No greenwashing in sight at the ESG Masterclass

This year The Inside Network held its industry-leading Environmental, Social and Governance or ESG Masterclass with some of Australia’s leading thinkers from the sector, to engage with and discuss some of the biggest problems humankind is facing, and the role of investors and advisers in contributing to a more sustainable economy.

Hosted by Giselle Roux, an independent industry expert, we welcomed Angela Ashton from Evergreen Consultants, Andre Roberts from Invesco Quantitative Strategies, Leah Willis and Dr Stuart Palmer from Australian Ethical, Jeremy Dean and Chris Fayers from Pendal and Will Baylis from Martin Currie, discussing every angle, challenge and opportunity across the ESG spectrum.

This masterclass was especially useful for advisers so that they could use ESG as part of portfolio construction and have meaningful discussions with clients. It also highlighted various aspects that will likely assist with navigating what can be an emotive and divisive topic.

The ESG sector has exploded following US president Joe Biden’s decision to lead the world in the push to be carbon-neutral by 2050. He not only returned the United States to the Paris Agreement (from which former President Trump had removed it) and has allocated some US$2 trilllion-US$4 trillion ($2.6 trillion-$5.2 trillion) to decarbonisation.

So, what is ESG and Impact Investing?

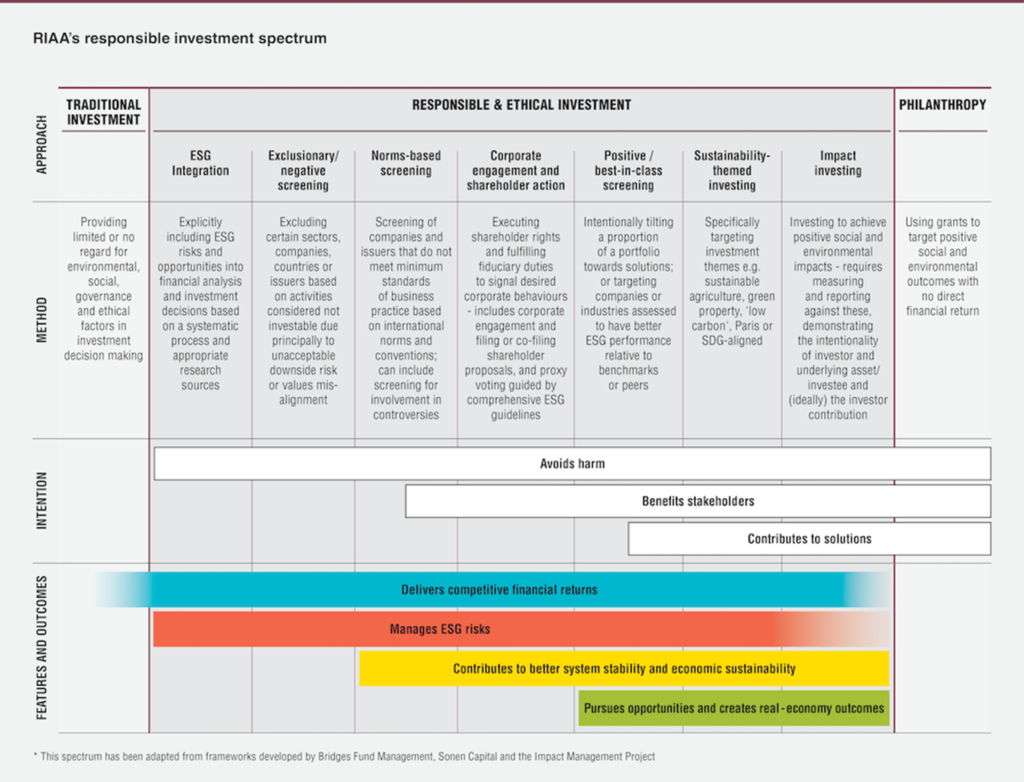

Environmental, social and governance is the process of using a filter to screen-out stocks that you feel have negative attributes from an ESG standpoint, or include (“positive-screen”) certain “green” stocks; whereas impact investing is the process of investing for the positive merits of an asset rather than from a profit view. Here is the ESG spectrum, courtesy of the Responsible Investment Association of Australia (RIAA):

Angela Ashton was the first to discuss the evolution of ESG. ESG and sustainable investments have seen huge capital flows, which have forced asset managers to seek to discuss ESG, sustainability, impact and key ESG trends emerging out of 2020 that will impact coming years. She also discussed the peak bodies including the UN PRI (Principles for Responsible Investing) and RIAA (Responsible Investment Association Australasia), touching on the growing importance of sources external to corporations and the rise in carbon-neutral strategies.

Andre Roberts from Invesco Quantitative Strategies gave a unique insight into the difficulty of broad-based ESG investing and a passive approach to investment. Despite significant growth in the sector and an increasing number of specialist data providers, Roberts questioned whether ESG assessments should rely on publicly available data. Roberts discussed the role of assessing the different screens used by data providers and identifying which factors are most important for each sector.

Leah Willis, head of client relationships and Dr Stuart Palmer, head of ethics, at Australian Ethical Investment, spoke about ESG “outside the box.” While ESG has become a household term, there is a growing trend of ‘greenwashing,’ where managers sell themselves as being responsible or sustainable investors, but whose actions do not match their words. Companies under the spotlight such as Facebook, Twitter, WeChat and TikTok have created a social dilemma, as their corporate ethics are examined more closely – who actually drives those ethics? Willis compared Lendlease and Suncorp: one builds homes, while the other is an insurance company that can ultimately determine the construction and delivery of important energy projects.

Jeremy Dean and Chris Fayers from Pendal offered a study in governance within ESG. While ESG strategies are gaining headlines and capital flows throughout the world, what have they actually delivered? Governance has been at the forefront of ESG investing, yet the transgressions continue, and executive remuneration continues to appear a highly flawed process. The duo compared hearing implant maker Cochlear, which has an ESG rating of 37, and logistics property specialist Goodman Group, which also ESG of 37, but the two companies are very different. One manufactures hearing aids, but has arguably questionable social and governance issues with its manufacturing practices in China; the other has large Amazon “dark stores” that use artificial intelligence to operate robots.

Mans Carlsson from Ausbil Investment Management focused on “social licence to operate.” While the ‘environmental’ part of ESG is well-understood, both governance and social considerations play a role in the decisions made and the long-term success of businesses. Do clients care about social responsibility or do they only care about profit? It really depends on the client. The Australian bushfires of 2019-2020 did have an effect on many clients, and what they wanted to be invested in, because they were real, and it was on their doorstep. So, one can say, social values are changing. Wage theft is real, and companies do underpay wages.

And to finish the conference, Will Bayliss from Martin Currie discussed ESG investing over the next decade. He went through key determinants of success for ESG investing and whether ESG was just a number. In portfolios, should a fossil-fuel company such as Woodside Petroleum be included, considering it is planning to be carbon-neutral by 2050? Disclosure of carbon emissions and income disparity within corporate reports were also discussed.

The key takeaways from each session offered advisers an insight into building ESG considerations into ‘model portfolios’ for their advisery group. All in all, the Inside Network’s ESG Masterclass was a new-age interactive conference that involved everyone: it was unanimously viewed as a highly inspirational and practical session.