Investors getting bullish but a wall of money still on the sidelines

Similar to the Australian Investor’s Association in Australia, the AAII or American Association of Individual Investors, is a significant source of information for self-directed investors of all types. Running a series of events and with a huge following, the association is well positioned to measure the pulse of the industry.

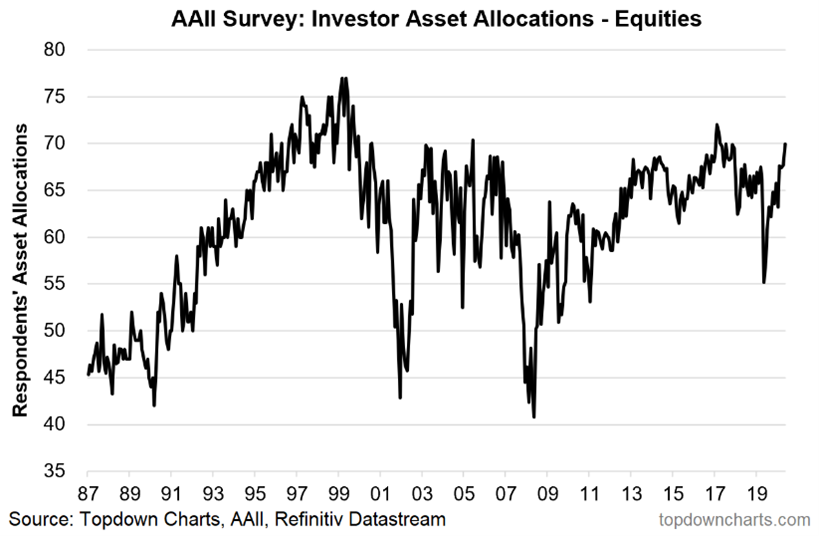

According to their latest Asset Allocation Survey which seeks to assess current and recent trends regarding investor allocations to cash, bonds, and equities, investors are bullish, but not overly so. The latest survey has confirmed that equity allocations reached a two year high in March 2021, reaching 70% of portfolios, closely tracking the all-time high of 77% reached in 2000 amid the Dot Com boom.

This is a huge switch from a nine year low of just 55% being allocated to the sector in March 2020. Callum Thomas, an author at AAII, suggests self-directed investors are ‘more in’ but not yet ‘all in’ on markets as the economic recovery accelerates. A key focus of his assessment was the recent changes in cash allocations, which have fallen to the bottom of their regular range, hitting 15% in March, not far from an all-time low of 11% in 1998.

The key here is scale, with cash allocations peaking at 26% last year before gradually turning around. Thomas says there are two key reasons behind higher cash allocations, the first is an active decision to cut equity market exposure and increase cash. The second is ‘portfolio drift’ which occurs when certain asset classes are performing more strongly sending percentage allocations lower. Both are, however, ultimately active decision.

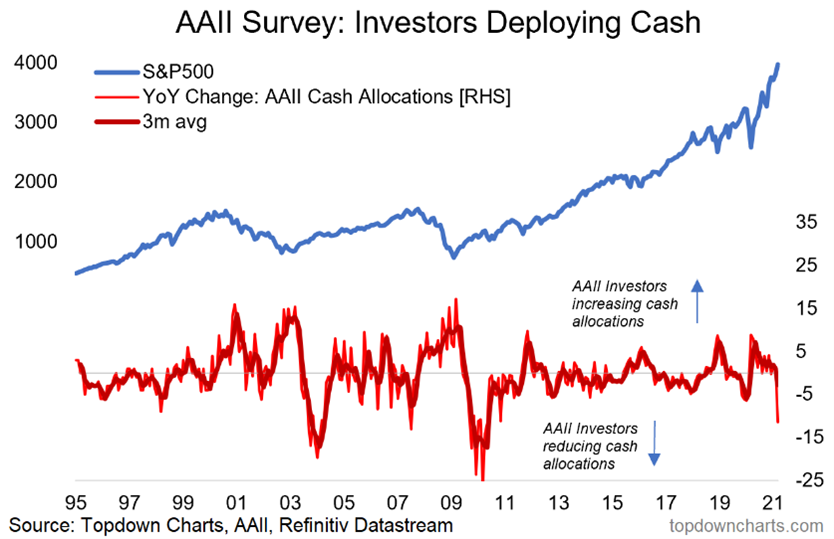

With ‘cash is trash’ an increasingly popular saying, taking a closer look at the annual rate of change in cash allocations likely offers more value. As shown in the chart below, investors are clearly actively making the decision to deploy additional capital into markets. Some would suggest this is a forced decision with interest and bond rates remaining near zero.

A closer look at the chart evidences one of the biggest challenges facing individual investors and financial advisers alike, and that is increases in cash weightings always seem to coincide with market falls. This suggests investors are selling at exactly the times they shouldn’t be.

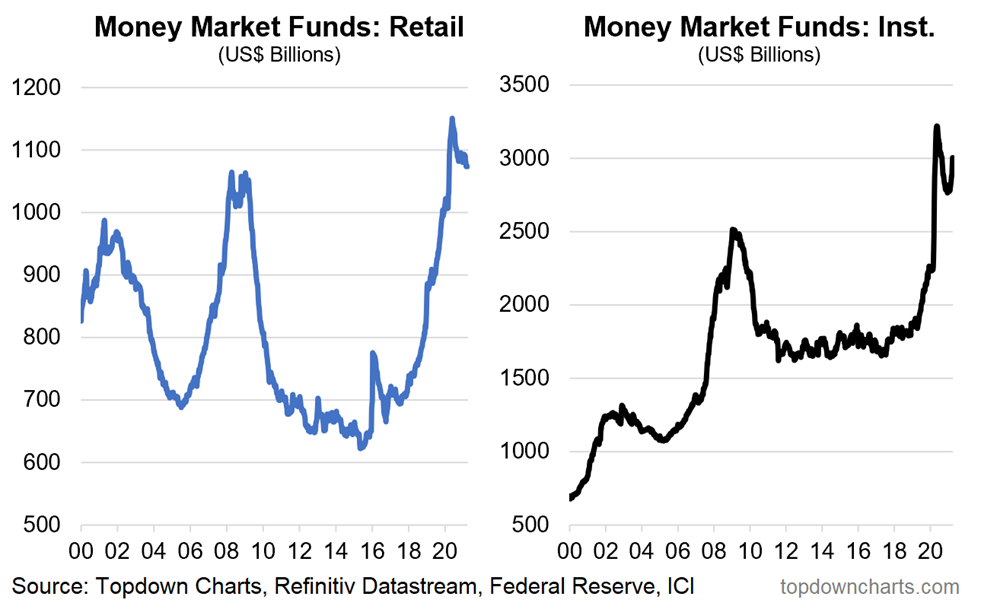

One of the most important takeaways of the report however is the difference between ‘cash levels’ and ‘cash allocations’ which could have significant implications for markets in the short-term. As you can see below, despite the headlines that cash allocations within portfolios are falling towards all-time lows, money market allocations, a proxy for cash in the US, have actually been reasonably stable. This suggests strong sharemarkets may be sending cash allocations lower and that there may in fact remain a ‘wall of cash’ waiting on the sidelines.