Tech, real estate buoy ASX (ASX:XJO), Bapcor sinks on slowing sales, RBA meeting now ‘live’

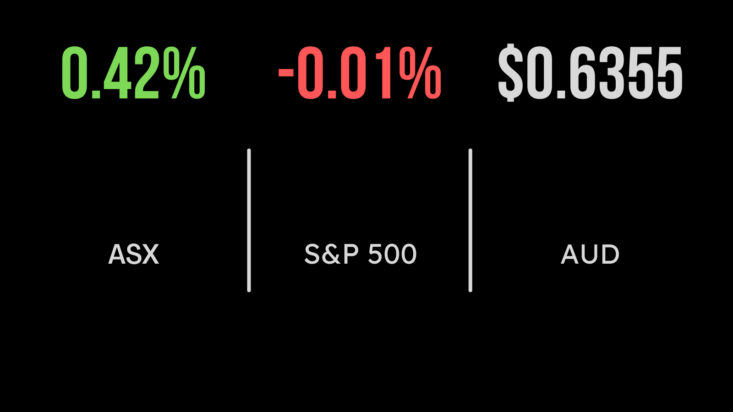

The local share market snapped its losing streak, with both the All Ordinaries (ASX:XAO) and S&P/ASX200 (ASX:XJO) gaining 0.4 per cent on a settling of bond yields and the latest Reserve Bank meeting minutes. According to the new governor, the board had considered raising and now sees November as a ‘live’ meeting with the potential for a 25 basis point hike should inflation continue to print more strongly than expected. Consumer businesses bore the brunt, with Harvey Norman (ASX:HVN) and JB HiFi (ASX:JBH) dipping 2.4 and 1.3 per cent respectively. The news was worsened by a downgrade from after-market vehicle parts seller Bapcor (ASX:BAP) with shares falling more than 11 per cent following news that sales growth in the second half had slowed to a single digit growth rate, down from the double digit levels realised in recent years.

Healthcare remains under pressure, TPG jumps on potential fibre sale, iron ore rallies

The healthcare remains under strong selling pressure with the likes of CSL (ASX:CSL) and ResMed (ASX:RMD) falling on Tuesday as investors fret the impact of weight loss drug Ozempic on their treatments. Cochlear (ASX:COH) also pulled the sector lower after flagging a $150 million profit hit on a previously undisclosed business acquisition. Telecommunications group TPG Telecom (ASX:TPG), fresh from the blocking of its deal with Telstra (ASX:TLS) saw shares surge more than 5 per cent after it was reported competitor Vocus Group was considering an offer for its fibre business. Reports suggest a value of $6.3 billion for the unit, with both companies engaged in discussions. It was also a positive day for iron ore, with BHP (ASX:BHP) adding 0.9 per cent after the price of the commodity rose above US$120 once again following moves by the Chinese government to begin stimulating the economy.

Dow flat on strong retail sales, Bank of America, Goldman Sachs deliver earnings

US benchmarks finished slightly weaker as investors digest both the latest round of quarterly earnings data and stronger than expected retail sales. Retail sales were 0.7 per cent higher, beating expectations of 0.6 per cent even when stripping out car sales, which is further evidence of the strength of the underlying economy. The result was a 0.1 per cent gain in the Dow Jones, a 0.1 per cent fall in the S&P500 and a 0.3 per cent fall in the Nasdaq. Earnings season began with a bang, as Bank of America (NYSE:BAC) rallied 2 per cent after reporting a 10 per cent increase in profit on the back of a small increase in revenue, as client numbers across each key business grew. Importantly, net interest income improved by 4 per cent and global markets revenue by 10 per cent as trading activity increased. Goldman Sachs (NYSE:GS) lost close to 2 per cent as earnings fell 36 per cent, primarily driven by a normalisation of revenue growth in its key markets and equities businesses.