Ahead of what is expected to be another 25-basis-point interest rate rise announced today, it was a reasonably positive tone from the Australian share market on Monday. The benchmark S&P/ASX200 index gained 45 points, or 0.6 per cent, to 7,328.6, while the broader All Ordinaries was up 41.7 points, also 0.6 per cent, to 7,525.7….

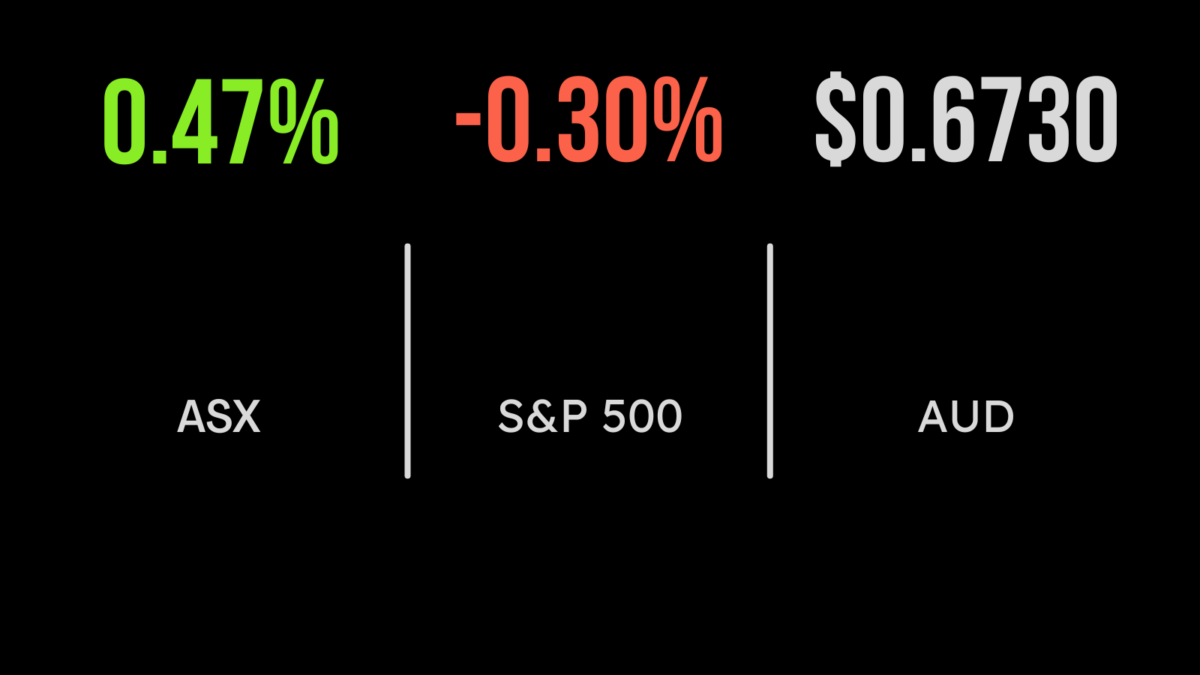

Rising iron ore prices helped mining heavyweights BHP Group, Rio Tinto, Fortescue Metals and Mineral Resources on Thursday, and in turn that helped to push the major indices higher. The benchmark S&P/ASX200 index finished Thursday up 3.8 points at 7,255.4, while the broader All Ordinaries gained 3.9 points to 7,460. Iron ore has risen 15 per cent since the start of 2023, on optimism…

Optimism for mining stocks battled a downturn in the big banks in deciding the direction for the Australian share market on Wednesday, with the banks prevailing just enough to see the benchmark S&P/ASX 200 close 6.8 points, or 0.1 per cent, lower at 7251.6, while the broader All Ordinaries Index retreated 1.9 points to 7456.1. The bullishness for the miners…

Australian retail sales rebounded in January as household spending defied inflation and higher borrowing costs, strengthening the case for the Reserve Bank to keep raising interest rates, and run a “higher for longer” rates scenario, taking its cue from its central bank peers in the US and Europe. Retail sales rose 1.9 per cent in January after…

