-

Sort By

-

Newest

-

Newest

-

Oldest

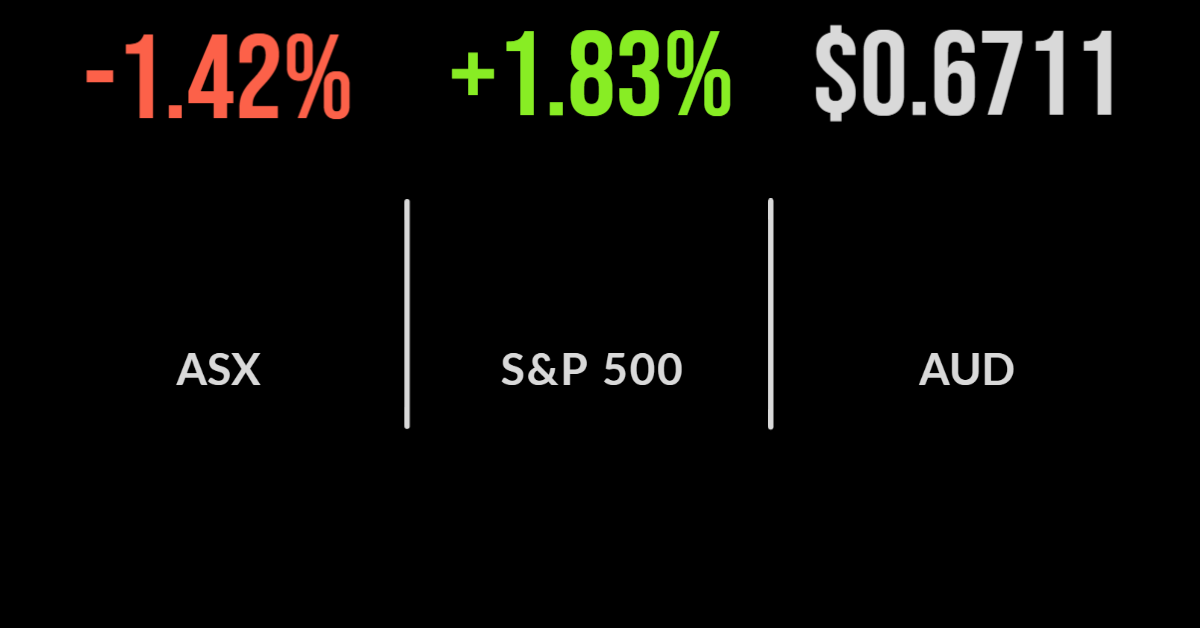

The Australian sharemarket surged in the afternoon, gaining more than 1.6 per cent after the Reserve Bank Governor flagged a more cautious approach to future rate rises. Every sector finished the day higher and significantly so with the technology sector gaining 2.8 per cent as bond yields fell. The top performers were Life360 (ASX:360), Megaport…

The Reserve Bank of Australia’s aggressive pursuit of a neutral interest rate policy setting has offered a challenging backdrop to the sharemarket this week, with the S&P/ASX200 falling 1.4 per cent on Wednesday. It wasn’t rates alone, however, with the oil price falling to levels not seen since January 2022 as concern grows about the…

After a positive start, the local market turned tail after the Reserve Bank board lifted the cash rate target by 50 basis points to 2.35 per cent, its highest level since December 2014, at its meeting yesterday. The central bank has now raised interest rates for five months in a row, in its most aggressive…

Energy powered the Australian market higher on Monday, with a 4 per cent rise in the S&P/ASX 200 Energy index at the heart of market sentiment, as oil, gas and coal prices rose. The energy action helped the benchmark S&P/ASX 200 advance 23.5 points, or 0.3 per cent, or to 6852.2, while the broader All…

