Advice regulator on the front foot to begin 2021

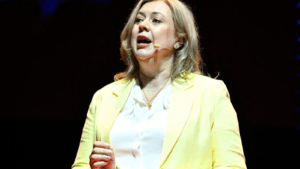

The financial services regulator ASIC has ramped-up its legislative activity in 2021, following a 2020 dominated by pandemic support and leniency. Commenting to media in recent weeks, ASIC’s deputy chair Karen Chester flagged recent proceedings lodged against industry funds Rest Super and Statewide Super as just the beginning. She flagged a “now-mature pipeline of non-Royal Commission-related superannuation legislation.”

Expanding on the comments, Chester confirmed that “the broad misconduct themes are trustee competence and oversight” along with “complaints handling processes and mis-charging fees” with the metrics of harm “well-known”. According to the announcement, there are currently eight matters in litigation, with two briefs in support of criminal charges along with “multiple surveillances about potential trustee misconduct.”

So where has the focus been so far in 2021? The aftermath of the Royal Commission and subsequent release of the FASEA guidelines culminated in significant clean-up of the vertically integrated advice sector, with fees-for-no-service and best-interest obligations the matters in focus.

According to reports, the case against REST Super is a civil proceeding on the basis that the superannuation fund may have been “misleading and deceiving members in relation to switching super funds.” It is alleged that between 2015 and 2018, Rest may have made representations in various forms to members that discouraged, delayed or prevented members from transferring some or all of their retirement savings to other super funds.

Under law, super funds are obligated to process rollovers within three days. ASIC is suggesting that members’ rights may have been denied in this process, resulting in the fund retaining additional assets under management, up to $14.8 million, and the fees associated with them. “The impact on some individuals was substantial, including emotional distress and confusion,” ASIC said.

Adelaide-based Statewide Super is also facing the regulator, with ASIC alleging that the group may have charged insurance premiums to members who didn’t hold group cover. The regulator alleges that between 2017 and 2020, the fund sent statements and warning letters to members detailing insurance that they did not actually have in place. But primarily, the regulator is concerned about the potential that the fund deducted insurance premiums of up to $1.5 million from the accounts of around 1,300 members who didn’t actually hold cover.

According to the lodgement, it is asserted that the fund did not notify members in a timely manner, nor did it prevent the further charging of premiums. According to reports the problem comes down to a software issue on a newly installed system, for which Statewide Super reported a breach to ASIC once identified and sought to assist the regulator in any way possible. According to the fund, “Statewide Super continues to progress its program of remediation, supported by external experts.”

With two high-profile cases to start the year, it is clear the regulator, along with the industry, is in for a busy few months.