Lifecycle super funds not aligned with investment mandates: APRA

More and more superannuation funds are offering ‘lifecycle’ investment options, which invest more of savers’ retirement money in growth investments when they are younger and automatically shift to more conservative assets as they get older. But in some cases, the funds aren’t shifting money often enough according to some experts.

The Stronger Super reforms of 2011 first made lifecycle funds eligible as a MySuper product for Australian workers. Total assets under the management of lifecycle funds reached $234.3 billion in 2020, more than doubling from $71.5 billion in 2014, while the total assets of balanced funds have increased 61 per cent to $493.12 billion from $272.35 billion. According to recent research from SuperRatings, 37 per cent of the 75 MySuper products registered with the Australian Prudential Regulatory Authority (APRA) as of 31 March 2022 were designated as lifecycle products.

Yet a recent APRA paper highlights that the practices of many Australian lifecycle funds “is not aligned with their investment mandates, which might expose investors to unexpected risks.”

The paper – titled Do Australian Lifecycle Funds De-risk Over Time? – finds that lifecycle funds have increased investments in growth assets and reduced investments in defensive assets over time. For example, lifecycle funds for investors over age 70 invested, on average, 28 per cent in growth assets in 2014. But that figure had climbed to 42 per cent by 2020. For members below the age of 41, 84 per cent was invested in growth assets in 2014, climbing to 89 per cent in 2020.

“The results show that lifecycle fund series have adopted riskier investment strategies in the recent period and the change is more pronounced among lifecycle funds that are for close-to-retirement investors,” the APRA paper concluded.

“Contradictory to the investment mandate, we document that lifecycle funds have increased allocations in growth assets over time,” it said. “We find that this is driven by fund series investing less in growth assets in the early period, consistent with fund companies catering to the market demand for larger risk exposure.”

Performance in question, too

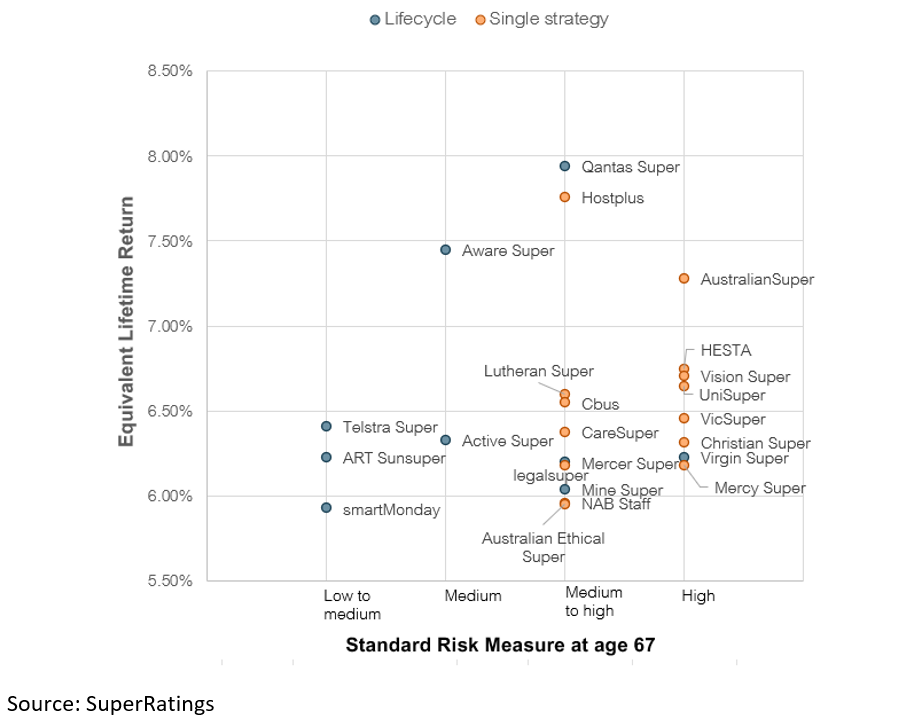

Lifecycle super products can deliver above-median lifetime superannuation performance while achieving investors’ risk objectives near retirement, SuperRatings research shows. But it depends on the fund. The research company says the top performing superannuation products remain predominantly single strategies that maintain exposure to higher-returning assets with higher risk up until retirement; that is, products that are not lifecycle funds, as the chart below reveals.

SuperRatings included only registered MySuper products for which at least five years of historical performance is available, and returns were calculated to June 30, 2022. There were 45 products in total, of which 15 were classified as lifecycle structures.

Camille Schmidt (pictured), market insights manager at SuperRatings, said key things for investors to consider when determining whether a lifecycle product is suitable for them are their desire to have a set-and-forget strategy in place, where movements between different investment option types are undertaken, and whether they are comfortable with the level of risk exposure at each age outlined by a given fund.

“It’s important to consider your superannuation as a long-term investment and speak to your fund or an adviser that you trust for guidance when establishing or changing your superannuation settings,” she said.

“The test for a lifecycle product is whether it is able to place the member in a lower risk position at retirement without compromising on investment performance over the member’s whole lifetime. Lifecycle products do this by investing more aggressively during the younger ages of a member’s career, to compensate for lower returns when the product starts de-risking.”