Real Estate drags the Australian market lower, and merger/acquisition activity heats up

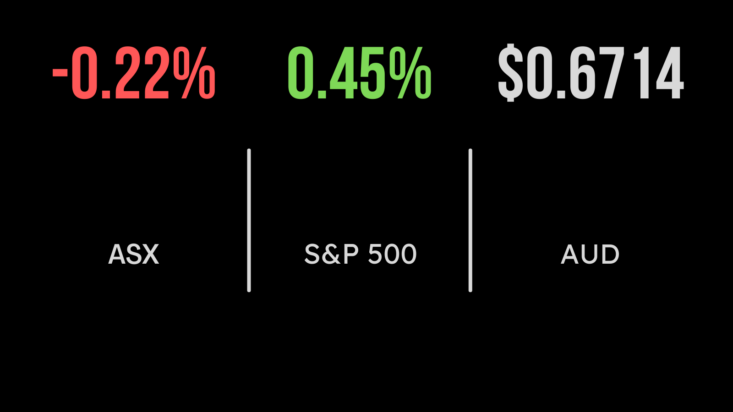

The S&P/ASX 200 dipped down 0.2 per cent, as eight out of the 11 sectors ended in negative territory. The real estate sector, sensitive to interest rates, faced the most significant setback on the ASX, plummeting by 1.4 per cent. Vicinity Centres, Mirvac, Scentre Group, and Dexus dropped by 2.4 per cent, 2.9 per cent, 1.4 per cent, and 1.8 per cent. Consumer staples also weakened, weighed down by major supermarket players. Woolworths slid 0.7 per cent to $36.40, while Coles declined 1.2 per cent to $15.86. Amidst a lower iron ore price, prominent mining companies underperformed, with BHP Group slipping 0.1 per cent to $49.34 and Fortescue Metals sliding 0.2 per cent to $27.79. However, it was corporate developments that ignited significant activity on the ASX, with announcements of deals totalling nearly $5 billion driving notable shifts in stock prices. Adbri surged by 31.2 per cent to $2.98 following CRH and major shareholder Barro Group’s agreement to purchase the building materials company at $3.20 per share, valuing Adbri at $2.1 billion. Link Group leaped by 27.1 per cent to $2.16 as Japanese giant Mitsubishi UFJ agreed to acquire the company at $2.10 per share in cash, along with a dividend of 16¢, to be franked at 25 per cent. Tabcorp secures key 20-year wagering license in Victoria

Despite Stockland Group’s finalized deal to acquire 12 master-planned communities from Lendlease for up to $1.3 billion, its shares dropped by 3.6 per cent to $4.30, in line with the real estate sector’s broader weakness. Concurrently, Lendlease shares fell by 1.2 per cent to $7.42. Meanwhile, Tabcorp surged by 23.1 per cent to 90.5¢ following its announcement to retain its exclusive license for retail wagering and betting in Victoria, effectively barring international competitors like Sportsbet. Energy giant Santos experienced a 1.6 per cent decline to $7.63, despite obtaining approval from the national offshore petroleum regulator for its revised plan to drill the $5.8 billion Barossa gas project in the Timor Sea. Despite securing a $150 million loan from US funds management giant Ares, Zip Co slid by 2.4 per cent to 61.5¢ in ASX trading. Melbourne-based biotech Neuren Pharmaceuticals soared by 29.5 per cent to $22.20 after unveiling positive phase-two clinical trial results for its drug designed to treat cognitive disorder Phelan-McDermid syndrome in children.

Nikola the EV company plummets, as founder gets sentenced to four years in prison

The Dow finished flat, S&P500 up 0.5 per cent and the tech-heavy Nasdaq finished up 0.6 per cent. U.S. Steel surged by 26 per cent to $50.11 after reaching an agreement to be purchased by Nippon Steel for $55 per share in cash or a total of $14.9 billion, inclusive of debt. Closing at $39.33 on Friday, U.S. Steel anticipates the deal’s completion in the second or third quarter of the following year, subject to regulatory approval. Apple experienced a 0.9 per cent decline following its announcement of temporarily halting Apple Watch sales to comply with a U.S. import ban.Adobe opted to terminate its $20 billion deal to acquire design tools maker Figma, resulting in a 2.5 per cent rise in Adobe’s stock value. Shares of solar company SunPower plummeted by 31 per cent after issuing a “going concern” warning in response to a potential default. VF Corp, parent to Vans and The North Face, faced a 7.8 per cent decline due to a security breach discovered last week, potentially impacting its business significantly. On Monday, Trevor Milton, the founder of Nikola, received a four-year prison sentence for making fraudulent claims regarding his electric vehicle company. Nikola is currently down 63 per cent year to date.