BlackRock’s Fink looks to Australia’s ‘good model’ for US super system

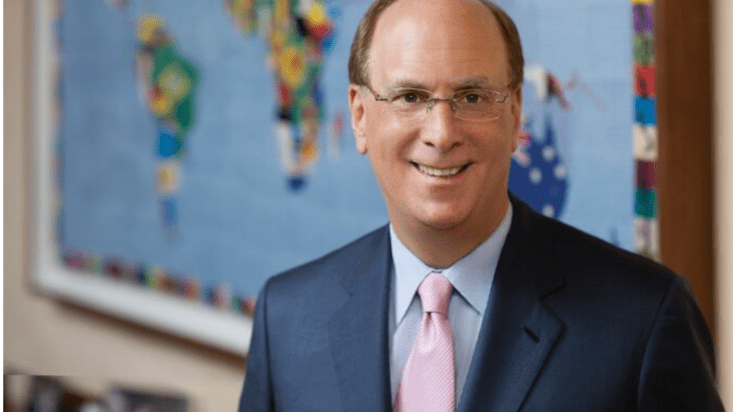

BlackRock CEO Larry Fink’s annual investors letters aren’t quite on same level of compulsory reading as Howard Marks’ investment memos, but for sheer sociopolitical impact they’re hard to beat.

Fink’s innocuous stance on ESG in 2020 has since snowballed into a culture war unto itself, with a handful of US state treasurers effectively banning the world’s largest asset manager from pension portfolios over (misplaced) concerns it would try to coerce companies into divesting pollutive assets to “force the global warming agenda” (in the words of North Carolina’s state treasurer).

So Fink will likely be hoping that 2024’s edition, which covers America’s challenges with the retirement phase, will prove less controversial but no less impactful. And few would disagree with his belief that Australia’s superannuation system provides an excellent example of what America’s retirement could one day be.

“Of course, every country is different, so every retirement system should be different,” Fink writes. “But Australia’s experience with Supers could be a good model for American policymakers to study and build on. Some already are. There are about 20 U.S. states – like Colorado and Virginia – that have instituted retirement systems to cover all workers like Australia does, even if they’re gig or part-time.”

“It’s a good thing that legislators are proposing different bills and states are becoming ‘laboratories of retirement’. More should consider it. The benefits could be enormous for individual retirees. These new programs could also help the U.S. ensure the long-term solvency of Social Security. That’s what Australia found – their Superannuation Guarantee relieved the financial tension in their country’s public pension program.”

But while defined contribution (DC) might be the undisputed accumulation world heavyweight champ, retirement threatens to deliver it a career-ending knockout blow. The “real drawback” of DC plans – in Fink’s example, the 401(k) plans that dominate the American retirement landscape – is that they remove the responsibility for retirement from employers and put it on employees.

“With pensions, companies had a very clear obligation to their workers,” Fink writes. “Their retirement money was a financial liability on the corporate balance sheet. Companies knew they’d have to write a check every month to each one of their retirees. But defined contribution plans ended that, forcing retirees to trade a steady stream of income for an impossible math problem.”

It’s not a perfect one-to-one comparison. While both systems are tax-advantaged and employer-sponsored, superannuation is compulsory, meaning that most Australians will definitively retire with a nest egg, while the super fund itself is increasingly invested in how that nest egg is spent. But many of the frustrations around retirement are the same. That’s what AustralianSuper found when it conducted research with its member base, with chief retirement officer Shawn Blackmore likening the accumulation experience to a plane on autopilot – and retirement the point at which members suddenly find themselves at the controls.

“Because most defined contribution accounts don’t come with instructions for how much you can take out every month, individual savers first must build up a nest-egg, then spend down at a rate that will last them the rest of their lives,” Fink writes. “But who really knows how long that will be?”

Predictably, BlackRock – which manages around US$10 trillion across its suite of exchange-traded products and multi-asset strategies – wants to solve for the problem with product, cutting through a debate that still rages in the Australian retirement system about advice with what it calls “LifePath Paycheck”.

That will allow participants to purchase a lifetime income stream in retirement, payable by insurers selected by BlackRock. And it’s unlikely that the world’s largest asset manager – with products that can be found in the portfolios of every super fund in Australia – will only roll it out in the US.

“We’re talking about a revolution in retirement,” Fink writes. “And while it may happen in the U.S. first, eventually other countries will benefit from the innovation as well. At least, that is my hope. Because while retirement is mainly a saving challenge, the data is clear: It’s a spending one too.”

While it’s unlikely that a potential global LifePath rollout will put an end to the advice vs product retirement debate – where positions tend to reflect the business conflicts of whoever holds them – it could be a ‘plug and play’ solution that many megafunds are searching for as they try to mass-cater for their members’ retirement needs. Whether a plug and play solution is the right solution is another question, and one for another day.

Pay attention to debt

Having recently acquired Global Infrastructure Partners in a US$12.5 billion deal, Fink also writes that public-private infrastructure partnerships will become more common as institutional investors get more involved in developing assets like air and sea ports in their hunt for yield and fiscal deficits grow.

“More leaders should pay attention to America’s snowballing debt,” Fink writes. “There’s a bad scenario where the American economy starts looking like Japan’s in the late 1990s and early 2000s, when debt exceeded GDP and led to periods of austerity and stagnation.

“A high-debt America would also be one where it’s much harder to fight inflation since monetary policymakers could not raise rates without dramatically adding to an already unsustainable debt-servicing bill.”

And the solution to that, Fink believes, is not instituting higher taxes or spending cuts.

“We can’t see debt as a problem that can be solved only through taxing and spending cuts anymore. Instead, America’s debt efforts have to centre around pro-growth policies, which include tapping the capital markets to build one of the best catalysts for growth: infrastructure.”