Is the next recession far away, or right around the corner?

The latest US non-farm payrolls figure saw a rise of 431,000 jobs in March. Despite being a touch below expectations, the 1.7 million rise in jobs for the quarter was seen as a strong indication that the economy was doing well. “It was both positive and negative news,” Jim Caron, portfolio manager and chief fixed income strategist for the Global Fixed Income Team at Morgan Stanley Investment Management wrote in his blog, Caron’s Corner.

“It’s good news that we had a very strong number, of people getting back to work and signals a strong economy. But it’s not-so-good news, because the Fed may engage in two 50 basis-points (bps) rate rises, May and June, that may trigger a recession,” says Caron.

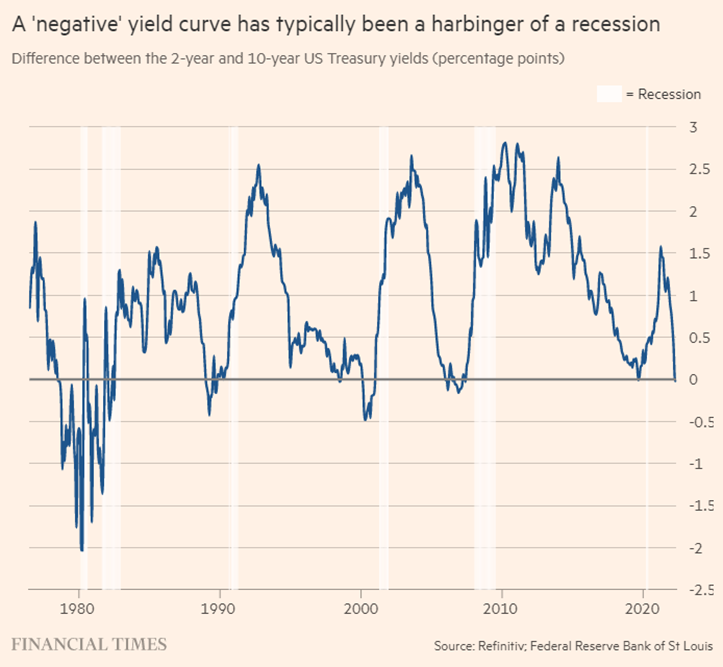

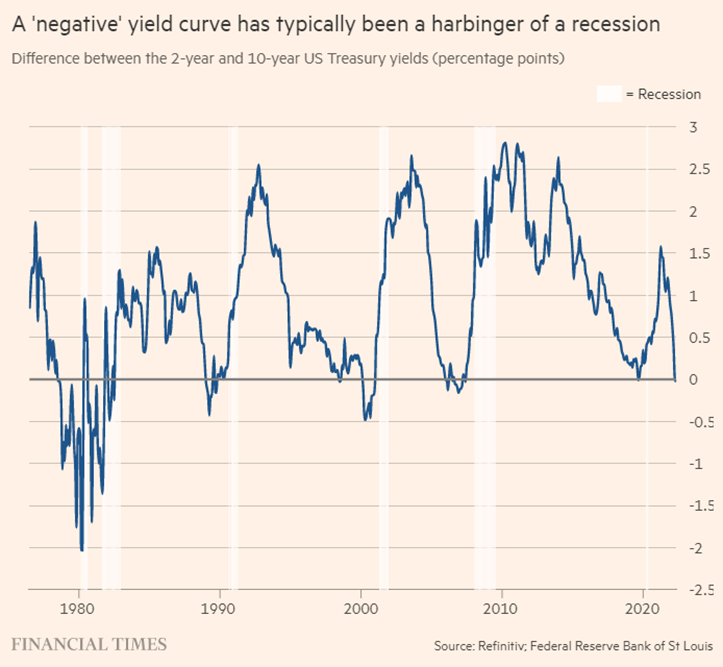

Looking at credit spreads, Caron says the yield curve has started to invert with the 2-year yield above the 10-year yield. Some analysts use this inversion as a strong indicator that a recession is looming: on that reading, recession comes 10-22 months after the inversion of that curve. Caron disagrees, saying the data behind this inversion isn’t conclusive.

The spread between the Fed funds rate and the 10-year note tells an interesting story, he says. When that curve inverts, a recession follows about 10-22 months following the inversion of that curve. The yield curve is usually upward sloping because investors demand higher returns from lending money for longer periods of time. Longer-dated maturities represent investors’ best guess at where inflation, growth and interest rates are headed over the medium to long term.

When an economy is slowing and inflation is slowing, the 10 year and 30-year yields tend to fall as inflation falls. They typically fall towards the shorter maturities. The yield curve flattens when investors expect an economic recession.

“If you are worried about recession today, it might be a little bit premature. What we have to recognise is that many recessions are kicked off by excesses in the markets. Typically, it’s the corporate side that’s over-leveraged or the financial sector of the market that’s over-leveraged or the personal leverage people have taken on – too much mortgage debt, things like that,” he says.

Caron isn’t convinced that the US economy is in any recession risk. Companies are cashed-up and interest coverage for corporate debt is low and manageable. Typically, it’s the energy and the financial sectors that trigger a recession because they over over-leverage. This time around, the banks are heavily regulated.

“We are not seeing that kind of leverage and pressure. The energy sector with commodities is still doing very strong and is also probably underinvested at this point. So, there’s not a lot of excesses there. The leverage, oddly enough, is more at the country or at the sovereign level. But your typical recession isn’t created from that,” says Caron.

In this environment what is the best investment strategy?

The highest yielding place on the curve is around the 3-year point on the yield curve right now, short duration is actually some of the highest-yielding parts of the curve. So that includes mortgage-related credit, higher-quality investment grade, consumer-grade or bank yield. These will get you extra yield and protect you against a movement against interest rates.

There is much you can do. By looking at shorter date assets, you don’t have to extend duration risk very, very much and take on more bond risk to get a lot of deals. Caron says, “Remember, the personal side of the balance sheet is pretty strong. Delinquencies and default rates at the personal level is very, very low. The jobs market is strong, incomes are good, the savings rate is high. You can add a spread onto the three-year yield, the three-year Treasury yield, by taking some credit risk around the three-year point.”