Market (ASX:XJO) lower on property, energy, Paladin dumped on nationalisation

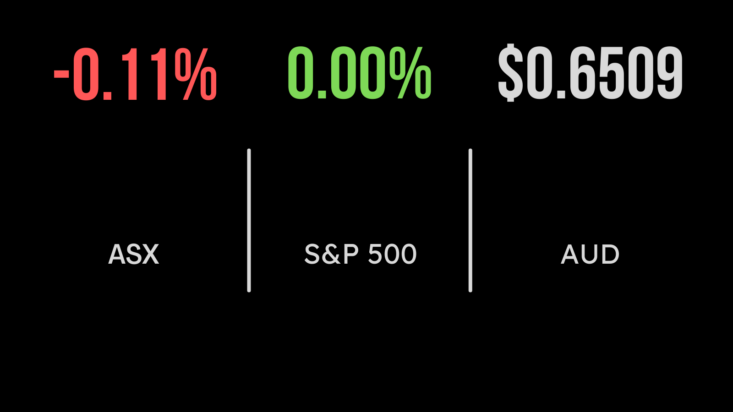

The local sharemarket paused for breath on Tuesday, with both the All Ordinaries (ASX:XAO) and S&P/ASX200 (ASX:XJO) falling 0.1 per cent. The property sector was the biggest detractor, down 0.9 per cent behind the likes of Charter Hall (ASX:CHC) which fell 2.2 per cent. Shares in popular uranium miner Paladin (ASX:PDN) tanked by close to 20 per cent after the Namibian Government indicated they make seek to take ownership stakes in energy-related business at no cost, representing a potential nationalisation of the company and once again flagging the challenge of investing directly into smaller Australian-listed companies. Shares in Qantas (ASX:QAN) were buoyed by an expected $400 million profit increase announced at the group’s investor day with the bounce driven by the resumption and popularity of ultra-long haul flights. In a sign that rate hikes are beginning to bit, consumer confidence fell to it’s lowest point since the recession in 1990, according to Roy Morgan research.

Wesfarmers out of Silk Laser deal, Crown confirms $450 million fine, Maggie Beer consumed

Wesfarmers (ASX:WES) shares were 0.5 per cent higher, outperforming the benchmark, after the company flagged more challenging conditions while confirming it would not be increasing it’s offer to acquire Silk Laser Clinics. Now unlisted company Crown (ASX:CWN) confirmed that AUSTRAC had delivered the $450 million for anti-money laundering breaches at the group’s Melbourne and Perth casinos, which is set to be ratified by the Federal Court in the coming months. Affordability continues to be a growing issue in the property sector with dwelling approvals falling 8.1 per cent in April, while dwelling units are now down 25 per cent on this time last year, as builders fall into trouble and demand disappears. Shares in food producer and retailer Maggie Beer (ASX:MBH) fell by close to 6.5 per cent despite an expected $10 million improvement in profit on the back of a reduction in the cost of the acquision of Hampers & Gifts in 2021. Revenue of the group fell 12.2 per cent as lockdowns ended while the broader Maggie Beer group saw an improvement of 5.3 per cent on the year.

US markets mixed on debt ceiling negotiations, another rate hike expected, NVIDIA nears US$1 trillion

US benchmarks were mixed on Tuesday, with the S&P500 finishing flat, the Dow Jones falling 0.2 per cent and the Nasdaq outperforming once again, gaining 0.3 per cent. The rally in technology shares continues on the back of another 3 per cent gain in semiconductor manufacturer NVIDIA (NYSE:NVDA) which sent the stock near a US$1 trillion valuation for the first time. The driver was news of the release of a number of AI-focused products, specifically around providing more computing power to super computers, which has taken the market by storm. The debt ceiling deal is set to be passed to Congress to be voted on however recent inflation data has seen the expectation of another rate hike in June increase to more than two thirds. In a similar story to Australia, consumer confidence has fallen to a 6 month low. Shares in Tesla (NYSE:TSLA) also gained more than 4 per cent after Elon Musk set off on a long-awaited trip to China, the home of the group’s main manufacturing plant.