Are ASX-listed asset managers undervalued or just falling knives?

The struggles of ASX-listed fund managers have been laid bare in the media and across return sheets in recent years, and exacerbated by the strong performance of index funds that track benchmarks buoyed by one of the most consistently robust market runs in modern history.

But those very same markets are cyclical, and an extended lean patch for traditional fund managers has forced them to create more efficient and effective companies which, when the market turns, could present the opportunity for a significant upswing in the depressed valuations we see today.

Investors would be forgiven for a skeptical outlook, however. After years of relative underperformance and huge outflows at some of the country’s most trusted fund managers, many would believe the prevailing narrative that equity managers, in particular, can’t beat the market consistently and won’t build enough FUM to grow the value of their businesses.

According to researcher Morningstar shares are relatively cheap relative to past averages, and asset managers are generally undervalued. A cyclical reprieve is likely on the horizon for equity managers, Morningstar says in its Industry Pulse 2024 Q2 report, but the structural headwinds buffeting the funds management industry remain.

The first thing to note is that recent performance has been mixed. Not all funds have seen their share price decline, with some significant outliers presenting. GQG Partners and Pinnacle, for example, are having stellar runs, up 96.1 per cent and 40.4 per cent respectively in the last 12 months. Challenger is holding firm with a 4.8 per cent gain.

For the rest, however, poor performance and consequent outflows have taken their toll. Platinum Asset Management (-39.9 per cent), Perpetual (-17 per cent), Magellan (-12.9 per cent) and Insignia (-21.6 per cent) have all toiled over the last 12 months while the ASX 200 gained 6.9 per cent.

Morningstar pinpoints stubborn inflation and interest rates, alongside “organisational issues”, as being behind these losses, noting that share prices have not recovered for these firms since 2022, when rates finally began rising after hovering near zero for a prolonged period.

But while the outlook for rates is murky, with last month’s elevated inflation figures dampening hopes of an early rate reprieve, an eventual pull back by the Reserve Bank should see more capital flow into the market and boost FUM levels next year.

“Lower rates should boost investor risk appetite, enhancing fund flows and asset prices,” Morningstar said. “Current futures curves suggest a decline in the federal-funds rate, which influences other interest rates globally, in fiscal 2025.

“Multiples for most of our covered managers are cheap relative to historical averages, aligning with our view that opportunities remain,” the researcher continued. “P/E multiples have risen and yields have contracted since October 2023 as the market eyes initially stable and eventually lower interest rates.”

Foundational issues remain

So there are reasons to believe domestic managers have better days ahead. The fly in the ointment, according to the researcher, is that a cyclical reprieve will only paper over what are foundational issues in sector.

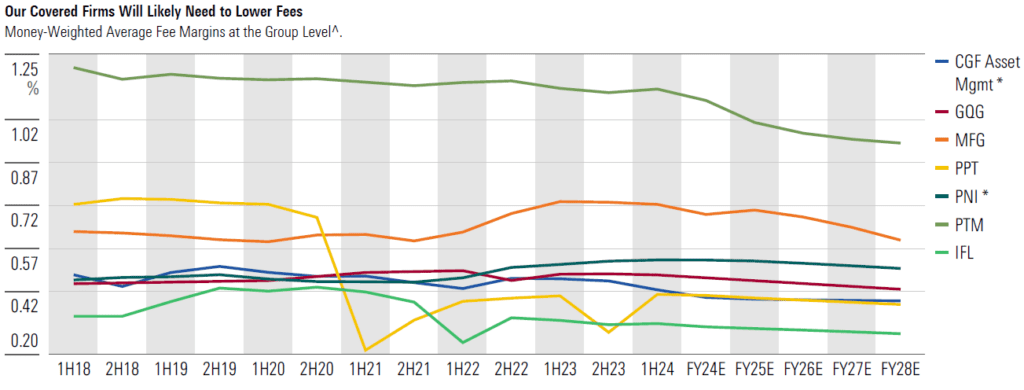

“This prospective interest rate tailwind is cyclical and does not lessen structural issues like fee compression, wage inflation, and the need for business development investment. These are headwinds for profit margins.”

Three core issues will keep traditional fund managers from retaining market share, Morningstar explained. Firstly, the trend to ETFs will likely persist as investors continue to value their diversification, low cost and easy access, meaning active managers “will likely need to trim pricing to counter passive competition” (see below chart).

Industry super funds will also increasingly gravitate towards low-cost investment options and unlisted options as they gain scale, Morningstar said.

The third factor is performance related: “We think the competitive positions of active managers are weakening,” Morningstar added, noting that the pool of funds or active managers is shrinking, and that “business wins are likely to be at the expense of close peers rather than structural gains from low-cost alternatives”.

Near term uplift

Despite the dour mid- and long-term forecast, the researcher believes there are near-term uplift opportunities, with FUM and earnings to increase for “most” of the listed firms.

“We expect FUM and earnings for most of our covered asset managers to recover from fiscal 2023 lows. Potentially falling interest rates in fiscal 2025 are likely to revive investor interest in growth assets, helping flows recover and supporting higher asset prices,” Morningstar stated. “This expectation has already led to some pre-emptive recovery in flows and investment returns in fiscal 2024.”

Opportunities are out there, the researcher says, but only some managers have the characteristics required to see out the structural headwinds.

Insignia Financial, for example, is still in the midst of extracting cost synergies after a spate of mergers and acquisitions over the last 5 or so years. It’s also accustomed to charging lower fees, so the incursion from passive won’t bite as deeply as some of it will for its peers, Morningstar believes.

“We believe the market underestimates Insignia’s ability to stabilize earnings, with cost-outs counterbalancing tepid revenue declines. There is still ample room to remove duplicate or nonessential costs to extract scale efficiencies. Moreover, we think revenue will decline in the long term but at a manageable rate.”