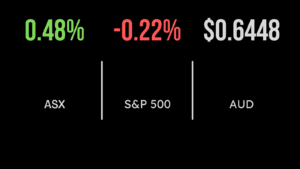

Mining titans weigh ASX to 0.5% loss

Reality bites, Oil Search gets a bid, AUD hits seven month low

Defensive earnings remained sought after on Tuesday with the healthcare sector outperforming once again, adding 1% behind CSL Limited (ASX: CSL) which finished 1.3% higher.

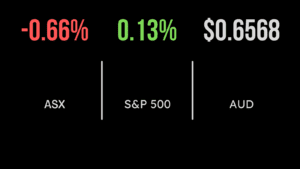

Growing global outbreaks of the Delta strain have shaken markets but the ASX 200 (ASX: XJO) was able to overcome an initial fall of over 1.2% to finish just 0.5% lower.

Energy and materials were once again the hardest hit with both falling over 1%, albeit with mixed results between companies.

Oil Search Ltd (ASX: OSH) gained 6.3% after revealing the worst-kept secret that Santos Ltd (ASX: STO) had made an offer to merge with the company.

The offer valued OSH at around $4.25 per share with existing shareholders to own 37% of the combined entity. Management welcomed the offer but suggested it didn’t quite represent fair value.

We suggest traders keep an eye on this one, however, Australian commodity companies don’t have a great track record in mergers.

Sticking with mining, BHP Group Ltd (ASX: BHP) fell 2.5% despite reporting record exports and quarterly production of 72.8 million tonnes of iron ore.

This represents 9% growth on the previous quarter, the reverse of key competitor Rio Tinto, with management confirming unit cost forecasts of US$13-14 per tonne remains on target.

Online sales boom for JBH, Ramsay’s offer rejected, Hub 24 delivers record inflows

Electronics and white goods retailer JB Hi-Fi Limited (ASX: JBH) jumped 3.7% after announcing a 68% increase in financial year profit to $506 million.

Management reported ‘strong sales momentum’ with revenue up 12.6% to $8.9 billion for the year and earnings increased 54% to $743 million.

Interestingly, online sales jumped 78% but remain at just 12% of total sales despite the pandemic, suggesting more margin improvement and growth may still be possible.

Counsel for the Royal Commission into Crown Resorts Ltd (ASX: CWN) predictably recommended their license be withdrawn once again sending the share price lower, down 2.6%.

The real advice comes in a month’s time when the recommendation is handed down.

Investment platform Hub24 Ltd (ASX: HUB) continued its recent record run, adding another $3.9 billion in quarterly inflows, taking assets under administration to $41.4 billion, supported by a number of recent acquisitions. HUB shares fell 2.4% on the news.

Ramsay Health Care Limited (ASX: RHC) had been rebutted on its takeover offer for Spire Healthcare in the UK, with shareholders rejecting the $3.9 billion bid despite both board and major shareholder support.

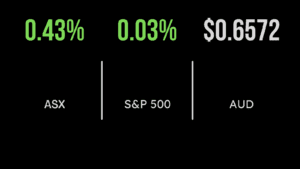

Buy the dip, US markets rally, Netflix misses, housing starts jump

The time-tested strategy of ‘buying the dip’ has paid off once again for day traders with US markets staging a strong recovery, the Dow Jones up 1.5% and both the S&P 500 and Nasdaq moving 1.6% higher overnight.

The strength comes despite growing warnings of the pandemic worsening as global cases numbers and deaths begin to increase once again.

The smaller companies Russell 2000 index was a key beneficiary, jumping 3%, as housing starts were confirmed to have jumped 6.3% in June.

Everything from cruise liner Carnival Corp (NYSE: CCL) airlines, including United Airlines Holdings Inc (NYSE: UAL), were both up over 6%.

Netflix Inc (NYSE: NFLX) on the other hand missed expectations in the fourth quarter, adding just 1.75 million subscribers, well below the 1.54 million expected.

Revenue was slightly ahead of expectations, US$7.34 billion, with price increases a key contributor; NFLX shares will fall on the miss.