Life insurance industry ‘slowly losing relevance’: Capgemini

Despite enormous tailwinds, including a historic wealth transfer and an ageing population, the global life insurance industry is slipping backwards according to a new report from business management consultancy Capgemini.

Since 2005, life insurance premiums have grown an anaemic 1.9 per cent, the report states, quoting figures from the International Monetary Fund, which is less than half the global GDP rate of 4.1 per cent.

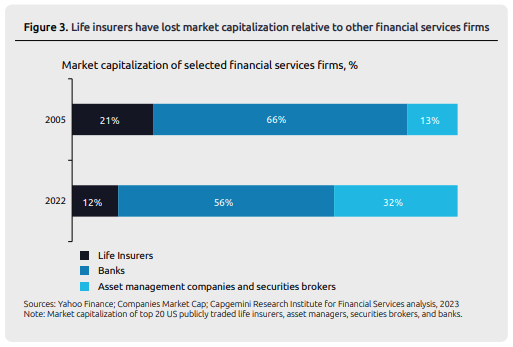

Over time, the report explains, well-capitalised competition from contemporary providers like asset managers, banks and securities brokers has eaten away at the market share of traditional life insurance companies.

“The life insurance industry is slowly losing relevance as multiple financial services providers compete to serve the needs of an ageing population,” it states. “The industry’s slow growth has dimmed its appeal to investors.”

The news gets worse for life insurers, with researchers predicting that the incoming wealth transfer from baby boomers to their descendants will trigger a significant outflow as a new generation of wealth holders sources a new cohort of providers.

“The industry’s financial situation is in flux as history’s largest intergenerational wealth transfer begins,” the report continues. “Currently, 65+ year old policyholders own 40 per cent of insurers’ assets under management (AUM), which for the 40 largest global life insurers totals $US7.8 trillion. However, these assets are poised to be transferred to beneficiaries by 2040, posing a significant risk for insurers to lose AUM.”

Nearly three quarters (71 per cent ) of the AUM up for grabs will shift to beneficiaries over 50 , the report notes. “Thus, the industry should prioritise deepening relationships with ageing policyholders and their beneficiaries.”

Domestic struggles

The global issues traditional life insurers are facing reflects a similar struggle in Australia, where a mix of mismanagement, poor investment and regulatory constraint has hobbled the life insurance industry in recent years.

The sector was already struggling in 2017 after the introduction of Life Insurance Framework laws that limited commissions to life insurance advisers. The 2018 Hayne Royal Commission then cast the industry in poor light after highlighting dodgy sales practices and proposing anti-hawking laws.

Data released by the Australian Prudential Regulation Authority in March revealed a 50.7 per cent fall in revenue for the sector in 2022, with net profit after tax falling 59.3 per cent.

While regulatory fixes have been brought in to limit policy loopholes that have seen insurers leak money, they have also been dealing with a narrowing distribution funnel; adviser numbers have shrunk ~40 per cent since the royal commission and it’s understood there are less than 1,000 dedicated insurance advisers in the country.

Open for disruption

All this has left the industry “one of the ripest for disruption”, PWC said in its Future of Life Insurance in Australia report. The consultancy giant believes a loss of trust is responsible for the problems plaguing the local industry, which leaves it wide open to market share loss.

“The public trust that is vital to the insurance model is a key issue on which the industry has found itself on the back foot,” PWC states. “The industry is also seen as being one of the ripest for disruption. Non-traditional players are looking for ways to use technological advances to create more valuable customer propositions and greater efficiency across the life insurance value chain.”

According to Capgemini, traditional insurers can get back on track by either partnering with technology players or investing in their own contemporary solutions to client needs.

“The public trust that is vital to the insurance model is a key issue on which the industry has found itself on the back foot,” the Life Insurance Report states. “The industry is also seen as being one of the ripest for disruption. Non-traditional players are looking for ways to use technological advances to create more valuable customer propositions and greater efficiency across the life insurance value chain.”