Battleground: Infrastructure in post pandemic world

In this article we compare heavyweights Magellan and ClearBridge (previously known as RARE Infrastructure) and their respective infrastructure-focused strategies. While Magellan and its CEO Hamish Douglass need no introduction, the infrastructure fund is run by Gerald Stack. He joined Magellan in 2007 and is both head of investments and head of infrastructure, leading the team responsible for managing Magellan’s infrastructure portfolios and providing research coverage of companies within the infrastructure, transport and industrials sector. Magellan has roughly $100 billion in funds under management.

On the other side, ClearBridge Investments (formerly RARE Infrastructure) is a global equity manager committed to delivering superior risk-adjusted investment performance. In December 2020, RARE announced that it would change its name to ClearBridge Investments in the first quarter of 2021, following its integration with New York-based global equities manager ClearBridge Investments LLC. ClearBridge is part of Franklin Templeton, but operates independently. The RARE Australian managed funds were renamed to incorporate the ClearBridge name, but kept the RARE (which stands for ‘risk-adjusted returns to equity’) moniker too. The ClearBridge Investments infrastructure fund is led by Nick Langley and his team.

A comparison of style

Both strategies seek to build high-conviction portfolios of between 20-40 global listed infrastructure (GLI) stocks, and deliver stable returns from the growing asset class. Conviction is clearly key in what is at times a somewhat concentrated sector, with less than 500 investments in the GLI universe at any given time. Magellan highlights its “conservative” definition of “core infrastructure,” seeking to avoid any commodity price risk within its investments. The manager’s primary benchmark is the S&P Global Infrastructure Index, with an additional performance fee measure being the yield of 10-year Australian Government bond, effectively making the strategy an absolute-return focus.

The story is similar for ClearBridge, but with an increased willingness to include both developed and emerging market infrastructure assets and an absolute-return benchmark. The fund benchmarks itself against an inflation-plus index, measured as the average inflation of the G7 economies plus 5.5%. This represents the return that many would suggest is required for an investment into global listed infrastructure assets, given the higher perceived risk.

Performance spotlight

Long-term returns for both strategies have been solid, delivering around 7% per annum over the journey. It is in the short term where their performance has diverged, with ClearBridge doing significantly better in navigating the tumultuous year that was 2020. The standout point has likely been ClearBridge’s ability to not only minimise the drawdown in March 2020, but also resist the temptation to pivot too heavily, too quickly, to lower-risk assets, and thus miss out on what was a swift recovery.

Fees

One of the most important considerations for investors is fees, with both broadly similar, around 1%, in line with the global average and reflecting the significant research required to navigate the sector. That said, Magellan also charges a performance fee of 10% of outperformance over the higher of the S&P Global Infrastructure Index and the Australian Government Bond Yield, which is currently around 1.60%.

Top holdings and commentary

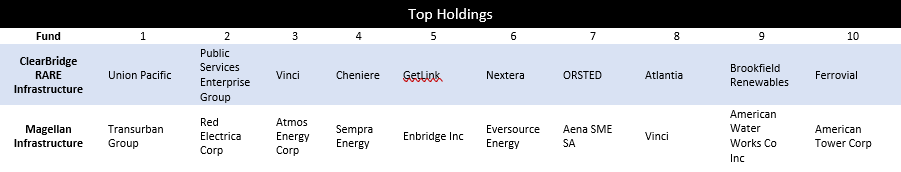

Not surprisingly given the concentration of the sector, there are a few overlapping holdings within the top 10, including energy construction group Vinci, but it differentiates quickly after that. Where Magellan holds its largest exposure in the toll roads (17%) and integrated power sectors (16%), ClearBridge is more focused on electricity distribution (33%) and railroads (12%).

ClearBridge

As at the end of February, the fund returned -1.9% for the month, lagging the MSCI AC World Index which returned 2.40%. Over the year the fund lost just 1.1% in value, which was better than the S&P Global Infrastructure Index which lost 7.1%, but much worse than the MSCI AC World Index’s return of 27.2%.

It was a tough month for the ClearBridge team, which underperformed general equities due to the reflation trade, as well as concerns around rising inflation and bond yields. The rotation out of growth and into value caught them by surprise. “Markets were squarely focussed on the risks of rising inflation, as vaccine rollouts, significant levels of fiscal stimulus, the Federal Reserve’s change in its inflation targeting methodology and its willingness to let the economy ‘run hot’ have raised expectations for a recovering economy,” says ClearBridge’s latest commentary. “The result was a rapid increase in 10-year bond yields and market concerns about the risk of breakout inflation that may ultimately impact equity valuations.”

Over the year, the sector as a whole was hit hard during the pandemic, after key assets such as toll roads, airports, bridges and all forms of public transport forced into a deep freeze. The infrastructure sector on average returned -16.43% year to date. On that basis, ClearBridge’s return of -11.40% for the year was a respectable figure.

Magellan Infrastructure

On all counts, this was a disappointing result from a fund manager that many consider the “top dog”. The poor performance came across the board with Magellan’s Global Open Class fund also recording its worst year in a decade after it underperformed the MSCI World Ex Australia index.

Most of the outperformance enjoyed during the second half of 2019 was all but given back following the pandemic. The fund manager was unable to position itself to stem losses despite saying it was protecting investors on the downside. The underperformance has led to a slashing of performance fees by 70% in the first half of 2021. According to The Australian, Hamish Douglass “rejected criticism of Magellan’s investment strategy and warned that markets have very little margin for error, with mutations of the coronavirus still posing the main risk.”

For the month of February the fund returned -2.3%, under-performing the S&P Global Infrastructure Index’s -0.5%. Over the year the result was much the same: the fund delivered a loss of 10.1% versus the index’s 7.1% contraction. In a note to clients, UBS said ”Key retail funds continue to deliver soft performance relative to respective benchmarks, and while near-term performance may remain volatile, our concerns now increase around the impact on its long-term track record and potential implications on net flows going forward.”

Magellan is however known for its consistent outperformance. If the last two months of last year were removed, Magellan says the performance wasn’t too bad.

All things considered, 2020 was a year like no other, dominated by one thing; COVID-19. Winners of the year were stocks that assisted people during lockdowns and helped defend against the disease. This included companies tied to face masks, e-commerce, buy-now-pay-later platforms and rubber gloves. COVID losers included stocks tied to travel, airlines and REITs, which were all but bulldozed. The start of 2021, however, has seen a dramatic fall in the number of COVID-19 cases as vaccines are distributed on a global scale. A rise in bond yields is implying market belief that the end of pandemic-driven uncertainty is near and a return to normality is not far off.

Many of the unloved, beaten-down value stocks are expected to benefit from this economic recovery. Whether Magellan or ClearBridge RARE, a tilt to global listed infrastructure should pay out handsomely when things turn around in 2021.