‘Persistent inflation and rising volatility ahead’ – Franklin’s Desai

“To work, or not to work” was the title of Franklin Templeton’s Chief Investment Officer of Fixed Income, Sonal Desai’s latest white paper. The detailed analysis on the US labour market offers insights into the future that lies ahead for Australia but also into the unique and difficult conditions the world is in as we emerge from the pandemic at varying speed.

Investing in fixed income markets in one of the most challenging environments in recent history requires a strong focus on fundamentals but also increases the importance of understanding exactly what is occurring in economies around the world. Inflation and interest rates are obviously among the most important considerations for any fixed income investor, get the duration call wrong, and returns evaporate.

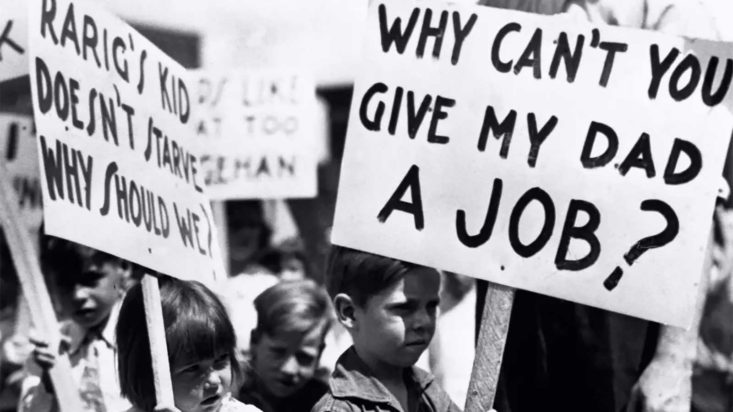

For this reason, that the latest update from Desai focuses solely on the unique challenges facing the US labour market; the story of which is similar to Australia. “Sluggish employment growth is perhaps the most important for investors to watch” she says noting that the issue is central to the current inflation pressures whilst also “holding back growth” in the economy. The pressure also has longer term implications in terms of making it difficult to reduce income inequality and slowing down the build of skills in the domestic labour force.

Desai highlights five key issues that are driving the trend, beginning with the fact that “may works didn’t want to get back in the game” after the pandemic. The participation rate among works in ‘prime working age’ is a full 1.5 per cent below its pre pandemic peak, starving the economy of job seekers. This is occurring while the cohort of 65 plus year old works has falling by 1 million compared to the trend of the last decade.

A falling participation rate is occurring amid one of the strongest “sellers markets” for employees in decades. There are some 11 million job openings in the US today, with plenty of jobs and limited competition across multiple sectors. The story is similar in Australia where seek just reported record job ads but clearly not enough people to fill them. The openings aren’t solely in hospitality as one would expect, but span everything from manufacturing to retail and wholesale trade. The unique market conditions mean that those willing to change changes are seeing significantly better wage gains than those who stay put.

Interestingly, according to Desai, most vacancies are actually coming from non-specialised sectors of the economy, debunking the myth that the US has a skills shortage on its hands. However a rise in self employment and business creation has reduced the pool of workers that businesses can tap by some 1 million since November 2020.

One of the more entrenched issues is likely the fact that people are “staying out of the work force because they can”. By this, Desai highlights the significant continuing employment and social security support packages as well as a number of tax credits coming from President Biden’s Build Back Better policy announcements. This isn’t to say these people will never return to work, rather after putting away capital during the pandemic, they don’t feel any urgency to do so.

According to Desai these trends are “unambiguously inflationary” with corporates forced to raise wages and pass these higher costs onto customers. They see the Federal Reserve ‘abandoning transitory inflation” and believe the likelihood of higher prices and higher rates is increasing.

This has two potential impacts, in the short term it will likely result in “bouts of asset price volatility” but the longer term is where the real issue may be. Sustained weak labour supply may in fact lead to lower potential economic growth and force greater investment into technology and automation at the expense of the labour market.

Franklin’s approach remains focused on having limited duration exposure and seeking strong fundamentals in corporate high yield, bank loans and emerging market debt.