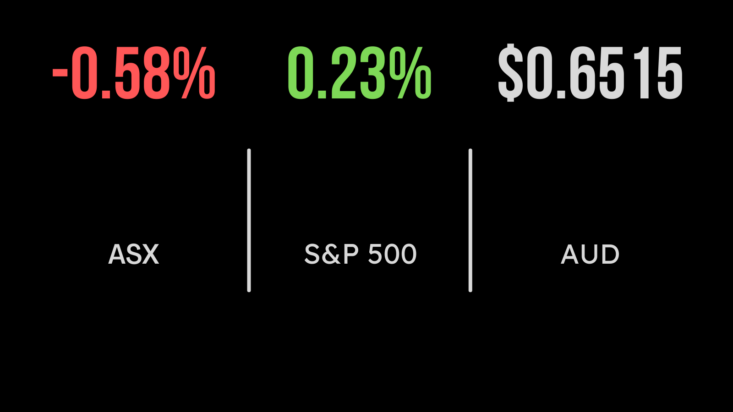

Market (ASX:XJO) falls on RBA call, technology sinks, retailers surge despite sales hit

Both Australian benchmarks fell on Tuesday for the second straight day, with the S&P/ASX200 (ASX:XJO) down 0.6 per cent with the energy sector, up 0.4 per cent, the only highlight. The selloff was led by the technology and materials sectors, which fell 1.8 and 1.3 per cent, with Fortescue (ASX:FMG) down 2.9 per cent as iron price prices continued to slide. All eyes were on the Reserve Bank of Australia which elected to keep rates on hold at 4.35 per cent citing hope that inflation would be back in the 2 to 3 per cent target range by 2025. The governor indicated she would need to be ‘convinced’ on the need for rate cuts while noting that the US economy is in a much stronger position than Australia. Retailers shone through despite a touch period for comparable, as furniture retailer Nick Scale (ASX:NCK) surged 16 per cent despite reporting a 29 per cent fall in profit.

Cochleae sinks on treatment hopes, Myer surges as store closures support sales

Hearing implant producer Cochlear struggled on Tuesday, falling 6.9 per cent after a key broker downgraded the company. The news came amid discussions that one of the key reasons for hearing implants may be nearing a vaccine which could hit long-term sales. Shares in Myer )ASX:MYR) jumped 14 per cent as the company reported a stronger than expected first half profit result, of between $49 and $53 million as store closures helped cut costs while sales began to recover. Magellan Financial Group (ASX:MFG) also managed a 1 per cent gain as the company reported a slowing of outflows to just $400 million.

US markets gains muted despite rate cut calls, Palantir surges on AI language models

US benchmarks were higher on Tuesday, with the Dow Jones gaining 0.4 per cent, the S&P500 0.2 per cent and the Nasdaq broadly flat. Cleveland Fed President Mester overnight suggested that she expects at least three rate cuts in 2024 but would not give an indication of timing, thought this wasn’t enough to boost markets. On the earnings side, shares in AI powered group Palantir (NYSE:PLTR) surged by more than 30 per cent after the company reported a 20 per cent increase in revenue to US$608 million during the quarter driven by a massive investment in AI powered language models by major corporates.