackRock? Given Warren Buffett’s pro-America view, does he speak for broader management in the country?

The group made several comments on the proposals highlighting that “we want our managers to do the right things and we give them enormous latitude to do that; consistent with our business model, each subsidiary is independently responsible for identifying and managing the risks and opportunities associated with their business, including those related to climate change.”

Similarly, “Berkshire’s commitment to diversity, equity and inclusion and the effectiveness of our companies’ related programs starts with our leaders, including our board of directors on which three female and two ethnically diverse members serve”.

However, as has been pointed out previously, these three women are part of a 14-person board, the remaining 11 of which are men; and whose five executive officers are also all men.