-

Sort By

-

Newest

-

Newest

-

Oldest

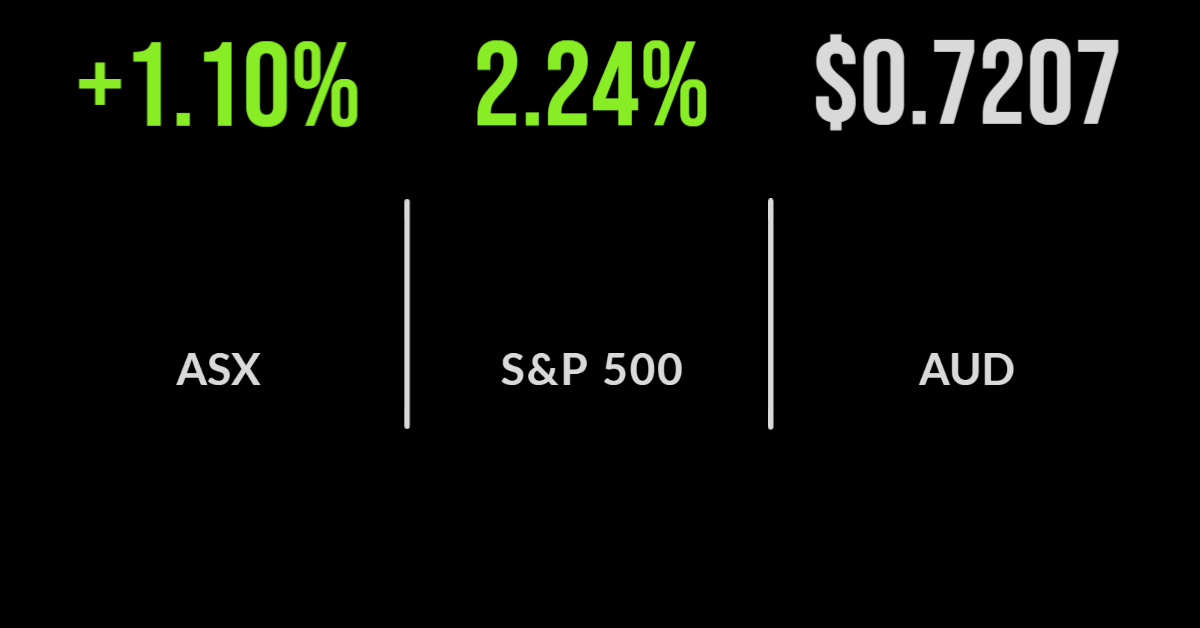

The tanking oil price has offered relief to the share market but will likely take some time to spread into the price of fuel, with the S&P/ASX200 gaining 1.1 per cent on Wednesday. The rally was widespread with every sector finishing higher but energy naturally the worst, gaining just 0.2 per cent. Hopes that interest rates will…

