-

Sort By

-

Newest

-

Newest

-

Oldest

The Australian sharemarket followed a strong global lead, finishing 0.1 per cent higher taking the weekly loss to just 4.3 per cent despite the war in Ukraine. On Friday, it was the technology sector that outperformed, gaining over 8 per cent, almost entirely due to a 32 per cent surge in Afterpay’s new owner Block (ASX: SQ2) which was a…

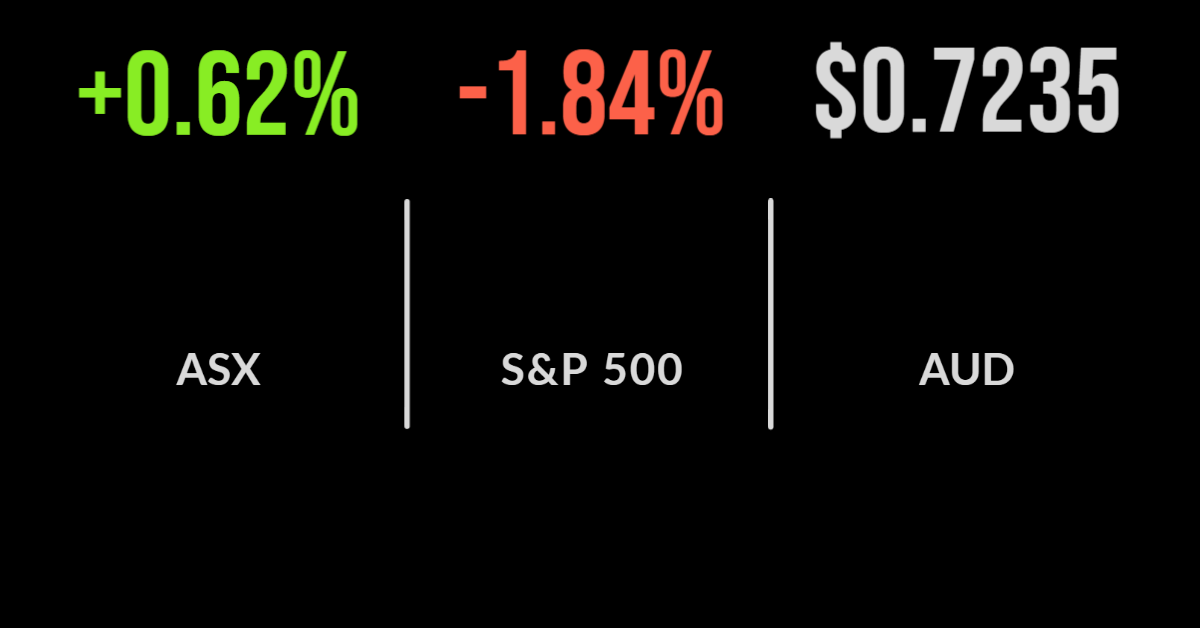

The Australian market overcame increasingly weak global sentiment to post a gain of 0.6 per cent on Wednesday. Whilst the events in Ukraine and associated impacts on the price of energy remain a major concern, another bumper day for reporting season pushed the market higher, with the technology and communication sectors faring best. WiseTech (ASX: WTC)…

The unexpected run of earnings and profit surprises in 2021 wasn’t enough to offset geopolitical concerns from Russia, sending the S&P/ASX200 down 1 per cent on Tuesday. The losses remain focused around the higher valued IT and discretionary sectors, which were down 3.2 and 2.7 per cent respectively. Energy has been the biggest beneficiary given Russia’s key…

The Australian sharemarket looked to be succumbing to overseas weakness on Monday, falling as far as 0.7 per cent before rebounding in the afternoon, to gain 0.2 per cent for the session. On what was a massive day for reporting season all eyes were on Russia, with the US and Russia agreeing to talks in part…

Surges from CSL and BHP powered the Australian sharemarket to a three-week high on Thursday – but the market is likely to struggle today following overnight falls in the US. Australia’s benchmark S&P/ASX 200 Index gained 11.3 points, or 0.2%, to 7296.2, its highest level since January 20. The healthcare sector led the rise, up just under 3%, led by CSL, which saw…

