Weak data weighs on market

The local share market has finished slightly lower as investors mulled weak economic data and the implications of higher rates for longer, following a perceived shift in stance from Australia’s central bank.

Before markets opened, Reserve Bank of Australia (RBA) governor Philip Lowe told a Morgan Stanley business summit that “some further tightening of monetary policy may be required” following Tuesday’s rate hike, which surprised many in the markets.

Also on Wednesday morning, the Australian Bureau of Statistics reported that the nation’s gross domestic product (GDP) lifted 0.2 per cent in the March quarter, compared to expectations of a 0.3 per cent rise.

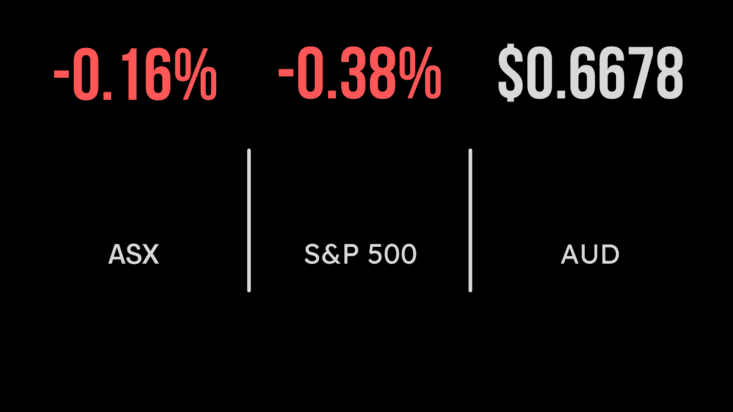

The benchmark S&P/ASX200 index rose as much as 0.4 per cent in the first 10 minutes of trade on Wednesday but ended the day down 11.6 points, or 0.2 per cent, at 7,118.0, while the broader All Ordinaries dropped 9.5 points, or 0.1 per cent, to 7,310.4.

Commonwealth Bank dropped 87 cents, or 0.9 per cent, to $95.69; National Australia Bank slid 46 cents, or 1.8 per cent, to $25.30; Westpac eased 31 cents, or 1.5 per cent, to $20.03; and ANZ softened 1 cent, to $22.73. But Global investment bank and wealth manager Macquarie Group managed to rise 97 cents, or 0.6 per cent, to $172.24.

Beach can’t take a Trigg

On the energy front, Beach Energy sank 11.5 cents, or 8.1 per cent, to $1.305, after telling the market it was abandoning its Trigg-1 gas exploration well in WA’s Perth Basin after poor test results. Woodside Energy lost 14 cents, or 0.4 per cent, to $34.40; Santos fell 7 cents, or 0.9 per cent, to $7.39; and Brazilian-based producer Karoon Energy shed 7 cents, or 3.5 per cent, to $1.95.

Gentailer AGL gained 1.5 cents, or 1.6 per cent, to $9.69; and its peer Origin Energy added 1 cent to $8.36.

Also, Viva Energy fell 9 cents, or 2.8 per cent, to $3.11 after an accident at its Geelong refinery in Victoria, which will curtail the production of premium petrol or diesel until September, with the Shell fuel station owner expecting to incur $25 million to $35 million a month in lost earnings over that time.

Among the big miners, BHP advanced 2 cents, to $43.62; and Rio Tinto gained 30 cents, or 0.3 per cent, to $111.63; but Fortescue Metals slipped 20 cents, or 1 per cent, to $20.16.

In gold, Newcrest Mining gained 18 cents, or 0.7 per cent, to $26.56; St Barbara spiked 2.5 cents, or 4.5 per cent, to 58 cents; and Bellevue Gold rose 4 cents, or 3 per cent, to $1.35.

On planet lithium, producer Allkem added 21 cents, or 1.4 per cent, to $15.39, but fellow producer Pilbara Minerals weakened by one cent, to $4.64. Mineral Resources, which produces iron ore and lithium, was down 8 cents, at $69.35.

Among the project developers, Liontown Resources gained 4 cents, or 1.5 per cent, to $2.77, and US-based Piedmont Lithium advanced 2.5 cents, or 2.7 per cent, to 94 cents.

In coal, Whitehaven Coal slipped 6 cents, or 1 per cent, to $6.14; New Hope Corporation added 3 cents, or 0.6 per cent, to $5.00; and Yancoal Australia retreated 12 cents, or 2.6 per cent, to $4.50.

PolyNovo soared up 15.8 per cent to a six-week high of $1.685 as the biotech company, which makes a polymer film surgical product that helps in the treatment of wounds and burns, reported that US sales nearly doubled in May. Also, revenue in the Middle East, Britain, Canada and Hong Kong nearly tripled on that of May 2022, to $1.9 million.

Rally pauses on Wall Street

In the US, the broad S&P 500 declined 16.33 points, or 0.4 per cent, to 4,267.52, while the 30-stock Dow Jones Industrial Average added 91.74 points, or 0.3 per cent, 33,665.02, and the tech-heavy Nasdaq Composite index lost 171.52 points, or 1.3 per cent, to end at 13,104.89.

On the bond market, the US 10-year yield advanced 12.3 basis points, to 3.797 per cent, and the 2-year yield, considered more sensitive to monetary policy, gained 6.7 basis points to 4.567 per cent.

Gold shed US$21.29, or 1.1 per cent, to US$1,942.02 an ounce, while the global benchmark Brent crude oil grade rose 66 cents, or 0.9 per cent, to US$76.95 a barrel and US West Texas Intermediate oil retreated 3 cents, to US$72.50 a barrel.

The Australian dollar is buying 66.55 US cents this morning, down from 66.71 cents at Wednesday’s ASX close.