ASX (ASX:XJO) hits three month high on falling inflation, Austal sinks on downgrade

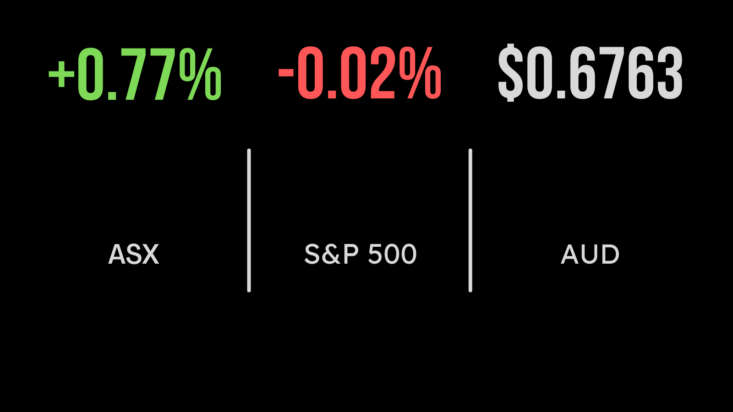

The local share market managed a 0.9 per cent gain, taking it to a five month high on the back of another confirmation of falling price levels and inflation. The materials sector was the standout, prior to Rio Tinto (ASX:RIO) delivering a strong quarterly update, gaining 1.8 per cent, while financials also added 1.1 per cent. The best performing stock on the day was Beach Energy (ASX:BPT) which gained 6.9 per cent while both REA Group (ASX:REA) and Wisetech (ASX:WST) managed to mark new highs after adding 2.5 per cent and 0.6 per cent respectively. Shares in Rio Tinto (ASX:RIO) finished 1.4 per cent higher, ahead of the company delivering a 34 per cent drop in profit due to weaker commodity prices and a near $800 million writedown on its alumina refineries. Shares in shipmaker Austal (ASX:AST) were also sold off, falling 10.5 per cent after the company warned that increasing costs on a US Navy project could see it switch from a $58 million profit to a $10 million loss.

Kogan gains despite falling sales, Corporate Travel updates earnings

Inflation data continues to point towards a pause in interest rate hikes, with the latest resulting showing price rises had slowed to 6 per cent in June from 7 pr cent in March, weaker than the 6.2 per cent expected by the RBA. The main contributors remain overseas travel and restaurant spending. This offered hope to online retailer Kogan (ASX:KGN) as shares gained 10 per cent despite the group reporting a 22 per cent fall in profits in the second half, as consumers began to slow spending. Earnings is now expected to be just $3 million in the second half, but on the positive side inventory has fallen by close to 60 per cent. Corporate Travel (ASX:CTD) also added 0.9 per cent as the company updated expectations for earnings of between $165 and $170 million on the back of strong business and leisure spending.

Dow hits 13, Fed hikes rates, pushing markets lower, Microsoft, Alphabet head in different directions

The Federal Reserve raised rates again overnight, with another 25 basis point increase taking the cash rate to 5.25 to 5.5 per cent. Despite this the Dow Jones managed to push towards a 13th straight day of gains, after a strong result from Alphabet (NYSE:GOOGL) which gained close to 6 per cent. The company reported a near 10 per cent increase in both profit and revenue, which reached US $74.6 billion for the quarter, with cloud sales jumping close to 30 per cent on the back of the AI boom. Management noted a strong recovery in advertising sales, albeit not quite at the prior historical highs. It was the opposite story for Microsoft (NYSE:MSFT) which lost close to 4 per cent after despite the company reporting another strong quarter in both cloud storage and Azure. The former saw 15 per cent growth and the latter 26 per cent as the business continues to benefit from its investment in AI group OpenAI, owner of Chat GPT.