Healthy earnings results from the likes of CSL, Treasury Wine Estates and Pro Medicus helped to push the Australian sharemarket higher on Wednesday, offsetting losses from the major resource stocks as iron ore and oil prices fell. The benchmark S&P/ASX 200 Index gained 78 points, or 1.1%, to 7284.9, following a strong lead from Wall Street on Tuesday night,…

Tuesday’s market highlight came before the opening, when diversified miner BHP reported a bumper half-year result. Strong commodity prices – in particular, record iron ore and coking (steelmaking) coal prices, and buoyant copper prices – enabled BHP to pay a record interim dividend for the third straight year. Revenue rose by 27%, to US$30.5 billion ($42.7 billion), while underlying…

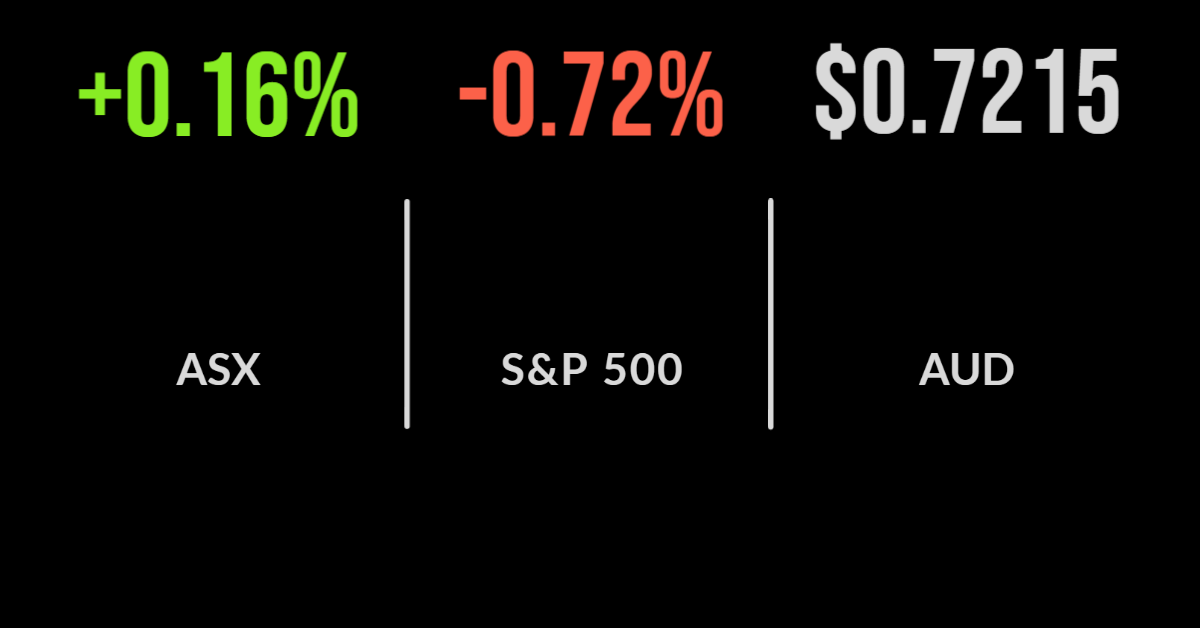

A promising February on the Australian ran into a roadblock on Friday, with the benchmark S&P/ASX 200 Index surrendering 71.2 points on the day, or 1.0 per cent, to 7217.3 points. While that was the biggest loss in more than two weeks, the index was still up 1.4% for the week, in its second straight rising week. Ten…

The S&P/ASX200 continued a recent strong run gaining another 1.1% on Wednesday with Commonwealth Bank (ASX: CBA) a key contributor. The financial and technology sector are seeing strong support as earnings season steps up another gear, they gained 2.6 and 4.2% respectively. In an about-face from recent weeks, the energy and material sectors underperformed after BHP (ASX: BHP) fell due to another warning…

The S&P/ASX200 recovered the ground lost on Monday, increasing 1.1% on Tuesday as the iron ore price showed no signs of slowing down. Having oscillated between a new commodity supercycle and a bear market, a resumption of steel production supported a 2.2% jump in the materials sector and 3.7% for BHP Group (ASX: BHP). Every other sector was higher barring technology, which fell…