Two down, three up for the local market

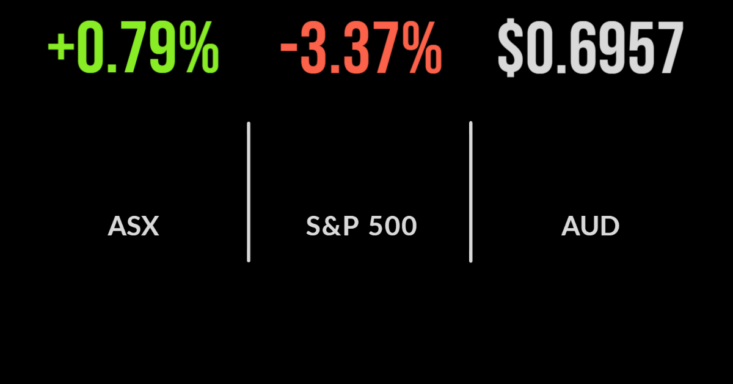

After two solid falls to start the week, the Australian market put three straight rises together by the end of Friday, to get itself back into the green for the week – but only just.

The benchmark S&P/ASX 200 eased 10.4 points, or 0.2 per cent, for the week, to end at 7,104.1. while the broader S&P/ASX All Ordinaries index retreated 12.9 points, or 0.2 per cent, to 7,345.8.

The local market suffered all week from nervous lead-ins from Wall Street, as US investors awaited Federal Reserve Chairman Jerome Powell’s keynote address at the Fed’s annual Jackson Hole symposium for central bankers and senior economists – more on that later.

US economic data was also closely watched, as usual, and with its own June 30 results reporting season in full swing, the ASX had a choppy week.

Commodity producers in the sweet spot

Commodity prices, particularly oil, helped the market, with the ASX Energy sub-index surging 671 points, or 6.3 per cent, higher over the week, to 11,346.7, while its Resources counterpart gained 171.6 points, or 3.1 per cent, to 5,713.7 points.

Coal star Whitehaven Coal had a cracker of a week, up 60 cents, or 8.1 per cent, to a fresh record high of $7.97, with Woodside Energy not far behind, up $2.40, or 7.2 per cent, to $35.95; Santos up 46 cents, or 6.2 per cent, to $7.91; and Beach Energy up 6 cents, or 3.8 per cent, to $1.76.

Coal producer New Hope rose 23 cents, or 4.7 per cent, to $5.13, while minnow Australian Pacific Coal (which is not yet a producer) ended the week 10 cents, or 40.4 per cent, higher at 36 cents, after tripling on Monday following a takeover proposal at 30 cents a share.

Among the bulk miners, BHP gained $1.61, or 3.9 per cent, for the week to $42.81; Rio Tinto added $1.86, or 1.9 per cent, to $98.66; South32 was up 11 cents, or 2.7 per cent, to $4.23; and iron ore heavyweight Fortescue Metals gained 92 cents, or 4.9 per cent, to $19.87.

In the lithium space, producer Pilbara Minerals shot 57 cents, or 19.1 per cent, higher over the week, to $3.55, while fellow producer appreciated by $1.82, or 15 per cent, to $13.91.

In the big-bank world, CBA eased $1.00, or 1 per cent, over the week, to $98.31; ANZ lost 4 cents, or 0.2 per cent, to $22.96; Westpac retreated 39 cents, or 1.8 per cent, to $21.68; and National Australia Bank gave up 19 cents, or 0.6 per cent, to $30.61.

Biotech heavyweight CSL added 48 cents, or 0.2 per cent, to $295.50; Telstra was down 11 cents, or 2.7 per cent, to $4.03; Macquarie Group surrendered $1.51, or 0.8 per cent, to $178.50.

Wesfarmers lost 67 cents, or 1.4 per cent, to $47.95; Woolworths dipped $2.54, or 6.5 per cent, to $36.76; and Coles Group followed its rival lower, down $1.69, or 8.7 per cent, to $17.65.

In Technology, the All Technology index fell 21.2 points, or 1 per cent, to 2,207.4, but some of its constituents had far better weeks.

Altium put on $6.37, or 21.2 per cent, after its FY22 results beat guidance, while logistics software player WiseTech Global surged $6.12, or 11.6 per cent higher, to $59.12.