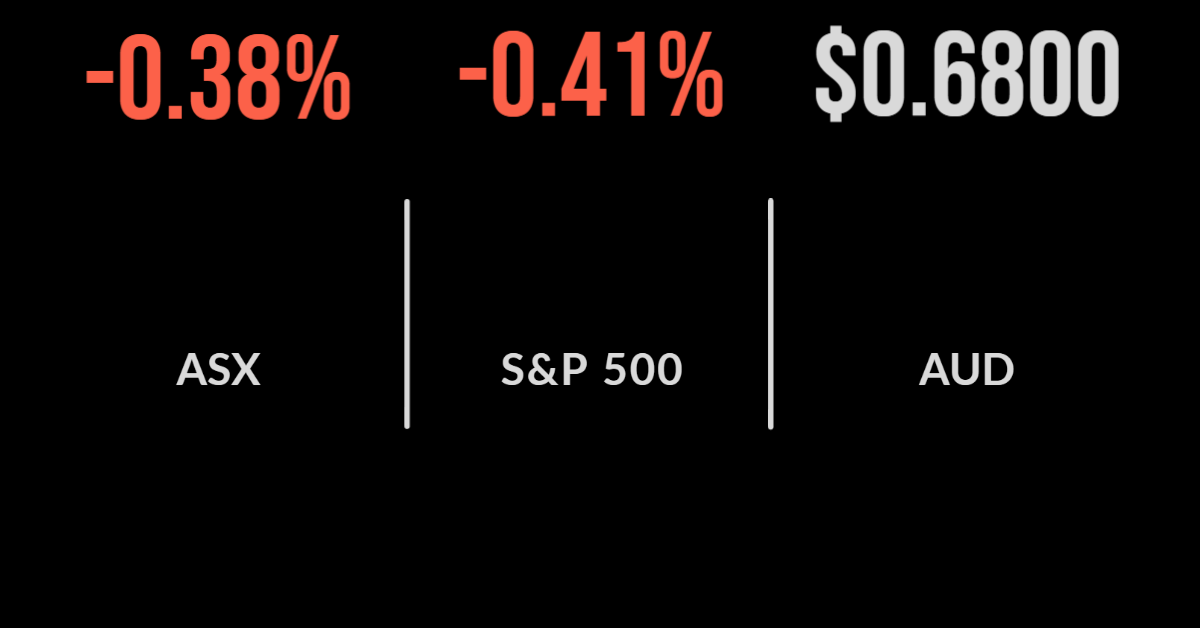

The local market capped off the worst week in several months, falling another 0.3 per cent and taking the weekly loss to 3.9 per cent. On Friday it was the financial sector leading the way on hopes that the economy may remain strong, bounced 0.7 per cent, with the more defensive healthcare and real estate…

The local sharemarket continued its recent weakness, falling another 2 per cent for the first day of spring. Australia’s largest company, BHP (ASX:BHP) was the biggest detractor falling 7.6 per cent, or $3.09 cents as the stock went ex-dividend. This is a regularly forgotten impact of the payment of dividends, which totalled $2.56 plus franking credits, as…