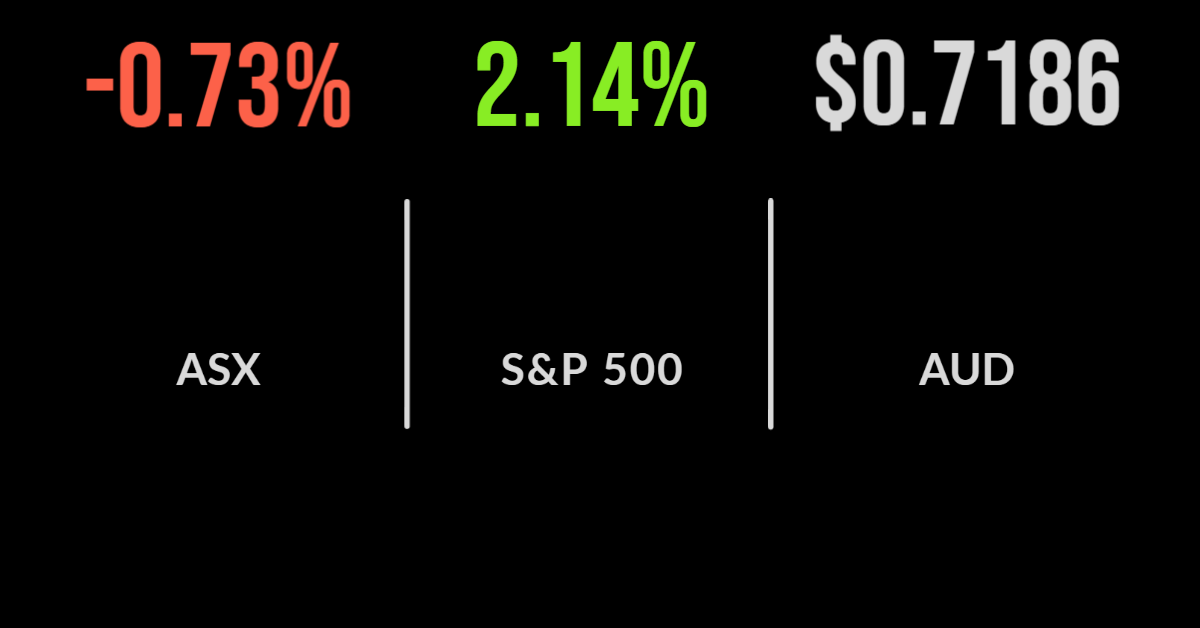

It was another difficult day for the domestic market with the Nasdaq entering a bear market and Chinese technology continuing to selloff putting further pressure on sentiment and the ASX’s position as a ‘risk on’ market. Ultimately the S&P/ASX200 fell another 0.7 per cent on Tuesday with energy and materials the biggest detractors, down 2.9 and 3.7…

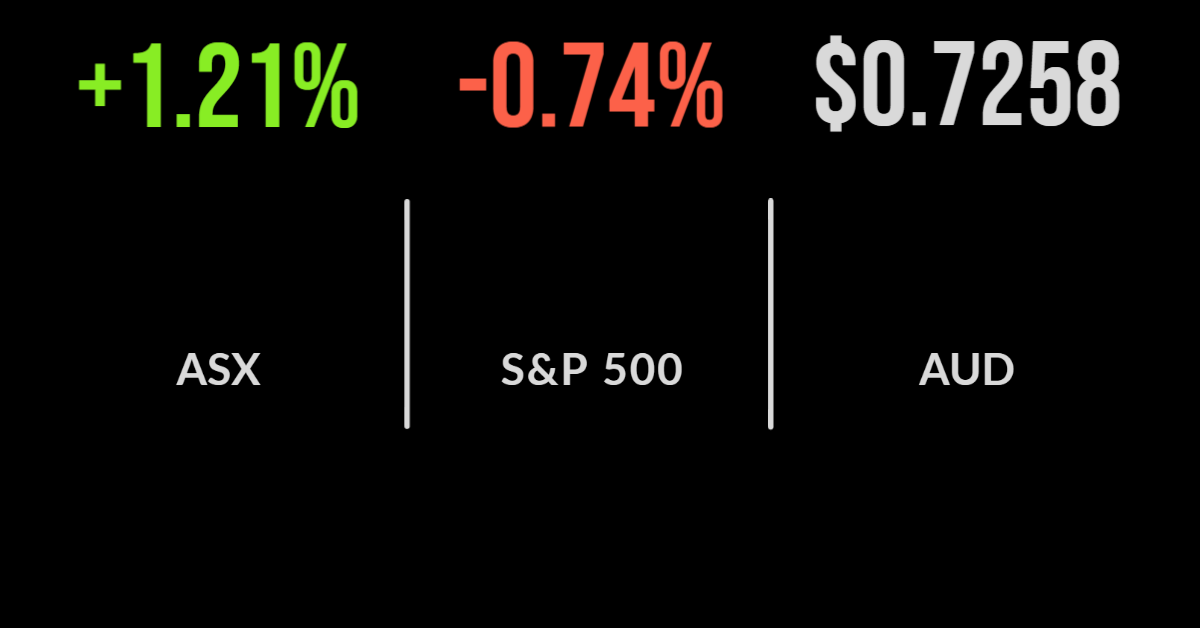

The Australian share market has remained remarkably resilient despite the broadening sanctions against Russia and greater economic implications, with the S&P/ASX200 finishing 1.2 per cent higher on Monday, a public holiday in Melbourne. All eyes were on the financials sector which was the standout, gaining 2.5 per cent behind a rally in ANZ (ASX: ANZ) and Commonwealth Bank (ASX: CBA) shares…

