‘Adapt or fail’: 16pc of asset managers to vanish by 2027: PwC

One in six asset management firms will be gone in five years, and 73 per cent are considering strategic consolidation in the coming months, according to a new PwC survey that sees the big players getting bigger in a rapidly changing industry.

After asset and wealth management (AWM) houses saw their biggest decline in assets under management (AUM) in a decade last year, the accounting firm forecasts a rebound by 2027 but says shifting investor expectations will vastly alter the status quo, forcing AWM companies to adapt or fail.

“Existential challenges are sweeping the asset and wealth management industry against a backdrop of social, economic and geopolitical disruption,” global asset and wealth management leader Olwyn Alexander said in announcing the 2023 Global Asset and Wealth Management survey.

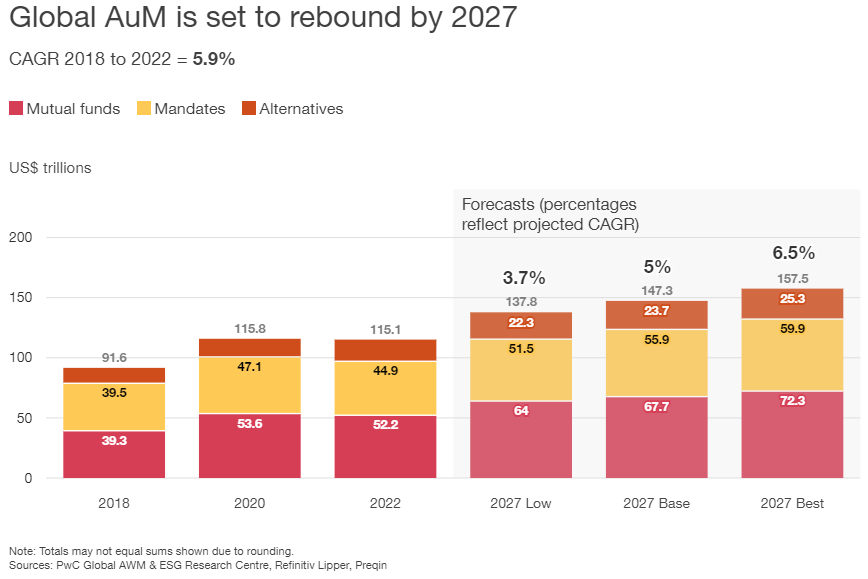

In 2022, the report noted, the industry saw AUM fall to US$115.1 trillion, nearly 10 per cent below the 2021 high of $127.5 trillion and the greatest decline in a decade. While inflation, market volatility and interest rate moves remain pressing concerns, it predicted AUM will rebound to $147.3 trillion by 2027, representing a 5 per cent compound annual growth rate (see chart).

Despite this expected resilience, the survey revealed that 16 per cent of existing AWM firms “will have been swallowed up or have fallen by the wayside” by 2027. That would be twice the industry’s historical turnover rate.

“By 2027, we expect the industry will be transformed and – as a result – it will be imperative for leadership to adapt accordingly,” the report stated.

In this changing landscape, PwC said, AWM firms will need to navigate “once-in-a-career upheaval” as challenging economic conditions make it difficult to outperform the market.

The industry has seen significant reallocations toward passive investments and private markets, the report noted, adding that managers who focus only on the public markets may lose market share.

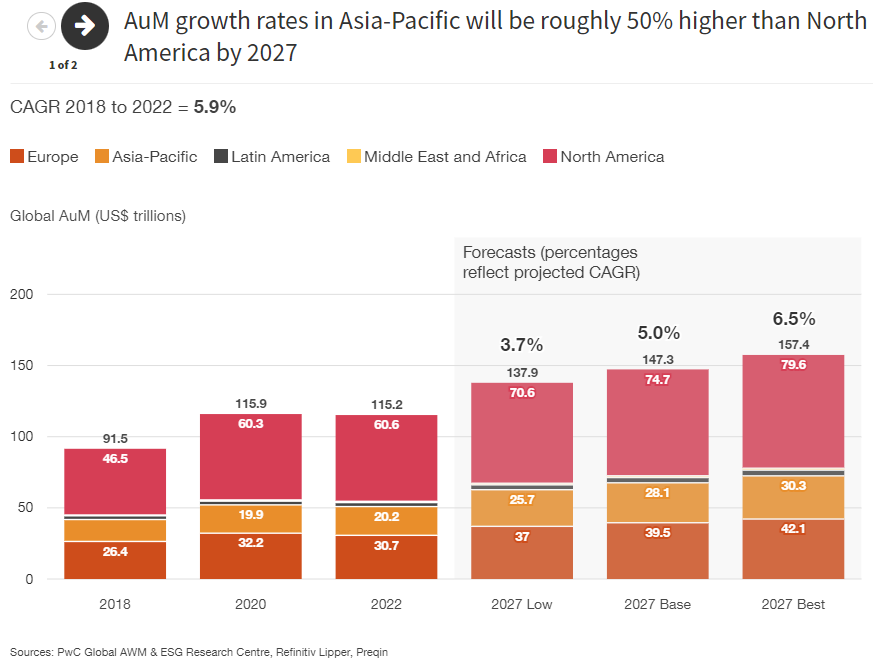

And AWM organisations are increasingly seeking yield in new segments, regions and asset classes, with Asia-Pacific and frontier and emerging markets setting the pace of growth. In PwC’s base case, it forecasts APAC will see 50 per cent higher growth rates than North America by 2027 (see chart).

‘Inflection point’

The report also identified better engagement with retail customers as a key imperative for AWM firms in the emerging environment, noting that the retail market “offers vast and still largely untapped openings for growth”.

“The opening up of private markets and shifts in investment allocation – including greater demand for exchange-traded funds (ETFs) – are transforming the competitive landscape and the frontiers for growth, amid a $68 trillion transfer of wealth from baby boomers to millennials by 2030,” the report said. The demands of millennial investors are also likely to drive further demand for ESG, crypto/digital and private markets investments.

“Together, these developments represent an inflection moment for AWM, creating openings for industry democratisation and growth on the one side and the serious risk of disintermediation on the other,” the report stated.

The need for AWM firms to deliver at scale amid cost and competitive pressures is also increasingly crucial, with decreasing total expense ratios (TERs) expected for both passive and active funds.

“The biggest downward push on fees is now coming from within the AWM industry, as large managers are able to exert a combination of scale and investment in the latest technologies to undercut competitors,” the report stated. “As industry concentration picks up speed, we expect the top 10 asset managers to control around half of all mutual fund assets globally by 2027.”

Against that backdrop, the report found 73 per cent of asset managers are considering a strategic consolidation in the coming months to gain access to new segments, build market share and mitigate risks.

“The AWM industry will need to continue to adapt to evolving investor needs and market conditions, while also addressing the shift towards more personalised, digital-first solutions. Firms that can effectively leverage technology, build meaningful inroads to new and existing customers, and deliver exceptional client experiences will be well positioned to thrive in this rapidly evolving landscape.”

*This story was first published in Investor Strategy News.