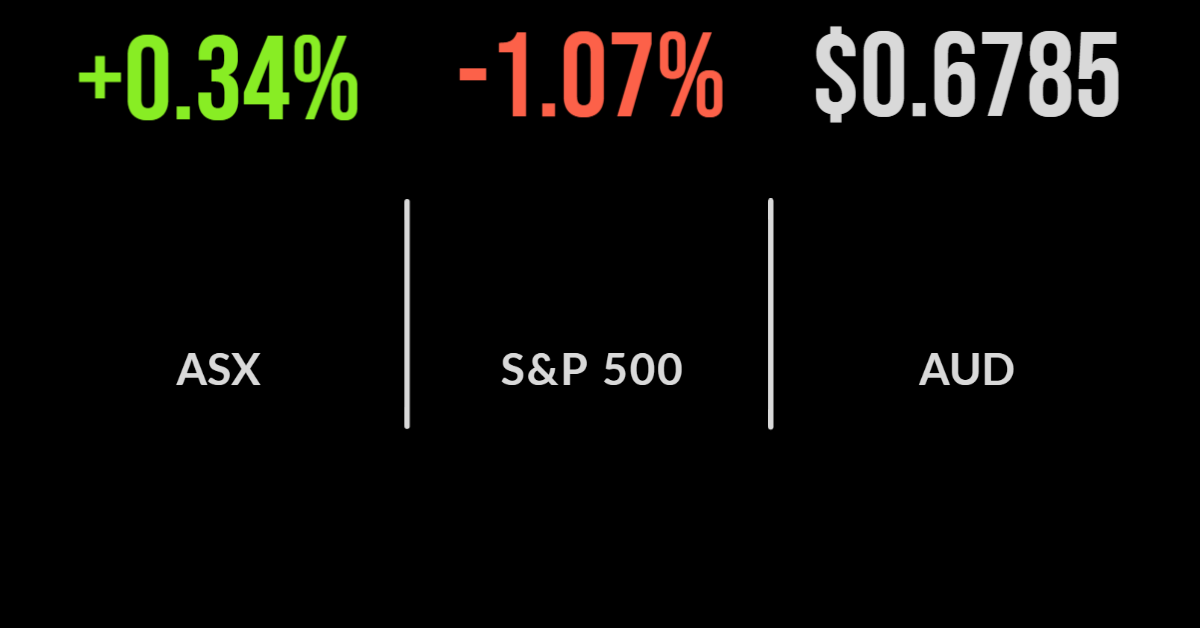

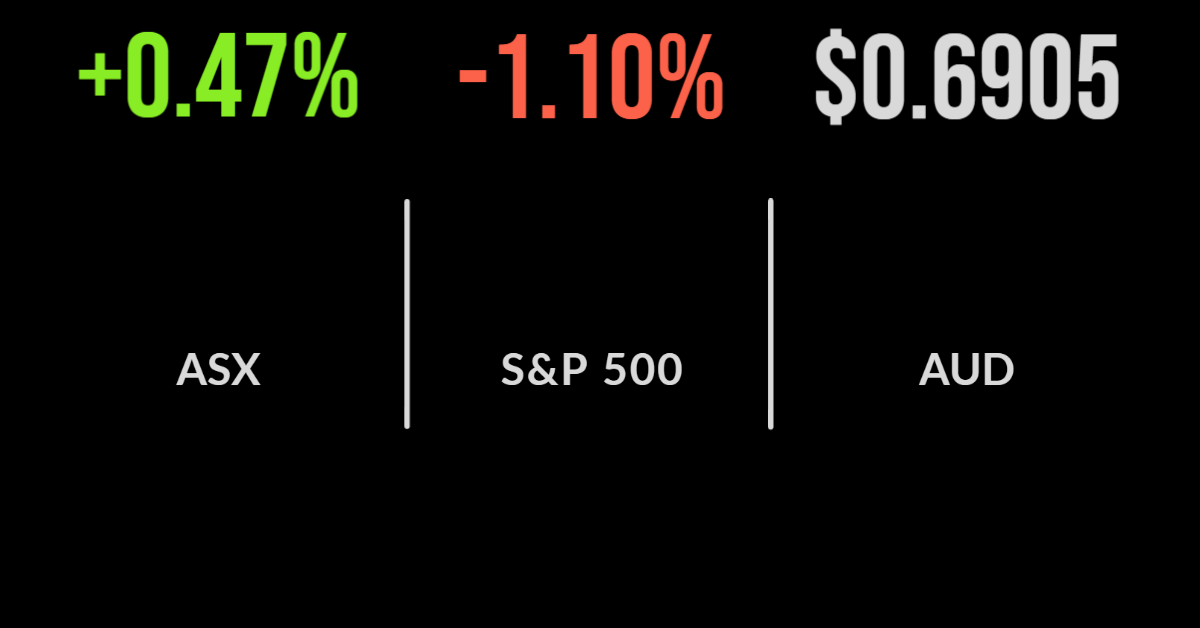

The local market managed to overcome another weak global lead, gaining 0.5 per cent on Tuesday, with the energy sector a key support. Gaining 1.4 per cent on the back of a strong inaugural report by Woodside Energy (ASX:WDS) the sector was second only to technology, which gained 1.8 per cent. Renewed conflict in Libya…

