ASX flat on strong jobs data, utilities, real estate weaken, MinRes surges on cancelled deal

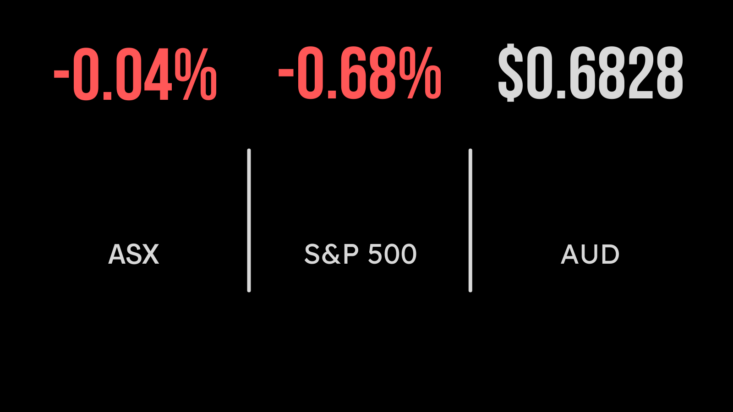

Positive earnings surprises continue to outweigh the negative, with the likes of Flight Centre (ASX:FLT) and Nuix (ASX:NXL) gaining strongly after offering updates to the market. The S&P/ASX200 (ASX:XJO) gained just 1 point, with the financials and technology sectors the key drivers, adding 0.4 per cent respectively. News that unemployment remained fixed at 3.5 per cent was enough to threaten another rate hike, with the interest-rate sensitive real estate and utilities sector both falling 0.3 per cent as a result. Lithium miner Mineral Resources (ASX:MIN) managed a 5.2 per cent gain after the company announced the cancellation of its deal with Albermarle, instead choosing to build its own processing plant. Shares in beleaguered BNPL player Zip Co (ASX:ZIP) gained 2.3 per cent after the company reported a solid, if not outstanding, result with transactions growing 9 per cent for the quarter. This is a long way from the multiples achieved 2020 and 2021 but a positive sign nonetheless.

Flight Centre jumps on corporate travel, BHP production underwhelms, Nuix surges

Travel agent Flight Centre (ASX:FLT) gained 4 per cent after the company guided to a full year profit of $295 to $305 million, a near 10 per cent upgrade on the previous forecast. This took total transaction volume to $11 billion, well above the peak in 2019 before the pandemic. Iron ore producer BHP (ASX:BHP) finished flat after the company pushed down expectations for iron ore production in 2024, and reported both lower production and sales volumes in the final quarter, albeit still beating historically high levels. Cybersecurity and technology company Nuix (ASX:NXL) gained 37 per cent after the company allayed concerns about contract losses, announcing a three year extension to its contract with the Australian Tax Office. The result was ongoing revenue expectations of $184 to $186 million for the year.

Dow Jones extends winning streak, Tesla, Netflix sink on earnings, Johnson & Johnson jumps

The Dow Jones has extended its winning streak to nine straight sessions, adding 0.5 per cent on Thursday, making the longest such streak in six years. The driver was solid earnings results from both Johnson & Johnson (ASX:JNJ) and IBM Corp (NYSE:IBM) which added 6 and 2 per cent respectively. The former reported around a 10 per cent increase in sales on the back of strong growth in its medical technologies business, with sales broadly rising a solid 6 per cent. Both the Nasdaq and S&P500 weakened, falling 0.7 and 2.1 per cent after earnings reports from Tesla (NYSE:TSLA) and Netflix (NYSE:NFLX) underwhelmed. While Tesla reported near 50 per cent sales growth, falling margins were a concern for investors. On the other hand, record free cash flow wasn’t enough to hide a similar issue at the streaming service. In economic news, existing home sales in the US continued to fall, while the survey of leading economic indicators was 0.7 per cent lower in June.