-

Sort By

-

Newest

-

Newest

-

Oldest

In what could be a harbinger for the coming year, the S&P/ASX 200 index has been on a roller coaster ride since the market opened on January 3. What’s making investors extremely jittery are fears incoming President Donald Trump’s policies will fuel inflation.

Higher starting valuations usually lead to lower returns, but the most important part of a bubble is “highly skewed psychology” – and investors remain anchored to sanity.

Markets are expensive, driven by powerful forces which want to turn a 40-year bull market into the first ever 50-year one. That trend is not one to embrace, and standing in its way could put investors in dire straits, writes Jonathan Ruffer.

Australia’s sovereign wealth fund’s prediction of a tough year for investors didn’t come to pass, but they’re not the only well-resourced manager that missed the mark. For investors, this period is a reminder that investment patterns may exist, but markets certainly aren’t beholden to them.

Despite latent geopolitical threats and a persistently hobbled commercial real estate sector, the market presents a fundamentally strong and stable picture according to the Melbourne-based investment consultants.

Whether it’s the right agenda, executive engagement, cold catering or the right to put a rambunctious shareholder on mute, there are myriad elements that go into an effective AGM according to those who’ve had their fair share.

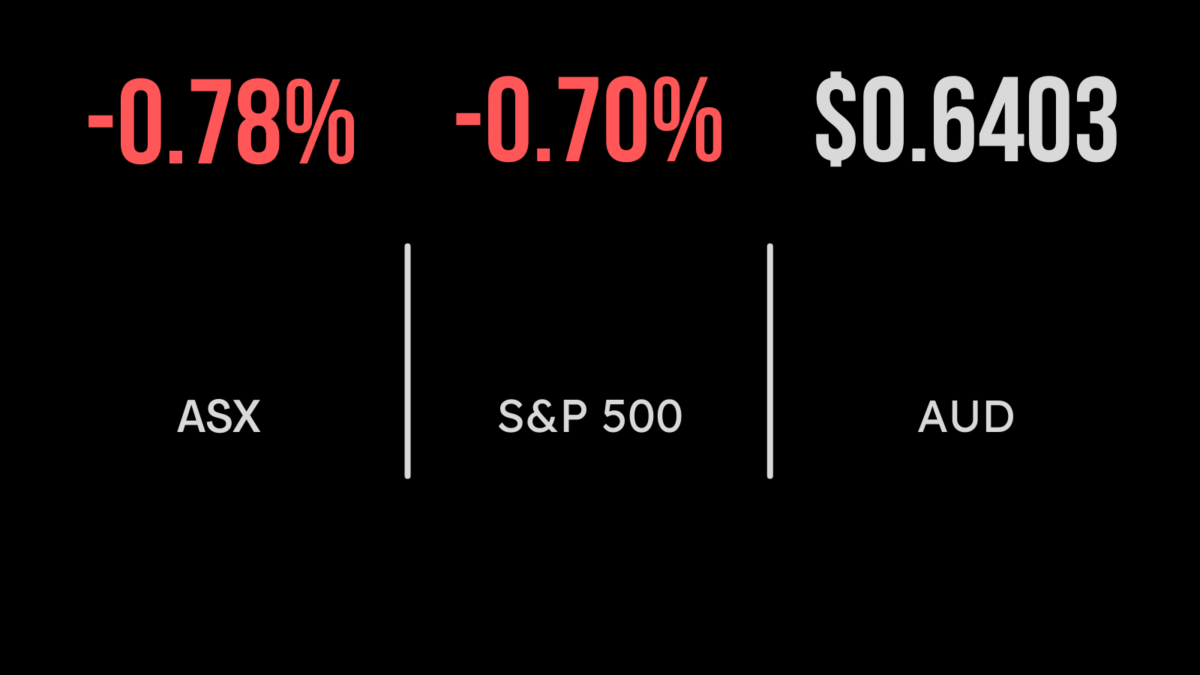

The local share market weakened again on Wednesday, with the All Ordinaries down 0.7 and the S&P/ASX 200 (ASX:XJO) falling 0.8 per cert as seven sectors fell by more than 1 per cent. The rare highlight was the energy sector, which gained 1 per cent on the back of the oil price surging above US$90…

Corporate profit growth is expected to moderate, especially in sectors focused on consumer sales, and mining companies have seen large downgrades. Meanwhile, markets are still not fully pricing in the high risk of recession, some analysts say.

True to form, US stocks are outperforming Aussie shares on the back of a resurgence in technology-related company valuations. Economists warn against straying from diversification, however, with Aussie miners still offering investors capital returns on top of an underlying hedge against a US downturn.

Dividend investing can be a good source of defensive income in volatile times, but changing fundamentals mean resources companies and banks may be the weaker play in 2023, with opportunities emerging beyond these traditional Australian dividend payers – although valuation will be key.