Resources lead local bourse

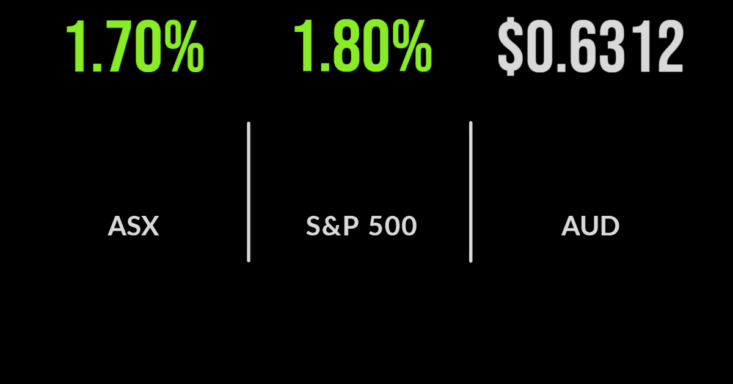

A strong lead-in from Wall Street gave solid impetus to the Australian market on Tuesday, and the result was a lift of 114.8 points, or 1.7 per cent, in the benchmark S&P/ASX 200 Index, to 6779.2; while the broader S&P/ASX All Ordinaries index added 121.9 points, or 1.8 per cent, to 6976.2.

Resources led the rise, with BHP gaining 54 cents, or 1.4 per cent, to $39.63; South32 up 9 cents, or 2.3 per cent, to $3.85; and Fortescue Metals advancing 16 cents, or 1 per cent, to $17.07

Rio Tinto rose 13 cents, or 0.1 per cent, to $94.27, as it announced an agreement with Wright Prospecting – the family company of the late Peter Wright – agreeing to modernise the pair’s 50-year-old joint venture and begin studies on a plan to bring Australia’s biggest undeveloped iron ore project, Rhodes Ridge, into production before 2030. The deal potentially unlocks a massive and high-grade source of iron ore in the Pilbara.

In lithium, producer Allkem gained 22 cents, or 1.5 per cent, to $14.62, while fellow producer Pilbara Minerals added 1 cent, to $4.80. Mineral Resources, which mines iron ore and lithium, advanced 57 cents, or 0.8 per cent, to $69.49. Lithium project developer Liontown Resources rose 7 cents, or 4.1 per cent, to $1.78, fellow project developer Lake Resources advanced 8.5 cents, or 8.5 per cent, to $1.09; and US-based Piedmont Lithium, which has contracts to supply lithium to Tesla, added 5 cents, or 6.3 per cent, to 84 cents.

Some of the heat came out of coal superstar Whitehaven Coal, which closed 39 cents, or 3.6 per cent, lower at $10.41; but elsewhere in the sector, New Hope Corporation added 4 cents, or 0.6 per cent, to $6.91; Coronado Global Resources gained 9 cents, or 4.4. per cent, to $1.97; and Stanmore Resources advancing 9 cents, or 3.5 per cent, to $2.69.

All that glitters ain’t gold for St Barbara

In gold, after an 8.2 per cent slump yesterday, St Barbara shares really turned on the downward jets, plunging 15 cents, or 21.6 per cent, to 52 cents, after reporting a blow-out in the cost of production, in its first-quarter update. The gold miner reported an all-in sustaining cost of $2,490 an ounce for the quarter, against a realised gold price of $2,486 – a negative margin that is clearly not sustainable. St Barbara’s total cost of doing business has ballooned by two-thirds from $1492 in the first quarter of 2021-22.

The miner produced a lower-than-expected 63,700 ounces of gold for the quarter because of difficulties in the availability of essential equipment for underground mining and associated labour shortages. St Barbara said it would defer planned capital investment by $50 million, and for good measure, cut its 2022-23 production guidance. All up, it was no wonder that the shares got the staggers.

Energy heavyweights Woodside Energy and Santos were both down, Woodside falling 25 cents, or 0.8 per cent, to $32.88; and Santos sliding 9 cents, or 1.2 per cent, to $7.48; but the big “gentailers” were both up, with Origin Energy gaining 10 cents, or 1.8 per cent, to $5.72 and AGL Energy adding 6 cents, or 0.9 per cent, to $6.72.

Australian techs were buzzing, rising 4.2 per cent on the back of the tech-laden Nasdaq rallying overnight. Xero surged $4.27, or 5.9 per cent to $76.77; WiseTech Global jumped $2.63, or 4.8 per cent, to $57.72; and Afterpay’s owner Block, Inc. lifted $8.97, or 10.7 per cent, to $92.90 following an 8.6 per cent rise in the dual-listed company’s US shares overnight.

The financial sector index gained 2 per cent, with all the big banks higher. CBA added $1.69, or 1.7 per cent, to $99.78; NAB gained 45 cents, or 1.5 per cent, to $31.23; and ANZ advanced 24 cents, or 0.9 per cent, to $25.65. Westpac rose 55 cents, or 2.4 per cent, to $23.98 after confirming that it is interested in buying payment system provider Tyro Payments. Westpac said the talks were preliminary, and a formal approach is not guaranteed. Tyro, which gained 3 cents, or 1.9 per cent, to $1.59, stated that it had been approached by other parties as well.

Elsewhere, battery metals stock Novonix surged 34 cents, or 19 per cent, to $2.13 on no news; investment platform HUB24 jumped $3.13, or 14.2 per cent, to 25.21 after releasing a first-quarter result in which it stated that it has seen “another strong quarter of growth.”

Biotech Telix Pharmaceuticals spiked 62 cents, or 11.1 per cent, to $6.21 after reporting positive preliminary data in two trials of its radio-pharmaceutical imaging agent in two kinds of cancer.

Wall Street continues strength

Another green-lit night on Wall Street saw the 30-stock Dow Jones Industrial Average gain 338 points, or 1.1 per cent, to 30,523.8; the broader S&P 500 index climb 42 points, also 1.1 per cent, to 3,720; and the Nasdaq Composite add 96.6 points, or 0.9 per cent, to 10,772.4. Better-than-expected earnings results – in particular, from Goldman Sachs and defence heavyweight Lockheed Martin – helped push the indices higher. In the bond market, the benchmark US 10-year bond yield remained above 4 per cent – close to 14-year highs – but the market is doing its best to convince itself that these highs are a temporary ceiling.

European stocks were mostly higher, with the Stoxx 600 index up 0.4 per cent as all major markets made gains. In commodities, gold gained US$2.06, or 0.1 per cent, to US$1,652.76 an ounce, Brent crude oil lost US$1.59, or 1.7 per cent, to US$90.03 a barrel and the West Texas Intermediate grade added 62 cents, or 0.6 per cent, to US$83.44 a barrel. The Australian dollar is buying 63.12 US cents.