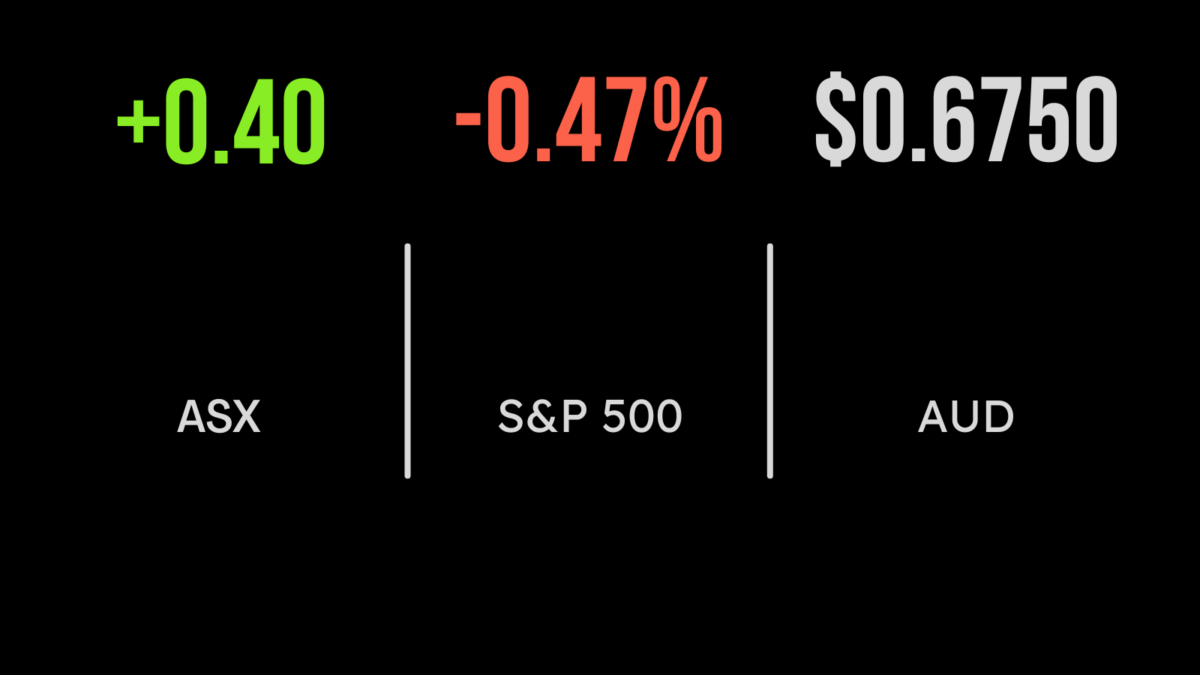

Local investors had the weekend to digest Friday night’s alarming report of the Federal Reserve’s preferred inflation metric, and they decided they didn’t like it. On Friday night Australian time, the US personal consumption expenditure (PCE) figure showed that US consumer spending rose 4.7 per cent in the year to January, well above the market…

Negative-yielding debt topped US$18 trillion at its height in late 2020, representing a quarter of global bonds outstanding at the time. With the stock of negative-yielding bonds now yielding in the positive, owners of the debt face ugly marked-to-market losses – but counter-intuitively, there were investors willing to buy them.

The SMSF adviser took an unusual path to joining the profession, one that involved almost a decade playing rugby on the hot sand and gravel of Saudi Arabia.

ETFs have revolutionised the investing universe for many good reasons. But ultimately ETFs are just like stocks – there are the good, the bad and the ugly.

It was a COVID-inspired idea that fell foul of the electoral cycle, but the nation’s small business advisory peak bodies continue to push for subsidised advice for small businesses.

Like many people, Ashley O’Connor, head of investment strategy at Invesco Australia, did not exactly plan for the career he ultimately embarked upon. But some serendipity brought him to a role he truly values.