-

Sort By

-

Newest

-

Newest

-

Oldest

The release of a landmark report by corporate and financial regulator the Australian Securities and Investments Commission (ASIC) into the nation’s rapidly expanding private markets – and shrinking public markets – has brought this dichotomy into the spotlight, as indeed it has around the world.

“I wish I could say this is an isolated example,” Kirkland said, explaining the regulator’s concern about a small cohort of advisers who transfer client funds into high-risk investments after being referred by cold-calling telemarketers.

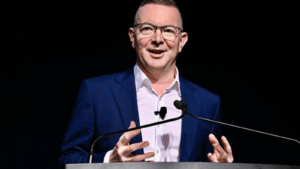

The legislative threads surrounding financial services “look less like an elegant tapestry and more like a painting by Jackson Pollock”, the ASIC chair said, before announcing a new thinktank to reassess ways the regulator can help make the system more efficient and less complex.

Private markets are worth around $14 trillion globally, ASIC believes. It’s not sure, and that uncertainty hints at the wider problem – private markets, and their effect on public ones, is still largely a mystery.

It came as a relief instrument rather than the expected guidance note, but ASIC’s move still managed to give advisers the surety they need to legally use the FSG exemption.

It doesn’t matter whether funds mislead investors with intent or not, and it doesn’t matter if other parties were partly to blame. The authorities have had enough of the excuses, and they’re lobbing record fines at transgressors.

The Bill comes after a report from the Council of Financial Regulators warned that the financial system’s reliance on financial market infrastructure had “significantly increased” following the 2008 global financial crisis and subsequent reforms.

Rather than striving to tick legal boxes, the commissioner said, compliance teams should build their work practice around the right ethical pillars to engender trust with consumers and investors.

On the whole, product providers like fund managers have “made progress” with their adherence to target market determination rules. But ASIC warns that when third party distributors come into play, compliance standards begin to slip.

Licensees were given a month to clean up the information they provided to ASIC about adviser qualifications and training. That time is up, and enforcement action is not off the table.