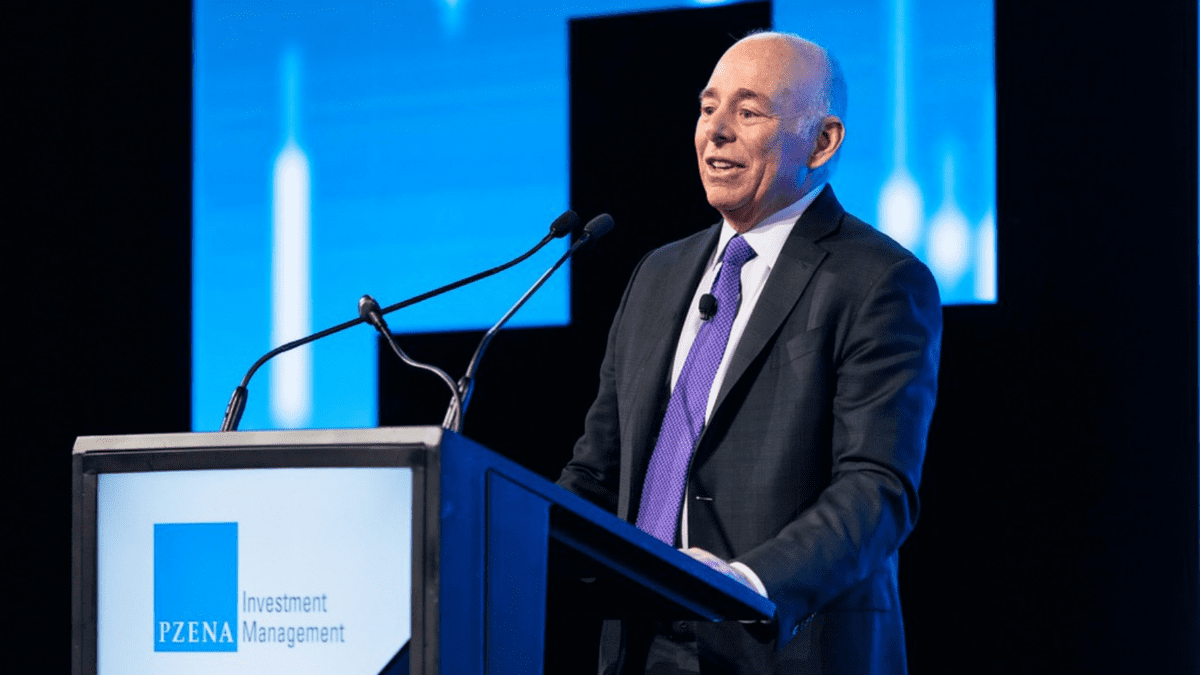

Chairman Powell blindsides Wall Street

After waiting all week for Federal Reserve Chair Jerome Powell to speak at the Jackson Hole symposium, the US markets were wishing he hadn’t after he reiterated that the central bank won’t back off in its fight against rapid inflation.

The heavy implication was of higher interest rates kept in place for a longer time than the markets were expecting, and in response, the 30-stock Dow Jones Industrial Average dropped 1,008.4 points, or 3 per cent, on Friday, to 32,283.4, with losses accelerating into the close.

The broader S&P 500 fell 141.5 points, or 3.4 per cent, to 4,057.7, and the tech-heavy Nasdaq Composite slid almost 500 points, or 3.9 per cent, to 12,141.7.

The sell-off was so wide-ranging, that only five stocks in the S&P 500 posted gains on Friday. Over the week, the Dow Jones shed 4.2 per cent, the S&P 500 lost about 4 per cent and the Nasdaq Composite retreated 4.4 per cent.

The market did receive better-than-expected data on the US economy on Friday, which contracted at a more moderate pace than initially thought in the second quarter – revised from a 0.9 per cent slide to a 0.6 per cent fall – as consumer spending neutralised some of the drag from a sharp slowdown in inventory accumulation.

The Commerce Department reported on Thursday, showing the US economy growing steadily last quarter when measured from the income side.

The implied underlying economic strength follows recent upbeat readings on the jobs market, retail sales and industrial production.

West Texas Intermediate crude oil gained 2.5 per cent for the week, to US$93.06 a barrel, helping the S&P 500 energy index defy the general mood, rallying more than 5 per cent.

Brent crude oil futures gained about 4.4 per cent, to US$101 a barrel.

The Australian dollar rallied over the trading week, to reach the 70.06 US cents level, but had eased back to 68.9 US cents by the end of weekend trading.