What’s old is new again

The persistent era of disruptive services has its counterpart in companies considered ripe for extinction. History, however, suggests one should not be quite so fast in judging.

The advent of affordable motor vehicles (and of course, other factors such as urbanisation) resulted in the waning of mail-order catalogues and the rise in the department stores, easily accessible to a driving consumer. Lo and behold, here we are again with the equivalent of online mail order threatening the very existence of those department stores.

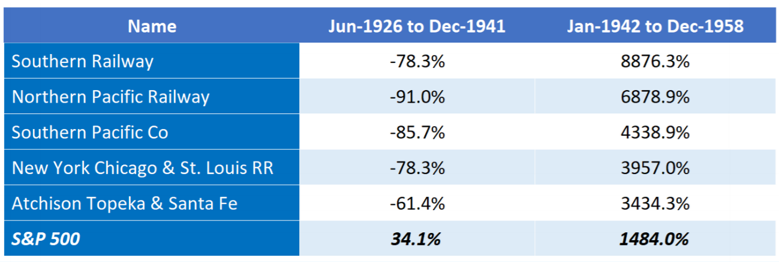

Railroads felt the same pressure as trucking fleets proved more flexible and cheaper than the coal-fired engines of the early 1900s. In the 15 years to 1941, rail company share prices returned -60 per cent-70 per cent while the S&P 500 rose by 34 per cent. It took a while but eventually rail companies reduced their costs, updated engines and improved service, resulting in a return more than three-fold that of the S&P 500 in the following 15 years.

While it has been a long time in coming, the rollout of 5G networks will likely spawn another world of connectivity devices, systems and features. Given the reluctance to use Chinese technology, Ericsson and Nokia are the western world choice of providers. Management schools are full of studies of how Nokia missed past advantage, but here it is again. The fibre cable industry has Corning as leading supplier, yes, the same old one that used to make that glass-based kitchenware mum loved.

There is no doubt some industries are heading for demise; oil extraction is possibly the most likely. Energy clearly not. Energy importers such as Spain are now exporters thanks to favourable sun and wind. As an aside, energy price stability may well be a thing of the future, as oil price fluctuations fade away. It also should partially undermine the USD as local-currency pricing over-rides the dogged hold of USD oil prices.

The end of the COVID era is often framed as “when things return to normal.” The initial response is that many functions and services will be permanently changed. A push back to office-based work may suggest that the WFH phenomenon was just a passing phase, with perhaps a few still doing flexible arrangements. Past experience implies that there will be a greater legacy and unexpected changes in behaviour. Decentralising the workforce into hubs, perhaps resulting in repurposed street shopfronts into workspace, while the essential addition of a study into the family home (rather than media room) is all probable.

The sector that is now firmly in the spotlight is payments and banking. Recent problems with the new banks in Australia do not undermine the inevitable shift in how households want to transact. Legacy banks, particularly here, have structural handicaps, not least their inertia and inflexibility. Further, private credit is narrowing its reach. It begs the question, what part of their business cannot be handled more effectively by new specialist companies without the chain and ball of antiquated systems? Like department stores, banks no longer serve the same purpose. Here is a bet that financial services is the most changed sector in ten years’ time.-