Big city advisers paid more, but big city paraplanners paid less

Recent research from Business Health suggests it’s much more lucrative for senior financial advisers to work amongst the wealthy practices and HNW clients of the bigger cities and states, yet paraplanners based in regional areas earn much more than their big-city counterparts.

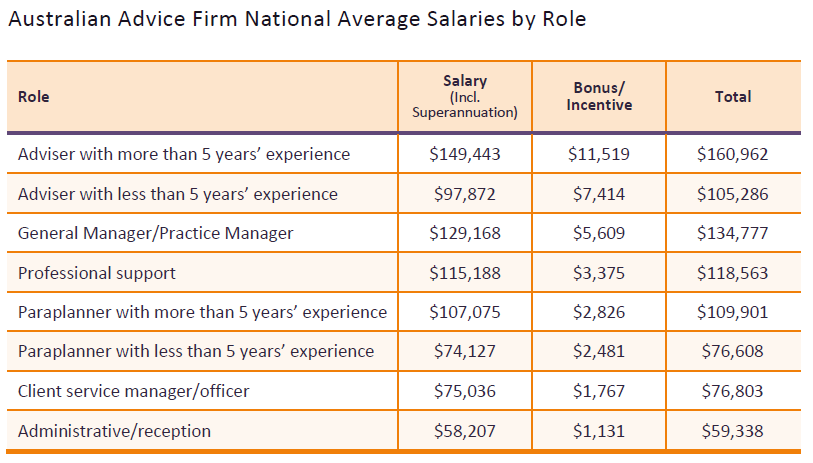

The research consultancy recently surveyed 100 practices around the country on their human resource value proposition, which included information about salary, bonuses and other employee benefits as part of their February Swimming at the deep end of the talent pool report.

It found that while the average salary for an Australian adviser with five years or more experience is just under $150,000, location matters. Advisers in the more populous states of NSW ($153,668), Queensland ($153,774) and Victoria ($150,333) typically earned much more than those in South Australia, Western Australia and the Norther Territory, which averaged out at $132,327 (figures not including bonus amounts).

Similarly, senior advisers located in regional/rural areas earn significantly less ($140,214) than those in city/metropolitan areas ($153,656).

The divide was just a stark for junior advisers, categorised as those with less than five years’ experience. Those in the city and metro areas earned $101,157 while the regional junior advisers took home $89,250.

Flip side of the coin

But while city advisers were broadly paid more than their regional counterparts, it was a different dynamic for paraplanners, with those living and working in less sparsely populated areas earning far more than their metropolitan counterparts.

Senior paraplanners (ie. those with 5 years or more experience) earn an average of $107,075 across the country, which is – for the first time – higher than the average salary for junior advisers. Regional firms are paying senior paraplanners an average of $137,854, however, which is much higher than the $92,869 being paid out to their city-based peers.

The disparity is “perhaps reflective of limited supply”, the Business Health team notes, with less qualified and experienced senior paraplanners located outside of cities.

Interestingly, junior paraplanners are down as being paid relatively evenly across city and regional lines. The only curious exception to the uniformity of salary for paraplanners with less than five years experience is that those in Queensland are paid significantly less ($67,471) than the other states ($74,127).

The carrot and the stick

According to the Business Health report, 43 per cent of practices surveyed do not offer incentive payments to their staff, which the researcher says came as a “surprise”.

“Of even greater concern was the fact that half of the owner/principals that do offer their staff a bonus plan, are not confident that their incentive program is delivering the desired results for their employees or for their business,” the report states.

The researcher says that anecdotally, the staff who participate in the survey are highly averse to participating in bonus programs that involve a high degree of owner/manager discretion, which are “fraught with danger”.

“A third of business owners state that their incentive program is not based on clear, measurable and pre-agreed individual performance objectives and over half report that their incentive payments include a discretionary overlay,” the report states.