SVB damage contained by Fed support, but VC and PE managers count losses

The US stock exchange is on tenterhooks after the collapse of California’s Silicon Valley Bank (SVB), with the shockwaves reverberating across the globe as venture capital outfits and private equity managers scramble to contain the damage.

Early last week tranches of SVB customers – largely technology companies in need of cash due to financing challenges – started withdrawing deposits from the bank. In need of cash to cover the shortfall, SVB was forced to sell bonds and residential mortgage-backed securities that had their value cut sharply by rising interest rates, leading to the largest US banking failure since the global financial crisis.

The collapse of SVB – which had approximately US$209 billion in assets and held US$175 billion in deposits – was set to affect hundreds of technology-affiliated companies with deposits at the bank, as the US-based Federal Deposit Insurance Corporation (FDIC), which took control of SVB, only insures deposits up to US$250,000.

That fear was staved on Sunday in the U.S. when Treasury secretary Janet Yellen, Fed chair Jerome Powell and FDIC chair Martin Gruenberg issued a joint statement promising to backstop all deposits at the failed bank.

“Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system,” the statement read.

In an effort to shore up confidence in the banking system, US authorities also announced a lending fallback program to ensure that banks can meet deposit requests.

This came just a day after 300 of the North America’s largest VC firms signed a statement of support for the bank and asked US Treasury Secretary Janet Yellen to help prevent an “extinction level event” for the technology sector.

On February 14, and in what would come as a blow to the reputation of Forbes, the magazine included SVB in its annual list of the “best banks” in America.

Broad exposure

Both here and abroad, private equity managers with wholesale and high-net-worth clients were faced with the challenge of transferring deposited client funds out of SVB and into new accounts, due to cumbersome approval processes for new account openings.

For now, that problem is largely allayed. Private equity purveyors, especially those that invest heavily in technology startups that have heavy initial capital requirements, will welcome the reprieve on deposits while continuing to assess the damage on investment portfolios.

Exposure to the collapse is far from limited to those typically invested in technology companies. US-based behemoth ETF providers Vanguard and BlackRock are the bank’s biggest shareholders with 11 per cent and 8 per cent of SVB’s equity held in client portfolios, respectively.

The next biggest shareholder is Swedish pension fund Alecta, which holds a 4.45 per cent stake that was worth about US$600 million before the bank failed (representing about 0.6 per cent of the fund’s holdings).

Safe and resilient

Fears of contagion in the banking sector have been elevated by the recent failure of other, smaller banks linked to technology. Recently both crypto-friendly banks Silvergate and Signature have been shut down by US state regulators.

The world’s banking system is typically strong enough to absorb failures of this magnitude, however. A handful of US banks close every year; In 2022, there were none.

“The American banking system is really safe and well-capitalized,” Yellen told US media outlet CBS this week. “It’s resilient.”

Despite early valuation falls, the major banks that form the spine of the banking system – both in Australia and abroad – are expected to benefit from the SVB collapse as consumers and companies gravitate away from second tier banks and towards safer, more established providers.

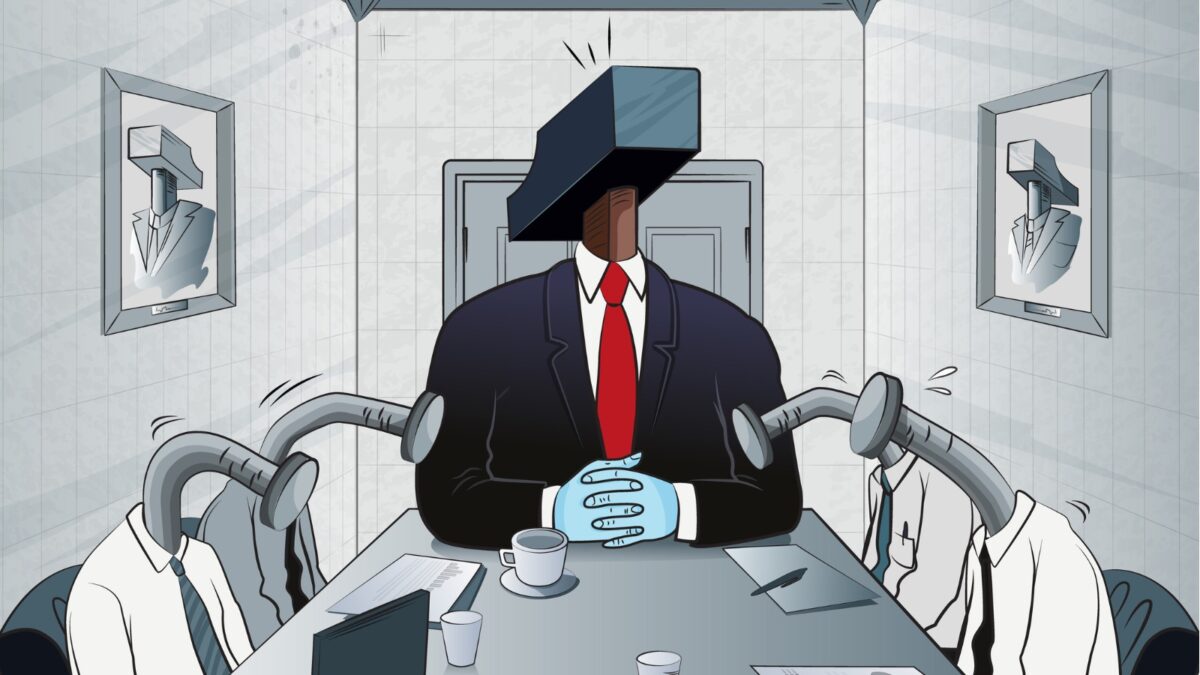

False equilibrium

While the factors leading to SVB’s collapse are varied, economists argue that developed world economies are paying the price of 15 years of ‘easy money’, ultra-low interest rates and a dependance on levers such as quantitative easing.

According to Ninety One portfolio manager Iain Cunningham, coming out of this “false equilibrium” is creating stress points in finance systems the world over.

“Policy makers have, for some time, set policy far too loose relative to prevailing economic fundamentals, evidenced by the material appreciation in asset prices over the period,” Cunningham says.

The false equilibrium since the GFC has created “imbalances and excess”, he continues, and inflation has broken the condition required to maintain it.

“Policy makers have been willing to pivot or add stimulus at any sign of a wobble, seeking to minimise economic and market volatility. Such action has increased confidence and deeply embedded this false equilibrium in the decision-making processes of many households, corporations and even governments.”