Power of attorney practices ‘inconsistent’, and under-served by advisers: Report

The Australian Human Rights Commission (AHRC) is urging the federal, state and territory governments to urgently implement reforms to achieve national consistency in laws governing financial enduring power of attorneys (FEPOAs) across all jurisdictions.

This key recommendation stems from the AHRC’s detailed report, titled Empowering Futures: A national survey on the understanding and use of financial enduring powers of attorney.

Released on Tuesday, the report emanated from an online survey of more than 3,000 Australian adults to determine the levels of awareness and use of FEPOAs.

The report uncovered critical shortcomings and lack of knowledge about FEPOAs, with some key findings being:

- Only half the people with an FEPOA sought professional advice before creating one, and just a quarter of those acting as appointed decision-makers felt they understood their responsibilities very well when they started in the role.

- Concerningly, two in five had granted an FEPOA to someone who showed characteristics identified as risk factors for perpetrating elder abuse.

- Before creating their FEPOA, only about half of the principals (52 per cent) sought professional advice and discussed it with the person they wanted to appoint as their decision-maker. Fewer than half of the principals (42 per cent) explained to other family members or friends why they chose their appointed decision-maker.

- Fewer than three in 10 principals (29 per cent) discussed their choice of a prospective decision-maker with a trusted third party or considered whether to set limits or conditions to their FEPOA (27 per cent).

- Only one in four (23 per cent) correctly identified that an FEPOA cannot be made after the principal has lost capacity to make decisions.

- Few Australians (six per cent) felt they knew a lot about FEPOAs, while more than a third (35 per cent) felt they knew nothing despite some of them being involved in the process.

- Australians overwhelmingly (85 per cent) agreed that more education was needed on FEPOAs. Having information that is standardised across the country was identified as a top need (93 per cent).

COTA Australia, the organisation focussed on issues germane to seniors, has added its voice to the AHRC’s recommendation for national consistency in laws governing FEPOAs.

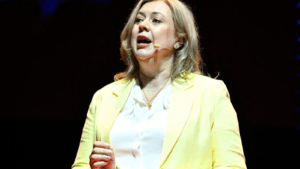

Chief executive officer Patricia Sparrow says this report lays bare the severe shortcomings in the system that imperil the financial security and decision-making autonomy of older Australians.

“The patchwork of laws across states and territories is a major roadblock to comprehensively safeguarding against elder abuse. We desperately need clear, consistent legislation and a national register to shield older people from financial exploitation.”

She adds that the report’s findings are alarming with only half of those with a FEPOA seeking professional advice before implementation, and a staggering 37 per cent granted this power to individuals with known risk factors for perpetrating elder abuse, highlighting the need for governments to invest in awareness and education.

“We’ve long advocated for reform in this area, and this report from the AHRC reinforces the critical need for change,” Sparrow says.

“The facts are clear: widespread inconsistencies and knowledge gaps are jeopardising the safety and autonomy of older Australians. It’s crucial we address these issues through comprehensive legal reform which should be a critical discussion point at the next Standing Council of Attorney Generals.”