Soaring ETF market needs asset servicing to match its growth

While the global exchange traded fund (ETF) market reaches new heights, the legacy asset servicing behind it – which includes transfer agents, fund accountants and custodians – needs significant improvement according to a new whitepaper from Calastone.

The growth of the ETF industry has been so rapid, Calastone explains, that the servicing elements underpinning are playing a catch-up game. According to PwC global ETF assets under management (AUM) achieved a compound annual growth rate of 18.9 per cent in the past five years. In 2023 alone AUM grew 25 per cent to reach US$11.5 trillion globally, with the domestic ETF market just tipping over AU$200 billion according to Vanguard.

The trend is set to continue, with new data from Investment Trends showing advisers “now equally consider ETFs and active unlisted managed funds for their core portfolios”.

Yet while investors have piled into ETFs at record rates, with a large part of those flows coming at the expense of unlisted managed funds, this has put an exponentially greater deal of pressure on the back office systems, trading and clearing houses that facilitate the market.

This is where the inefficiencies need to be rooted out, Calastone believes.

“In order to support the requirements of the ETF industry, manage regulatory changes and reduce the costs facing issuers/investors, asset servicers will need to allocate more resources into their technology systems and deliver on standardisation, the benefits of which can be passed downstream from ETF issuers to investors,” the A New ETF Asset Servicing Paradigm Emerges whitepaper states.

Now more than 30 years old, the ETF industry is past its adolescence and has become a certified juggernaut, with the inherent products becoming increasingly complex as demand for hybrids, active and thematic ETFs has grown.

“These changes are forcing ETF asset servicers to adapt, but many are struggling to do so,” Calastone argues. “Although many providers are investing heavily in their businesses, most of this capital expenditure is either being earmarked for maintaining legacy technology or for supporting highly bespoke builds for specific clients. This is making it harder for asset servicers to both innovate and standardise their technology, which in turn is preventing them from achieving scalability.”

A lot of the older asset service managers are spending money just maintaining legacy technology stacks, Calastone laments, rather than developing new systems. The new ETF asset servicing entrants may have better technology, but they have less capital behind them because of slower growth in their AUM.

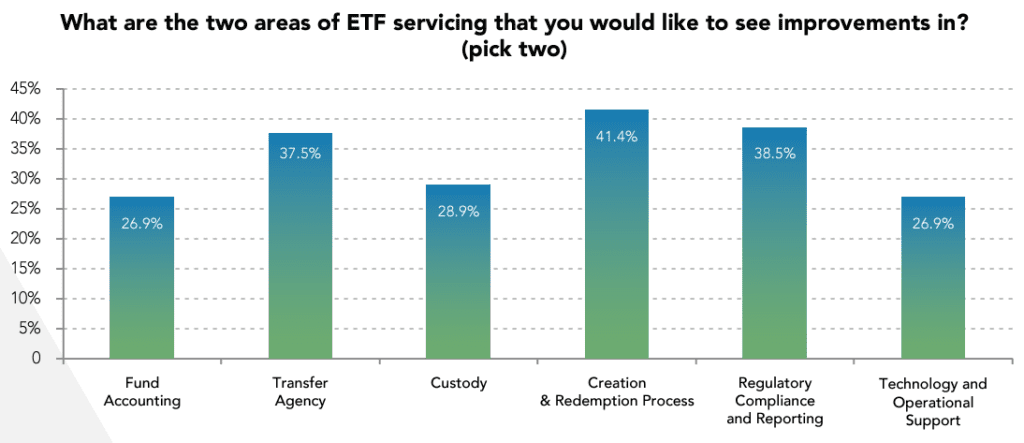

The end result? Inefficiencies remain, which adds extra basis points for consumers when they buy and sell ETFs. “This is a major issue for the industry,” Calastone says, adding that the areas investors most want improvements in are creation and redemption processing, regulatory compliance and reporting, and transfer agency (see below).

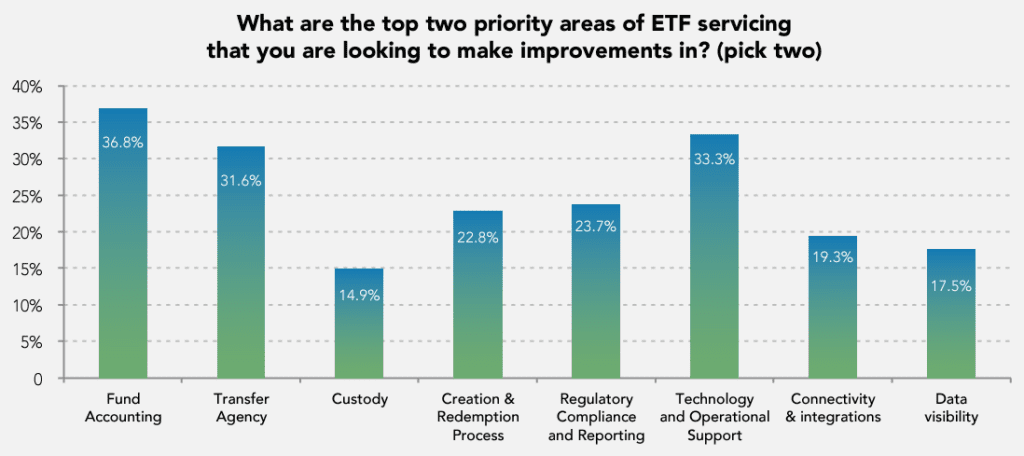

In an indication that there may be a disconnect between the asset services and their client base, however, the areas asset services are looking to make improvements in are remarkably different, with fund accounting, plus technology and operational support the main priorities.

“Improving the creation and redemption process is something asset servicers do need to work on, if they are to retain and win business moving forward,” Calastone states. “This will require providers to focus more of their resources on upgrading their systems, as opposed to continually re-investing in legacy technology or leveraging third-party solutions.”

The other lesson? Don’t let customers’ desire for highly customised solutions get in the way of ensuring systems are robust and future proof for all.

“Instead of continuously developing tailored solutions on a client-by-client basis, asset servicers need to better standardise their underlying technology,” the whitepaper states.