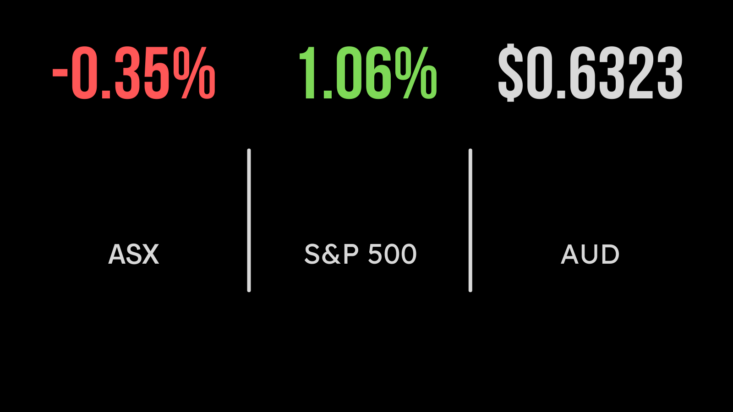

Markets hit by risk off sentiment, ASX200 (ASX:XJO) down 0.3 per cent, Israel-Hamas crisis pushes energy higher

Both the key Australian indices fell on Monday, with the S&P/ASX200 falling 0.3 per cent and the All Ordinaries 0.4 per cent with the technology sector the biggest detractor, down 2.8 per cent. The primary culprits were Xero (ASX:XRO) and WiseTech (ASX:WST) which fell 3.4 and 2.3 per cent respectively as the Israel-Hamas crisis made investors move back to risk off positioning while also threatening further pressure on energy price inflation. On the positive side was the materials sector, which gained 0.4 per cent, driven higher by a surging gold price and further weakening on the Australian dollar. The likes of Regis (ASX:RRL) and Northern Star (ASX:NST) gained 5.8 and 3.2 per cent amid a flock of investors returning to safe haven assets once again. It was a similar story for energy, with the Israel conflict set to keep the oil price above US$90 per barrel and benefitting the likes of Woodside (ASX:WDS) in the short-term.

Magellan Global Fund restructure, CSL not hit by Ozempic, Liontown deal off

The Magellan Global Fund (ASX:MGF), a listed investment trust that has been trading at a discount, rallied 4.2 per cent on Monday, after the company announced its intention to restricted the closed end vehicle into an unlisted open-ended one, in an effort to remove the discount to NTA. Shares in Liontown (ASX:LTR) remained in a trading halt after Gina Rinehart managed to push away global lithium giant Albemarle from a $6.6 billion deal with the company now needing to raise fresh funds to pay for the construction of its Kathleen Valley asset. Blood treatment group CSL (ASX:CSL) fell just 0.6 per cent on a weak day for the market, with management indicating the company would not be impacted by the increasingly popular Ozempic treatment, which has been seen as a solution to kidney treatments. Fletcher Building (ASX:FBU) fell 8.6 per cent after exiting a trading halt that highlighted widespread issues with a number of plumbing products.

S&P500 gains on oil retreat, Israel-Hamas conflict to remain local, earnings season ahead

Investors paused on Monday in the US, pulling back on safe haven bond and gold purchases amid hope that the Israel-Hamas conflict would remain localised. This pushed the oil price lower, however, many experts still see significant risk that Iran or Egypt become involved thus escalating the situation. The result was a 1 per cent gain in the Dow Jones, 1.1 in the S&P500 and 1.2 per cent in the Nasdaq. Lululemon (NYSE:LULU) shares gained more than 10 per cent after the company received news it was set to be included in the S&P500 index from Wednesday, thus attracting ETF and index fund flows. Earnings season is set to kick off this week, beginning with Goldman Sachs (NYSE:GS) and Bank of America (NYSE:BAC) with hope that the six-month earnings recession may be reversed following another strong period for the consumer.