TPB review highlights over-regulation of advisers

Whether it’s due to the long delay on Parliamentary sittings or the realisation that financial advisers had become regulatory gymnasts, it seems the tide is starting to turn on financial advice. The establishment of the Tax Practitioners Board (TPB) and requirements for any financial advisers who provided ‘tax’ advice to be registered was no doubt a positive in providing confidence for consumers, but the resultant compliance, registration and code of conduct hoops were simply becoming too much for many.

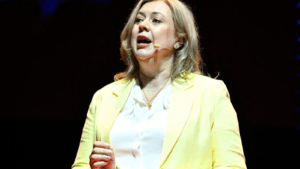

It was for this reason that Financial Planning Association (FPA) this week welcomed the release of the independent review of the TPB and the Federal Government’s response.

The review was commissioned by the Federal Government to ‘look at the effectiveness of the TPB and Tax Agent Services Act’ among other matters that impact the 17 million tax payers who use an accountant or tax agent to prepare their returns each year. Ultimately, the report made 28 recommendations, with a focus on independence, responsibilities and communication with other regulatory bodies. The Government agreed with all but eight of these recommendations, with important news for financial adviser.

Towards the end of the report is Recommendation 7.1, ‘which recommends a new model be developed for regulating tax (financial) advisers in consultation with ASIC, FASEA, the TPB and Treasury’. Most importantly, the model should be adjusted to incorporate:

- A single point of registration for individuals;

- The requirement to abide by only the one code of conduct;

- Any disciplinary action involving the provision of tax advice be decided by experts of that profession.

Any self-licensed adviser will no doubt be aware of the multiple regulatory logins, continued professional development (CPD) completion and reporting requirements, as well as the various lodgements that need to be made throughout the year to both ASIC, the FPA, the SMSF Association and the TPB in some cases.

In their response, the Government ‘noted that the regulatory overlap should be reduced’ and that a new single disciplinary system will ‘cover all financial advisers, including individual tax (financial) advisers. This is expected to be announced during 2021.

There were a number of additional recommendations, supported by the Government, that may impact on financial advisers or accountants with AFSLs, including:

- Recommendation 3.1 – The TPB should become a separate agency and review its own specific appropriation from the Government, rather than as part of the ATO budget, assisting in maintaining the TPB’s independence.

- Recommendation 3.6 – The Tax Agent Services Act 2009 is amended to mandate at least one member of the Board is a community member.

- Recommendation 6.1 – The Board’s sanctions powers need to be increased to include similar enforcement powers as ASIC.

The financial advice regulatory landscape is clearly evolving before our eyes, with this latest recommendation seemingly s positive move to remove overlaps and the associated time burden on advisers.