Level of managed funds dips from record high

Australia’s managed fund industry shrank in the March quarter of 2022 from the December 2021 quarter to $4.48 trillion, although the amount of money Australians invested with offshore managers rose as the nation’s home investment bias diminishes, and the ETF market continues to grow as the overall level of managed funds falls.

As at 31 March 2022, the consolidated assets of managed funds institutions dipped to $4.48 trillion from a record level of $4.54 trillion in the December 2021 quarter, a fall of 1.4 per cent, according to managed funds data from the Australian Bureau of Statistics (ABS).

Despite that drop, a record amount was invested with offshore fund managers during the quarter, with the amount of money managed by non-resident investment managers striking a record high of $1.75 trillion, up slightly from $1.74 trillion in the December quarter, almost catching-up to the level invested with Australian fund managers, which totalled $1.83 trillion, down from $1.85 trillion in the September quarter.

Financial experts say people are diversifying their portfolios away from Australian shares and property into assets abroad to reap potentially greater returns. According to CommSec, while the Australian share market offers some excellent investment opportunities, it makes up around 2.2 per cent of the world’s total by share market capitalisation.

Super values fall

The value of Australia’s superannuation pool fell 0.8 per cent to $3.49 trillion during the March quarter, while the value invested in retail managed funds dropped by even more, down 2.6 per cent to $483.0 billion.

While the value of bond investments fell, the value of share investments held by super funds rose $30.8 billion or 5.2 per cent, during the March quarter despite the volatile performance of share markets. However, retail managed funds did not manage the volatility so well, with the value of their shares holdings falling $1.7 billion, or 2.2 per cent, during the quarter.

Highlighting the difficulties retail fund managers continue to face, Magellan Financial Group recently released a funds under management (FUM) update in which it noted a 5.3 per cent fall in its total FUM during May, driven by 4.8 per cent fall in its retail holdings to $23.6 billion and a 5.5 per cent drop in its institutional FUM to $41.4 billion, down from $43.8 billion.

Platinum Asset Management too has released a FUM update, outlining a 0.9 per cent fall in May, to $19,588 million. PTM also says that it “experienced net outflows of approximately $209 million,” which included “net outflows form the Platinum Trust Funds of approximately $154 million.”

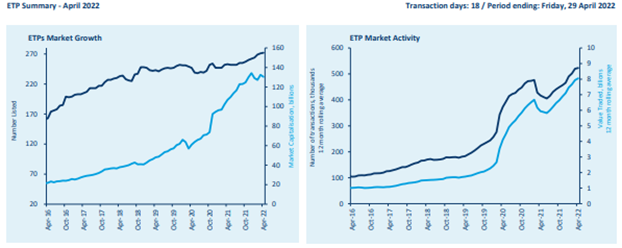

ETF flows decline in April after jump in March

Reflecting volatile share markets, the Australian ETF industry also dropped in value in April after rising in March, and despite positive net flows during April of around $1.2 billion, similar to that experienced in March. The industry’s market capitalisation fell 1.5 per cent or $1.9 billion to $130.4 billion, down from $132.3 billion in March 2022, according to data from the Australian Securities Exchange (ASX).

According to ETF provider VanEck, net flows into the sector over the year to April 30 have been $5.2 billion, with major inflows in international equity ETFs of $513.9 million and Australian equity ETFs of $351.1 million, highlighting that home investment bias may no longer exist among ETF investors.

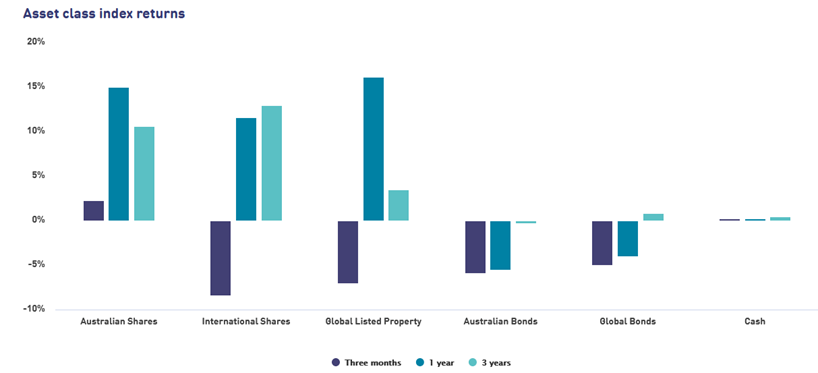

Australian shares outperform during volatility

While international shares fell 8.4 per cent in Australian dollar terms over the March quarter, due to increasing concerns over the war in Ukraine and rising inflation, the Australian share market convincingly outperformed, rising 2.2 per cent given its large weighting to banks and mining companies, which benefited from rising commodity prices. Market expectations of higher interest rates, to combat rising inflation, resulted in bond prices falling sharply.

Over year to the March 2022 quarter, local shares jumped more than global shares on the back of rising commodity prices, surpassing gains on other major asset classes, as the chart below shows.

The series of economic sanctions imposed on Russia caused major disruptions to countries which import Russian commodities. This led to market volatility and caused commodity price increases which amplified inflationary pressures.