Active management outperformance rarely lasts: US study

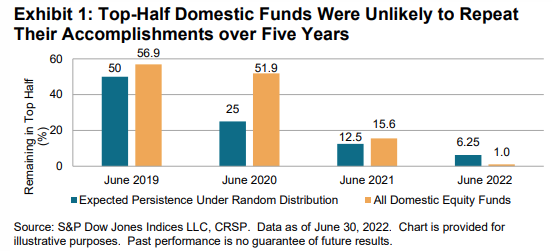

Research out of the U.S. suggests that while stock pickers may get it sometimes, beating the benchmark is rarely a feat that can be maintained with any degree of consistency over the long term.

S&P Global’s mid-year U.S. Persistence Scorecard, which looked at the managed fund performance in the US and in Australia, saw active fund persistence (the ability to outperform consistently) decrease in 2022 (YOY), with not a single U.S. fund whose performance placed them in the top quartile for the 12 months ending June 2020 managing to remain in the top quartile over the next two years.

Equities and fixed income management performed particularly poorly. Not a single equity fund whose 12-month performance placed them in the top quartile in 2020 managed to repeat the effort for two consecutive years, the report noted, with only 5 out of seventeen actively managed fixed income funds managing the feat.

“Over a five-year horizon, it was statistically near impossible to find consistent outperformance,” the report stated. “Among all actively managed funds whose performance over the 12 months ending June 2018 placed them in the top quartile within their respective category, not one fund in any of our reported fixed income and equity categories remained in the top quartile in each of the four subsequent one-year periods ending in June 2022.”

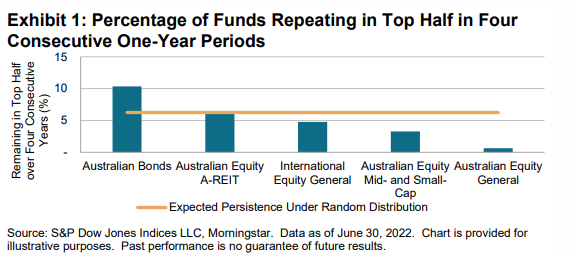

Closer to home, the poor results continued, albeit with “tentative evidence” that fixed income managers.

Looking across across Australian Equity General, Australian Equity Mid- and Small-Cap, International Equity General, Australian Bonds and Australian Equity A-REITs, nota single fund that outperformed in 2018 managed to repeat the feat for four consecutive following years.

Ten per cent of bond funds that outperformed, however, maintained that outperformance for four consecutive years.

If performance were purely random, S&P said, at least a quarter of funds would be able at least remain in the top quartile in the year after outperformance. While there were pockets of outperformance across all categories of active management, finding consistency in those efforts appeared to be problematic.

This story was first published in The Inside Investor.