Miners lead positive week for local market

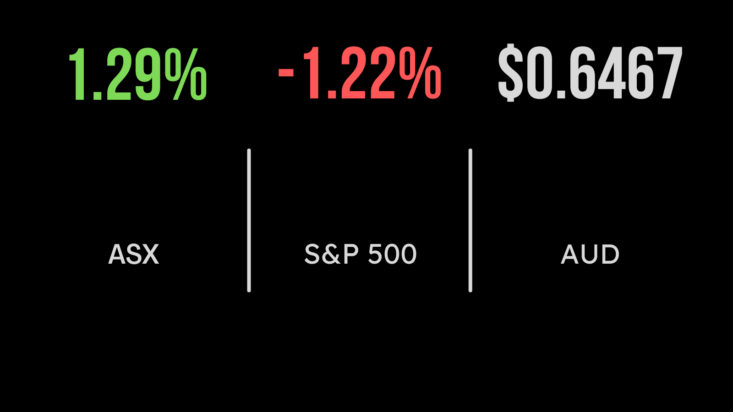

A positive mood on Friday lifted the benchmark Australian index, the S&P/ASX 200, by 92.5 points, or 1.3 per cent, to 7,279 points, in its best day since July. That helped push the index to a 1.7 per cent rise for the week. The broader All Ordinaries rose 99.9 points, or 1.4 per cent, to 7,482.6, to match the 200’s performance, with a 1.7 per cent improvement on the week.

Miners led the market higher, as heavyweights Rio Tinto, BHP and Fortescue Metals surged after the iron ore price pushed to its highest level in six months.

BHP lifted $1.54, or 3.5 per cent, on Friday, to $45.68, notching a 5.5 per cent gain over the week. Fortescue Metals advanced 81 cents, or 4 per cent, to $21.22, making a gain of almost 10 per cent. Rio Tinto improved $3.46, or 3 per cent, to $118.91, to be up 6.8 per cent for the week, its biggest weekly increase since November last year.

The big four banks were all higher on Friday, with National Australia Bank gaining 37 cents, or 1.3 per cent, to $29.68; Commonwealth Bank up $1.03; or 1 per cent, to $103.16; Westpac advancing 15 cents, or 0.7 per cent, to $21.77; and ANZ adding 10 cents, or 0.4 per cent, to $25.70. For the week, NAB was up 3.1 per cent, CBA gained 2.3 per cent, Westpac was up 2.9 per cent, and ANZ put on 2.3 per cent.

Qantas had a good week, which has been rare, of late: the stock gained 2 cents, or 0.4 per cent, on Friday, to $5.61, a gain of 8 cents over the week, or 1.4 per cent.

US stocks rise, but bonds less buoyant

In the US, stocks fell on Friday as investors prepared for the Federal Reserve’s policy meeting. The blue-chip Dow Jones Industrial Average slid 288.87 points, or 0.8 per cent, to 34,618.24; the broader S&P 500 index lost 54.78 points, or 1.2 per cent, to 4,450.32; and the tech-heavy Nasdaq Composite Index shed 217.72 points, or 1.6 per cent, to 13,708.33.

For the week, the Dow Jones pushed ahead by 0.1 per cent, but the S&P 500 and Nasdaq both suffered a second straight week of losses, lower by 0.2 per cent and 0.4 per cent, respectively.

In the bond market, yields continued to move higher (that is, prices fell) reflecting a less optimistic view of the economy.

In commodities, crude oil continued its rally, with West Texas Intermediate (WTI), in particular, gaining about 4.6 per cent last week, to its highest close since the beginning of November, at US$90.93 a barrel. Brent crude is at US$93.98 a barrel. Meanwhile, gold prices were slightly higher, at US$1,923.02 an ounce, capitalising on a slow pullback in the US dollar.

Data flow to continue, led by Fed

It was a big week for economic data. US consumer price inflation rose by 0.6 per cent during August for a 3.7 per cent annual increase, up from 3.2 per cent a year for July, and its biggest monthly rise for 2023. The monthly increase in inflation was mainly driven by increases in rent and fuel costs. The core rate, which strips out food and energy, rose by 0.3 per cent, slightly higher than economists had forecast with the annual rate falling to 4.3 per cent from 4.7 per cent in July.

In a separate report, inflation at the wholesale level rose by 0.7 per cent in August, nearly double the rate forecast by economists. The annual rate, however, was up by 1.6 per cent with the core rate slightly higher at 2.1 per cent. Energy prices were the main contributor to the rise with the energy index surging 10.5 per cent.

The European Central Bank raised its key rate to a record 4.5 per cent, from 4.25 per cent, warning that inflation was “expected to remain too high for too long”.

In Australia, the local employment data for August showed that 64,900 jobs were gained, 62,100 of them part-timers, and the unemployment rate remained steady at 3.7 per cent.

The week ahead brings several central bank rate decisions, headlined by the Federal Reserve, on Wednesday, US time. The Bank of England and the Bank of Japan also step up to the rates plate. According to the CME FedWatch tool, the Fed is widely expected to leave rates unchanged.

The Australian dollar ended the week at a two-week high against its United States counterpart, buying 64.58 US cents. It starts this week at 63.64 cents.