Weaker Chinese data, aggressive Fed floor local stocks

The Australian share market struggled on Thursday, with sentiment hit by a weaker-than-expected economic update out of China, and an aggressive statement from the Federal Reserve saying that at least 75 basis points in rate hikes – or 0.75 percentage points – is in the offing in 2023 as the US central bank continues its fight against inflation. In Australian data, the Australian Bureau of Statistics reported that 64,000 new jobs were added in November, more than three times what the market was expecting.

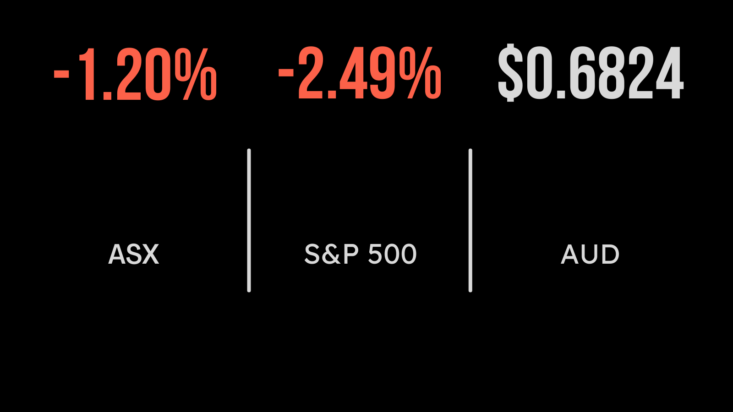

The benchmark S&P/ASX200 index finished Thursday 46.5 points, or 0.6 per cent, weaker at 7204.8, while the 500-stock All Ordinaries index retreated 48.4 points, also 0.6 per cent, to 7390.3.

The market was not happy with China’s monthly economic update, which showed industrial production, fixed asset investment and retail sales all coming in under expectations. The “China re-opening trade” has seen the miners bid higher in recent months, so the disappointing update was bound to show up in their prices. The Mining sub-index sank 1.4 per cent on the back of the Chinese economic data, particularly the lithium sector, with the Chinese data coinciding with an update from producer Pilbara Minerals saying that its latest shipment of ore concentrate to China was auctioned at a price 3 per cent lower than the previous month.

Lithium woes lead miners lower, coal resists

While the market expects lithium prices to soar in the long term, there are now well-founded fears that some short-term price weakness is on the cards, and those concerns saw the lithium stocks pounded.

Pilbara Minerals was hammered 52 cents lower, or 11.4 per cent, to $4.03, while fellow producer Allkem was down 64 cents, or 4.9 per cent, to $12.47. Among the lithium project developers, Core Lithium slid 11 cents, or 9.4 per cent, to $1.06; Liontown Resources dropped 13 cents, or 7.8 per cent, to $1.58; Piedmont Lithium slipped 3 cents, or 3.6 per cent, to 80 cents and Lake Resources lost a relatively respectable 2 cents, or 2.3 per cent, to 86 cents.

Among the mining heavyweights, BHP was down 37 cents, or 0.8 per cent, to $45.94, Rio Tinto was down $1.03, or 0.9 per cent, to $113.64, and Fortescue Metals retreated 5 cents to $20.41.

In coal, Whitehaven Coal gained 38 cents, or 3.9 per cent, to $10.20; New Hope Corporation surged 27 cents, or 4.7 per cent, to $6.07; Terracom added 2.5 cents, or 3 per cent, to 87 cents; and Yancoal Australia rose 3 cents to $6.06; but Coronado Global Resources didn’t get the memo, slipping 2 cents, to $1.93.

Among the energy heavyweights, Woodside Energy was down 15 cents, or 0.4 per cent, to $35.50, but Santos gained 7 cents, or 1 per cent, to $7.23, Beach Energy added 1 cent to $1.64, and Brazilian-based producer Karoon Energy put on 2 cents, to $2.24.

In the big bank world, ANZ retreated 11 cents, or 0.5 per cent, to $23.90 as CEO Shayne Elliott told the annual general meeting that the bank was bracing for a rise in household financial stress over the next six months as cost-of-living pressures started to bite. Westpac was down 7 cents, or 0.3 per cent, to $23.50, and Commonwealth Bank dipped 12 cents to $106.80, but National Australia Bank bucked the trend, advancing 8 cents, or 0.3 per cent, to $30.79. Investment bank Macquarie Group slid $2.52, or 1.5 per cent, to $171.69.

Biotech heavyweight CSL dropped $2.14, or 0.7 per cent, to $297.17.

US markets, A$ take a fall

Sentiment deteriorated in the US markets after new data showed that retail sales declined more than expected in November, raising fears that the Federal Reserve’s relentless interest rate hikes are pushing the economy into a recession. Certainly, inflation appears to be hurting consumers more than thought, with US retail sales sliding 0.6 per cent in November, twice the fall than economists’ consensus expected.

The blue-chip Dow Jones Industrial Average fell 764.1 points, or 2.3 per cent, to 33,202.22, in its worst day since September. The broader S&P 500 index lost 99.6 points, or 2.5 per cent, to 3,895.7, while the tech-heavy Nasdaq Composite index sank 360.4 points, or 3.2 per cent, to 10,810.5.

In commodity action, gold lost US$30.53, or 1.7 per cent, to US$1,777.19 an ounce, the global benchmark Brent crude oil shed US$1.29, or 1.6 per cent, to US$81.41 a barrel, and West Texas Intermediate crude gave up US$1.05, or 1.4 per cent, to US$76.23 a barrel. The benchmark iron ore price gained 2.5 per cent to US$112.71 a tonne in Thursday trading, a six-month high. The Australian dollar is buying 66.94 US cents, down almost 2.5 per cent on the local close on Thursday, at 68.28 US cents.