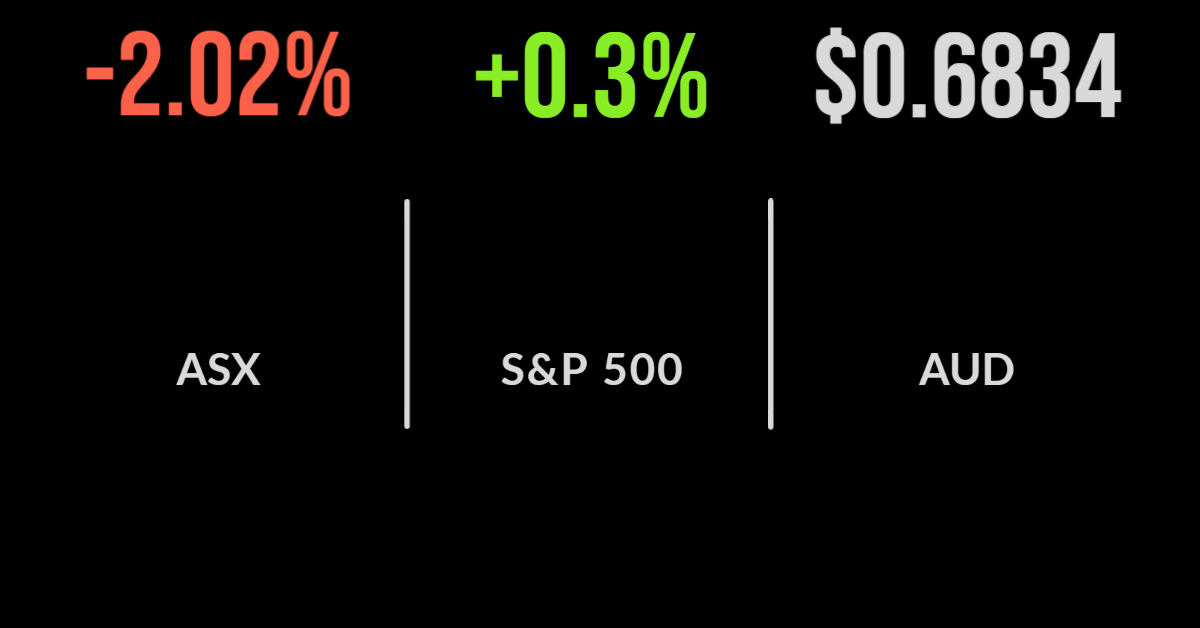

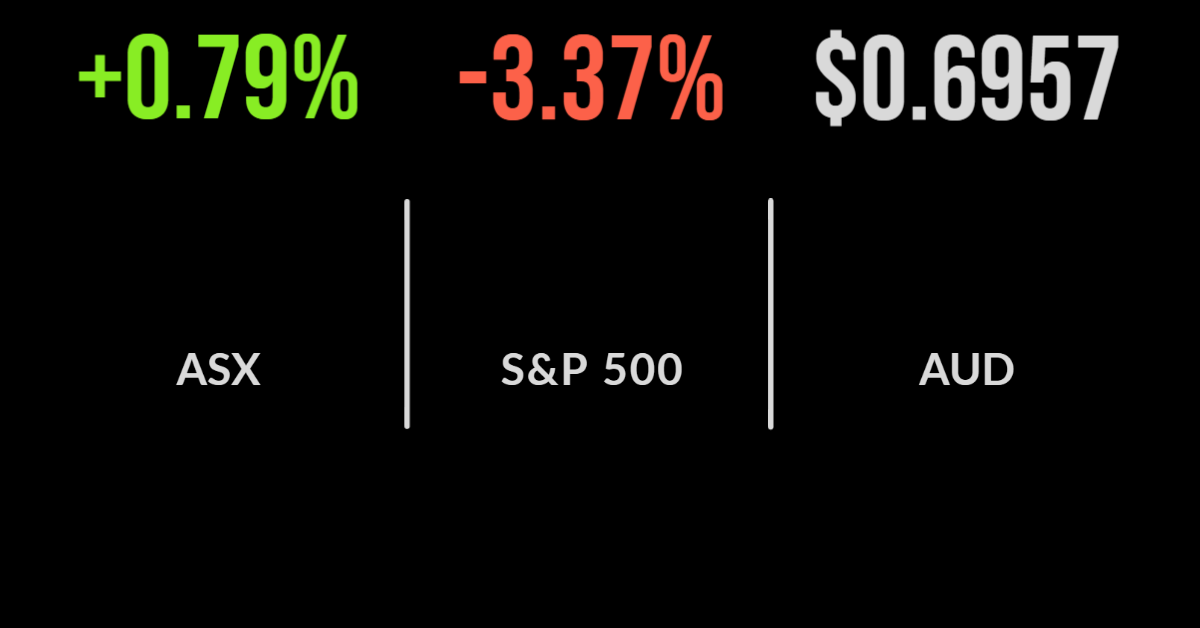

The local market followed an increasingly negative global lead, ultimately finishing 2 per cent lower. The sole driver was commentary from Federal Reserve Chair Jerome Powell from the Jackson Hole summit, which suggested aggressive central bank action was unlikely to slow any time soon. The result was just four companies posting increases on the day,…

After two solid falls to start the week, the Australian market put three straight rises together by the end of