Tech pushes market to gain, rate decision ahead, EML slump deepens

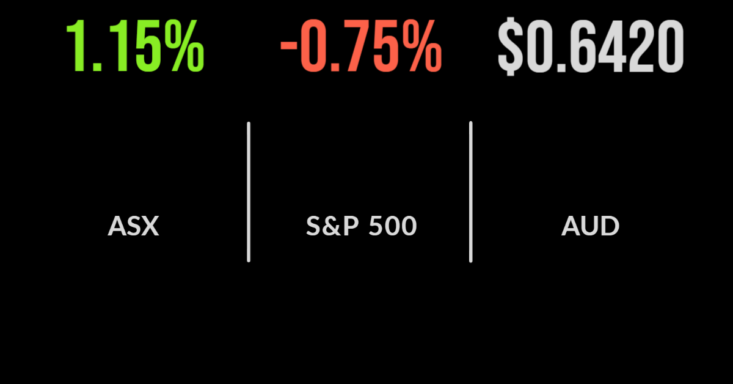

The local market followed a strong overseas lead to post another 1.2 per cent gain on Monday, spurred higher by a rally in the technology and discretionary sectors, which added 2.6 and 2.7 per cent respectively.

The strength was broad based with only the energy sector contracting, as smaller and mid-cap companies took centre stage behind the likes of Life360 (ASX:360) and Nanosonics (ASX:NAN) which gained over 7 per cent each.

The low light by far was another 35 per cent capitulation in EML Payments (ASX:EML) with the company reporting they would stop onboarding new customers as they sought to address concerns raised by the Irish regulator.

The cessation is set to cost the company around $5 million in revenue but a significant hit to confidence. Shares in GrainCorp (ASX:GNC) topped the market after news of the end of an agreement between Russia and Ukraine around grain exports sent prices higher in the US; the company finished 7.9 per cent higher on the news.

Vicinity CEO to retire, Nitro software bid increased, Origin product flat by shares rally

Shares in Vicinity (ASX:VCX) countered the market, falling 0.3 per cent on news that CEO Grant Kelley would be stepping down in June next year, following a challenging period at the top of the company.

Origin (ASX:ORG) shares managed a 3 per cent gain despite ongoing uncertainty around the future of the electricity market and gas industry.

The company posted an increase in revenue of just 1 per cent from the APLNG plant, reaching $2.7 billion for the quarter.

A slight fall in production and weaker sales volumes impacted the bottom line in what the CEO described as “incredibly challenging”.

Shares in Nitro Software (ASX:NTO) gained more than 20 per cent after KKR-backed Alludo gained exclusive due diligence after they lobbed a bid of $2 per share for the company.

A strong jump in retail sales, up 0.6 per cent in September and 18 per cent for the last 12 months has supported the retail sector.

China economy slows, market lower ahead of rate decision, cannabis stocks surge

US markets closed out one of the best October’s in history, bucking the long-held suggestion that October was the worst month of the year.

The Dow Jones, S&P500 and Nasdaq all fell, down 0.4, 0.7 and 1 per cent respectively but posted solid gains for the month.

The Dow was up close to 14 per cent on an extended recovery in the energy and utilities sectors.

Investors continue to expect a large rate hike by the Federal Reserve, with the market pricing in 75 basis points, but this may well be the beginning of the end.

On the negative side, Chinese data continues to weaken with the region suffering from weak sentiment, both the manufacturing and services sectors PMI readings fell below 50 points, which is seen as contractionary, as the end of lockdowns bites.

According to analysis it has been a strong earnings season with 71 per cent of companies surprising, albeit not many of the larger technology players.

Pressure remains on the energy sector with President Biden pushing back against record profits while changes to law on cannabis saw a significant jump in the sector, including Canopy Growth (NYSE:CGC).