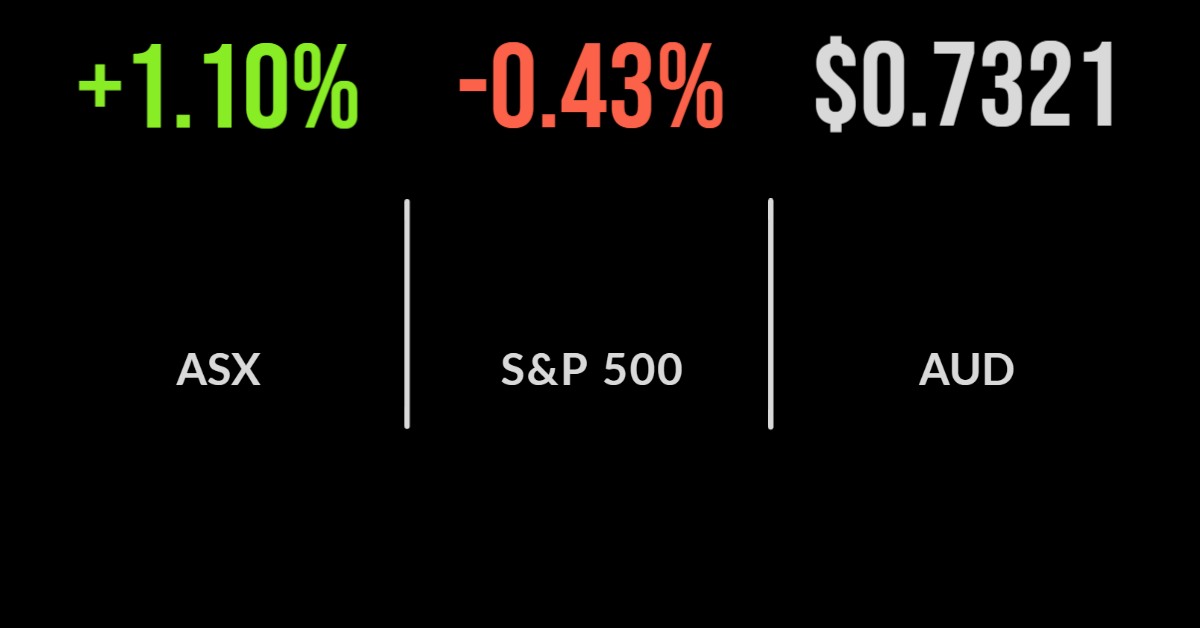

It was another strong day for the S&P/ASX200 (ASX: XJO) with the market looking through challenging headlines and volatility towards what will otherwise be a resurgent economy. The market finished 1.1 per cent higher with 6 of the eleven sectors gaining more than 2 per cent. Technology and property were the standouts, gaining 3.3 and 2.5 per…

The S&P/ASX200 (ASX: XJO) has delivered another positive day despite the incredibly negative backdrop with issues ranging from inflation to commodity price uncertainty and the Ukraine invasion. The market finished 1 per cent higher with the technology and communication sectors central to the performance, up 3.2 and 2.4 per cent respectively. The highlights of today were mainly…

The selling pressure continued on Wednesday with the S&P/ASX200 falling 0.8 per cent as uncertainty around the world continues to grow. Recent winners in energy and materials led the selloff down 3.6 and 3.3 per cent respectively with BHP (ASX: BHP) and Rio Tinto (ASX: RIO) among the hardest hit, falling 3.7 and 4.3 per cent. Among the strangest moves in recent…

The trends of the last two weeks look to set to accelerate for the rest of March with the S&P/ASX200 following the lead of US futures to fall another 1 per cent to open the week. As has been the case since the invasion of Ukraine began, the energy sector remains the biggest beneficiary gaining 5.3 per cent with Woodside (ASX:…

News that the Russian invasion of Ukraine had resulted in a fire at one of the country’s many nuclear reactors sent shockwaves through global markets, with Fukushima returning to front of mind. Shares in Paladin (ASX: PDN) bore the brunt, falling 14 per cent but trading as much as 25 per cent lower, as investors once again…

The Government bond market is now experiencing more volatility than the equity market, with the Australian 10-year yield increasing 10 basis points today, whilst the S&P/ASX200 gained 0.5 per cent once again. Just four of the 11 key sectors were lower, led by Consumer Staples, which fell 2.3 per cent, primarily due to Coles (ASX: COL) moving to ex-dividend and…

President Biden delivered his annual State of the Union address during the session, with strong commentary around Ukraine and targeted investment into domestic manufacturing capacity supporting US futures and ultimately pushing the S&P/ASX200 up another 0.3 per cent. Despite the positive day, seven of the 11 major sectors were down with cyclical companies in the property and the…