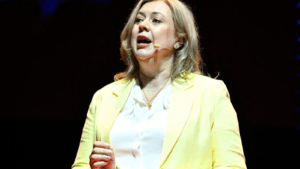

Adviser levy relief delivered by Frydenberg

Some positive news was delivered to the financial advice industry this week with the ASIC Supervisory Levy to be reduced to 2018-19 levels.

The announcement will see levies charged to advisers providing advice to retail clients restored to $1,142 for both the 2021 and 2022 financial years. The government went further, also announcing the flat per-licensee charge will remain at $1,500.

The FY21 ASIC levy was expected to $3,138 per adviser, plus the flat fee of $1,500.

Treasurer Frydenberg and the federal government stepped into what was becoming a growing issue within the industry, applying a temporary reduction in cost recovery levies for the next two years. This comes after nearly every other business sector in Australia had received some sort of government or taxation support.

Growing publicity and headlines along with pressure from a number of outspoken members of Parliament had flagged the issue with the industry funding model. As it stands, the legislation requires ASIC to recoup the costs of operations, including court cases against financial advisers and institutions who have left the industry, from those who remain.

The Treasurer announced that this funding model would be reconsidered considering the clear discrepancies and unintended consequences. This review is expected to take place in 2022 with the Department of Finance and ASIC both involved.

The government highlighted that the focus of its decision was to increase the affordability of financial advice and, while it is a positive first step, much more will need to be done to slow the desertion of advisers from the industry.

The decision was cheered by industry associations including the Financial Planning Association (FPA), which states “this is a significant milestone for the FPA and our members as we have been calling for a review of the flawed model since it was first proposed and then introduced three years ago. We would like to thank the Government for listening to our concerns and those of our members.”