Aussie market shrugs off inflation reading

The local share market managed a small gain on Wednesday despite the latest inflation reading surprising on the upside, raising the possibility that the Reserve Bank of Australia (RBA) could become more aggressive on rate hikes.

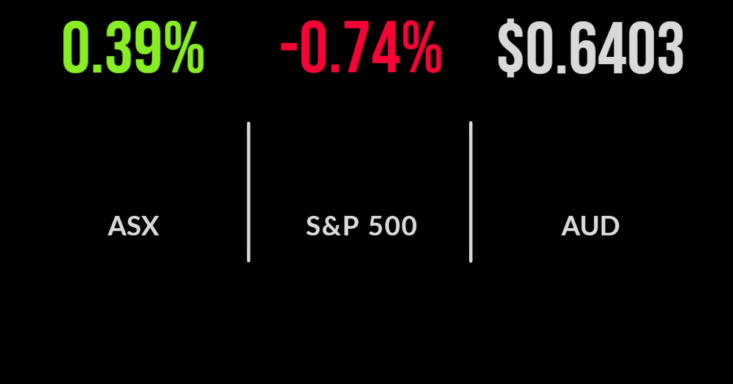

The benchmark S&P/ASX200 index finished Wednesday up 12.3 points to 6810.9, a gain of 0.2 per cent, while the broader All Ordinaries index climbed 11.4 points, also 0.2 per cent, to 7,005.1.

The major culprit certainly appeared to be the September CPI reading, which showed that consumer prices rose by 7.3 per cent in the 12 months to September 30, above consensus expectations of a 7.1 per cent rise. That indicated to all and sundry that another 50-basis-point rate next month was now looking more likely than not.

The accelerating inflation pressures in the economy are starting to affect even the defensive consumer staples sector. Supermarket group Coles Group yesterday posted supermarket sales for the 13 weeks ended September 25 that rose 2.3 per cent, to $9.02 billion – below analysts’ forecasts, and a significant slowdown from 3.3 per cent in the previous quarter. Coles’ liquor sales slid 4.3 per cent, to $839 million. In response, the shares retreated 44 cents, or 2.7 per cent, to $16.16.

Woolworths, which has quarterly sales due next week, warned at its annual general meeting on Wednesday that as we move further into 2022-23, Woolies expects the operating environment to remain challenging. Woolworths shares slid $1.05, or 3.2 per cent, to $32.33. Meanwhile, Coles spin-off Endeavour Group, which owns Dan Murphy’s, BWS and a slate of pubs, lost 34 cents, or 4.6 per cent, to $6.98.

All the big banks were higher, with CBA up 22 cents, or 0.2 per cent, to $102.00; ANZ adding 18 cents, or 0.5 per cent, to $25.84; Westpac gaining 11 cents, or 0.5 per cent, to $24.01; and NAB up 12 cents, or 0.4 per cent, to $32.07.

Medibank having a ‘mare

Medibank Private returned to trading for the first time since last Thursday following a devastating hack of customer data. The news has progressively worsened for the health insurer, which has now admitted that every single customer’s data was breached – and that it does not have cyber insurance. Unsurprisingly, the shares fell off a cliff the moment the market could trade them, with Medibank plunging 64 cents, or 18.2 per cent over the day, to $2.87.

It was a different story for shareholders in horticultural company Costa Group, whose former private equity owner Paine Schwartz Partners is back on the share register, buying a stake of up to 15 per cent. Shares in the fruit and vegetable grower surged 24 cents, or 10.8 per cent, to $2.47.

Among the big miners, BHP advanced 4 cents to $38.54; Rio Tinto gained 54 cents, or 0.6 per cent, to $91.86; Fortescue Metals eased 13 cents, or 0.8 per cent, to $16.13; and South32 gained 4 cents, or 1.1 per cent, to $3.64.

The coalminers had a second straight day in the doghouse, with sector leader Whitehaven sliding 84 cents, or 8.1 per cent, to $9.52; New Hope Corporation giving up 47 cents, or 7.1 per cent, to $6.19; Terracom off 6 cents, or 5.8 per cent, to 98 cents; Yancoal losing 26 cents, or 4.6 per cent, to $5.46; Coronado Global Resources retreating 9 cents, or 4.5 per cent, to $1.93; Stanmore Resources down 10 cents, or 3.4 per cent, to $2.87; and Bowen Coking Coal losing 1.5 cents, or 4.8 per cent, to 30 cents.

In lithium, producer Allkem was down 63 cents, or 4.2 per cent, to $14.36 and fellow producer Pilbara Minerals lost 38 cents, or 7.1 per cent, to $4.98. IGO, which mines nickel and lithium, went against the trend, rising 53 cents, or 3.3 per cent, to $16.44; Mineral Resources, which produces iron ore and lithium, gained $2.15, or 2.9 per cent, to $76.90. After almost doubling on Tuesday on news it had signed an option agreement to acquire two lithium brine exploration licences in South America, lithium explorer C29 Metals slid 6.5 cents, or 22.4 per cent yesterday, to 22 cents.

Tech earnings weigh on US market

In the US overnight, the broad S&P 500 index and the tech-laden Nasdaq Composite gauge both snapped three-day winning streaks, as the market mulled disappointing earnings from tech giants Microsoft, Alphabet and Meta Platforms. Alphabet dropped 9.1 per cent, Microsoft closed 7.7 per cent lower and Meta sank 17 per cent, putting the indices under pressure. The Nasdaq dropped 228.1 points, or just over 2 per cent, to close at 10,970.99. The S&P 500 lost 28.5 points, or 0.7 per cent, ending at 3,830.6. The 30-stock Dow Jones Industrial Average was virtually flat, up 2.4 points for the day and ending at 31,839.1.

In the bond market, the US 10-year bond rallied, but the yield remains above 4 per cent, at 4.006 per cent, while the more policy-sensitive 2-year Treasury note was unchanged at 4.418 per cent.

European markets finished broadly higher with shares in Germany leading the region. The DAX was up 1.1 per cent while London’s FTSE 100 gained 0.6 per cent and France’s CAC 40 advanced 0.4 per cent. The broad cross-continent Stoxx 600 index gained 0.7 per cent.

Gold is up US$11.82, or 0.7 per cent, to US$1,664.67 an ounce. Brent crude oil added US$2.50, or 2.7 per cent, to US$96.02 a barrel, while the main US grade, West Texas Intermediate, advanced US$2.59, or 3 per cent, to US$87.91. The Australian dollar is buying 64.81 US cents this morning, strengthening from Wednesday’s close of 64 cents, as the greenback weakens.