Friday, to get itself back into the green for the week – but only just. The benchmark S&P/ASX 200 eased 10.4 points, or 0.2 per cent, for the week, to end at 7,104.1. while the…

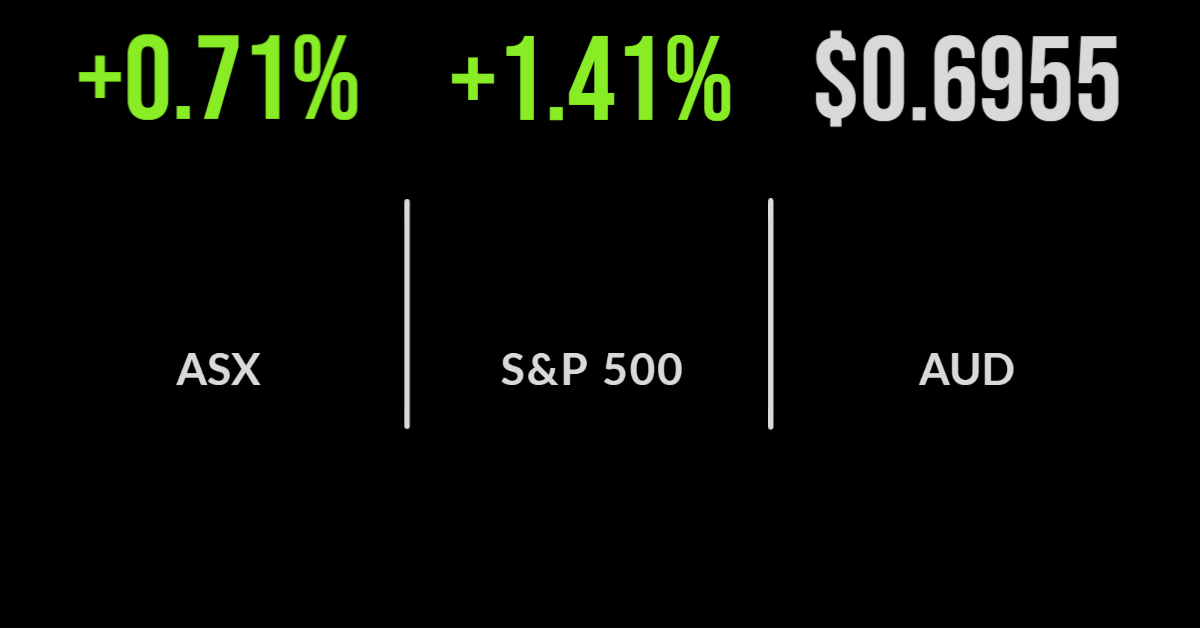

The Australian share market took a positive lead from US markets into Thursday and was also buoyed by Asia-Pacific news and earnings results. The benchmark S&P/ASX200 index gained 50 points, or 0.7 per cent, to 7048.1, while the broader All Ordinaries was up 49.6 points, also 0.7 per cent, to 7291.9. The gains followed news of…