Separating good stock picking from momentum

Hindsight is a wonderful thing. Looking back at the events of the last 18 months, it becomes abundantly clear what actions both investment advisers and fund managers should have taken, yet this offers little in the way of insights into the future.

As it stands today, almost every active fund managers should have delivered 20%+ returns, if not well ahead of their own benchmarks. These make for great headlines, and whilst great for clients, it is important to understand how these returns have actually been achieved.

Did the manager make significantly better stock selection decisions? And can these continue in a markedly different environment? Or were the returns actually delivered via their exposure to a number of ‘persistent’ and academically proven ‘factors’ that have driven returns for decades.

The team at Invesco Quantitative Strategies who contribute to the management of over US$480 billion in factor-based, systematic and market capitalisation weighted investments globally, have sought to answer this question from an Australian sharemarket context.

Factor analysis, as many readers will know, focuses on understanding the characteristics of individual companies that have driven returns consistently over multiple, and extended periods of time. These are generally distilled into six key areas, the majority of which are self-explanatory: Value, Earnings Momentum, Price Momentum, Yield, Size and Quality.

Each factor has their own characteristics, which are beyond the scope of this article, but are constantly reassessed and remeasured.

For comparison’s sake, it is worth beginning with the simplest concept of factor investing, size. The size factor focuses on market capitalisation and is relied upon by accumulation indices the world over, including the ASX200, which build a portfolio of investments based solely on how big or small a company is. Naturally, the performance of this factor is quite easy to measure; it is the ‘market’ or ‘average’ return.

Unbeknownst to many, the Momentum factor, particularly Earnings Momentum, which focuses on buying companies which have expectations of increased earnings growth, has been the dominant factor for an extended period of time. In fact, in many cases, the returns of some of the top performing global equity funds can almost entirely be explained away by capturing this ‘momentum’ factor. Naturally, this leads to the question of ‘how much value did stock picking actually have?’

Moving back to Australia, the Invesco Australian Equities team have offered an analysis of the key turning points, and factor performance in the 18 months since the pandemic began. Initially, they preface their analysis by noting that 2020 was a ‘challenging year’ for single and multi-factor-based strategies, simply because leadership changed so much.

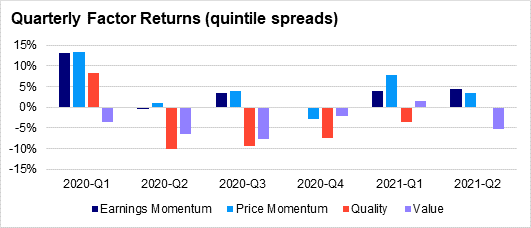

Focusing in on the turning points in 2020, the year began with ‘factors picking up where they left off in 2019’, with Momentum leading the way and Value continuing to struggle as it had for the much of the decade before. The quarterly performance comparison is shown in the chart below. The quality factor was virtually non-existent, with investors chasing the likes of Afterpay as the market peaked. Interestingly, the Value factor actually underperformed the most during the crisis, as the more capital-intensive business models suffered most from economic shutdowns.

As the selloff hit ‘factor performance-matched expected patterns’ with defensive, high-quality stocks like CSL, with strong balance sheets, faring better than their poorer quality alternatives. Then it all pivoted again, with momentum taking over as the COVID-winners trade focused on e-commerce, shipping and digital payments gathered steam, supporting a recovery in Momentum.

And surprisingly, not much has changed as we pass the halfway point of 2021, with Momentum continuing to dominate, whilst Value and Quality have stabilised. Despite the headlines, Value has displayed only brief periods of strong performance, according to the report, on the back of expectations of higher inflation, but this Value renaissance hasn’t been persistent in Australia i.e. Australia has yet to see a sustained Value recovery, despite the headlines.

Where to from here?

In my view, it seems difficult to bet against Momentum and Quality given the continuing outbreak of the Delta Variant that is sweeping the globe. Invesco on the other hand continues to reiterate the value of a multi-factor approach, that delivers diversification across each factor, rather than a reliance on one or the other depending on which fund manager you engage.