China crackdown is India’s gain

When talking about emerging markets, one thing naturally comes to mind: China.

China is by far the largest EM economy; in fact it’s the second largest economy in the world, just behind the US. And this poses a problem for EM indices with almost half of all emerging market ETF assets being invested in Chinese equities.

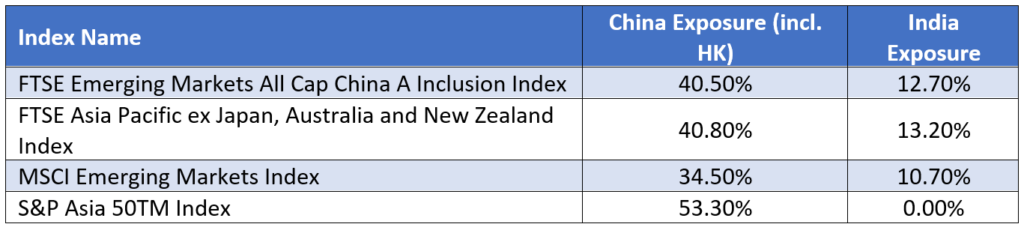

According to ETF Securities (ETFS), Chinese companies take “up to 40% of famous EM gauges. Chinese technology giants are usually the biggest holdings within emerging markets indexes.”

The ETF that is most exposed to China is the iShares MSCI BRIC ETF (ASX: BKF), with a massive 71 per cent of its portfolio in China. While there is not issue with this ETF, it is simply tracking an index, the recent regulatory crackdown is clearly making investors nervous about investing in the region. There are significant and growing risks to investing in China, from concentration risk to economic risk, and valuation risks.

Increasingly, many investors are seeking a more finely tailored approach to the country—if they want exposure to it at all. Especially with Beijing’s ongoing crackdown, it is exposing a huge fracture: reliance on China. This uncertainty and over-exposure to China in EM indices is causing angst among investors, who are now seeking alternatives.

What are the alternatives?

The obvious solution is to select an EM ex-China fund and manage your Chinese exposure separately; an option gaining in popularity with professional investors. The issue here is that very few are available in Australia yet. The next option, ETF Securities says, “is investing in specific EM countries on a case-by-case basis. In this way investors can decide for themselves what countries should qualify as EM and manage country risk more discretely.”

That brings us to India.

While having a similar size population, India’s GDP stands at US$3 trillion ($4 trillion), with S&P Global Ratings projecting a 9.5 % GDP growth in the current financial year and 7.8 % in 2022-23. The impact of the second wave of COVID on the economy and recovery process is the reason for the lower GDP rating. However ETFS says, “India receives less weight in EM indexes than China, but still a substantial 10% – 12%, depending on the index.”

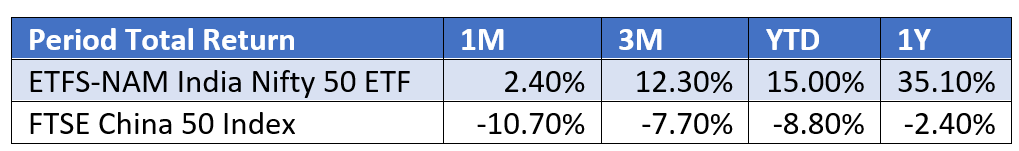

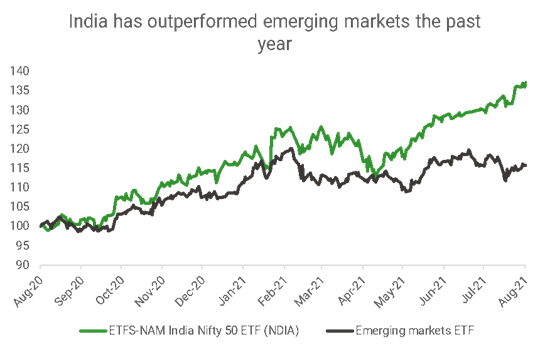

Investing in India makes sense. The country has less political risk, is not at trade war with its counterparts; and India is a major regional power, and ally of the US. But, most of all, the country’s Nifty50 Index has outperformed the the FTSE China 50 Index by more than 37%, over the year to end of July 2021.

Source: Bloomberg, data as of 12 August 2020 to 11 August 2021

India’s Outlook

ETF Securities is positive on India’s outlook, saying the worst of the deadly Delta virus is behind the country; vaccine numbers are rising with 28 per cent of the population having their second vaccination. Keep in mind, that’s 390 million people vaccinated. ETFs says “Indicators such as Earnings/GDP are bouncing back from historic lows. This is buttressed by the analysts’ expected earnings growth of 35% for FY22 – improving these metrics further. We fully expect the earnings cycle to remain strong over the medium term.”

And there is a real case for investing in India. Just looking at GDP consensus estimates of around 8%-10% growth in FY22, no other EM country has expected growth this strong. India also has low interest rates and a benign inflationary outlook. ETFS says this “points us to this being a catalyst for leveraged consumption such as Real Estate and Auto & Durable Goods. Real Estate recovery is positively impacting Cement, Consumer Durables, Pipes and the Tiles sectors.”

And the other big factor is urbanisation. In the same way that China urbanised, 40% of Indians will live in urban areas by 2030, via a huge migration from rural regions to cities driving domestic consumption higher. This includes a projected 1.1 billion internet users in India by 2030, which presents its own opportunities. A growing middle class will open new sectors in the market that were previously very small.

ETF Securities says “the middle class in India, which is estimated to number nearly 500 million people, will be where the story is still strong, and this will mean a shift in consumption to newer categories and companies such as in the personal and health care space.”