-

Sort By

-

Newest

-

Newest

-

Oldest

The real estate sector has long been a cornerstone of wealth generation in Australia, offering stable, income-generating assets that hold intrinsic value due to the finite nature of land. At The Inside Network Alternatives Symposium, Julian Biggins, co-CEO of MA Financial, outlined why advisers should be paying close attention to the opportunities emerging in the real estate market.

HMC has invested heavily in the hope that after 30 years of disappointing shareholders, Lendlease can reinvent itself by shedding non-core assets and recycling capital into its large scale urban projects.

While the greater housing market is already reflecting the pain of constricting economic conditions, a new property fund partnership between Trilogy Funds and Michael Birch’s Murray Darling Capital shows the potential of ‘rent roll’ portfolios of rental property management agreements to provide exposure to the supersized Australian property.

Max Swango from Invesco goes in-depth with James Dunn from The Inside Network on global real estate and the resilience of quality.

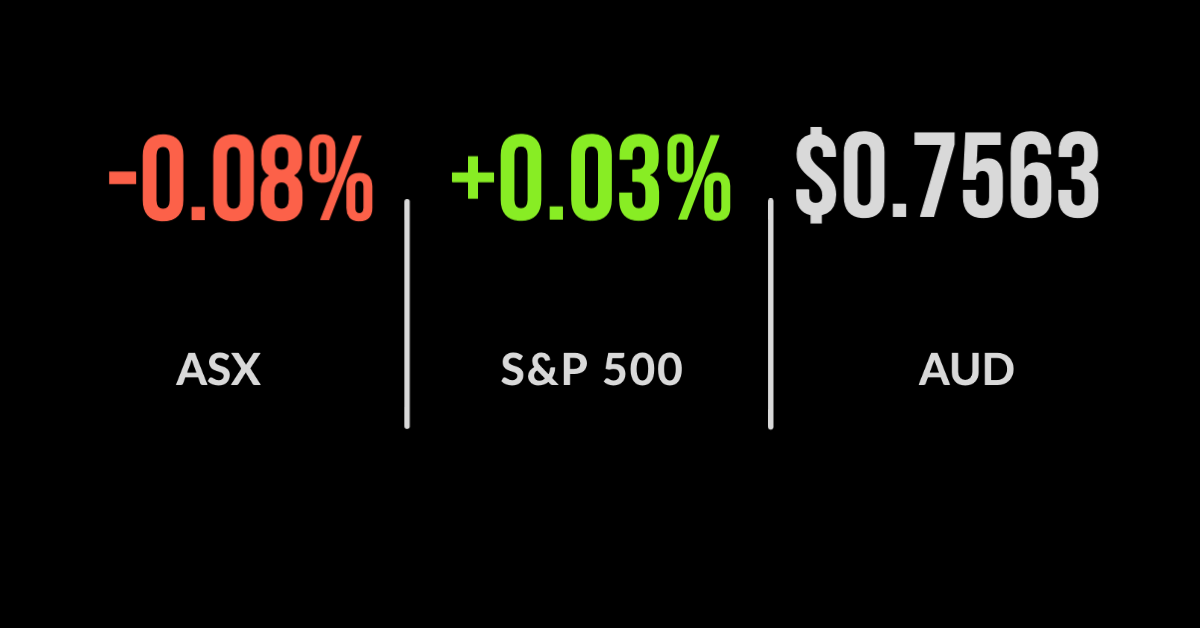

Risk on, Altium offer pulled, property rallies, Lendlease selling, and Kogan on track It was ‘risk on’ once again for the ASX 200 (ASX: XJO) with the market up over 1% during the day but ultimately finishing 0.8% higher. The strength was broad-based with just two sectors, industrials and IT finishing lower, as both materials and real…

Late comeback delivers, energy in the red, dividends hit real estate, CKF falls on earnings The ASX 200 (ASX: XJO) staged a remarkable recovery, managing a flat day despite falling as much as 0.9% on Tuesday morning. Energy, materials, and utilities were amongst the weakest performers, with a raft of dividend payments pulling the real estate sector…

Market records continue, materials weaker, activity grows in IT sector The ASX 200 (ASX: XJO) added another 0.2% on Tuesday, with the materials sector the biggest detractor, falling 0.1% under the weight of BHP Group (ASX: BHP) and Rio Tinto (ASX: RIO). The IT sector continues to surge, adding 1.3%, along with the real estate sector which jumped 1% on somewhat…

Markets weaken, Webjet raises $250m, lithium jumps as production ramps up The ASX200 (ASX:XJO) fell 0.3% to begin the week, struggling to overcome a weak overseas lead with a lack of material announcements for the local market. All eyes were on Federal Reserve Chair Jerome Powell’s 60 Minutes interview overnight in which he highlighted that the US economy is…

ASX to open higher, strong US lead, Commonwealth Bank (ASXLCBA) hit with ASIC investigation The ASX200 (ASX:XJO) finished 1.7% higher to start the week, rebounding quickly from Friday’s so-called ‘bloodbath’. Once again, market volatility was met with reassuring language from central banks and positive news around the vaccine rollout. The Reserve Bank of Australia confirmed that they would be…

I want to discuss a water utility, which may sound as dull as dishwater – but we global real assets investors have never been averse to safe, predictable, and yes, boring companies. The type of company that pays a dividend that is as dependable as a birthday cheque from Grandma. We have specialist in-house capability…