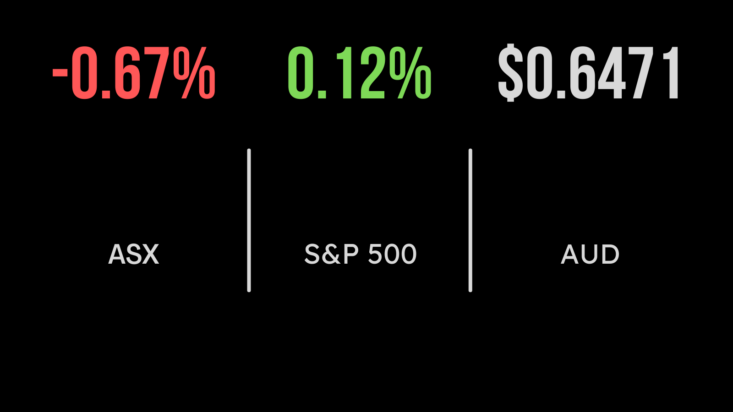

Australian market tumbles with the oil price

On Thursday, the S&P/ASX 200 index fell 0.7 per cent primarily driven by a sell-off in energy companies, with eight of the 11 sectors falling, overshadowing robust labour force statistics revealing the creation of 55,000 jobs within the Australian economy last month. Despite noteworthy data from the Australian Bureau of Statistics indicating job increases, including a revised additional 8000 positions in September, the unemployment rate also experienced a slight uptick from 3.6 per cent to 3.7 per cent. The growing momentum in labour markets and wage growth, coupled with recent low productivity, potentially poses future challenges for the Reserve Bank in managing inflation within its target range. Following the local jobs data, the Australian dollar-maintained stability around US65.09¢, having previously surged to a three-month high of US65.41¢ overnight. Meanwhile, on the ASX, the energy sector experienced the most significant decline, mirroring the drop in oil prices after an official report revealing a notable increase in US crude inventories. Santos saw a 1.9 per cent decrease, Woodside a 0.8 per cent dip, and Beach a 4.1 per cent decline.

Australian equities are on the move

AMP plummeted by 15.8 per cent, emerging as the poorest-performing stock on the ASX 200, following its disclosure of an anticipated very narrow net interest margin of 1.25 per cent for the 2023 financial year. A2 Milk saw a modest rise of 0.5 per cent to 3.82 despite the company’s CEO, David Bortolussi, cautioning about a significant downturn in China’s infant formula market, anticipating a more challenging business landscape this year. GrainCorp recorded a gain of 1.8 per cent, reaching $7.55, after the agribusiness announced a special dividend of 16¢ along with a fully franked final dividend of 14¢. Sonic Healthcare experienced a decline of 4.2 per cent to $29.23 following its intentions to acquire US medical technology firm Pathology Watch. The healthcare provider detailed that the acquisition cost of $US130 million ($199.8 million) would be financed in US dollars through Sonic’s existing cash and debt facilities. AACo ascended by 3 per cent to $1.355, despite reporting a first-half net loss of $105.5 million compared to a profit of $51.6 million in the previous year. Additionally, the beef grazing company faced a statutory EBITDA loss of $124.9 million, contrasting with a year-ago EBITDA of $92.3 million.

“Dictator” President Xi Jinping & Joe Biden meet

A cold meeting between Xi Jinping & Joe Biden, where a comment from Biden calling Xi Jinping a “dictator” eased the US markets frantic November rally, with the Dow, S&P500 and Nasdaq marginally lifting 0.47 per cent, 0.12 per cent and 0.07 per cent. In company news, Foot Locker Inc. revealed a multi-year collaboration with the National Basketball Association, solidifying the athletic footwear and apparel retailer as the official marketing partner of the professional basketball league. However, despite this announcement, Foot Locker’s stock declined by 4.2 per cent in midday trading and still experienced a 44.3 per cent decline year-to-date. Walmart Inc. is heading towards its most substantial daily per centage drop in over a year due to the retail giant’s tempered outlook, which overshadowed third quarter earnings. Walmart’s shares declined by 7.5 per cent on Thursday, marking a potential record decline not witnessed since July 26, 2022. Nio Inc. witnessed a significant 9.9 per cent drop, nearing a three-year low on Thursday. This decline followed the highly anticipated meeting between U.S. President Joe Biden and China President Xi Jinping, which concluded without any fresh agreements on the economic front. Additionally, discouraging remarks regarding China-U.S. relations within Alibaba Group Holding Ltd.’s added pressure on the Shanghai-based electric vehicle company’s stock.